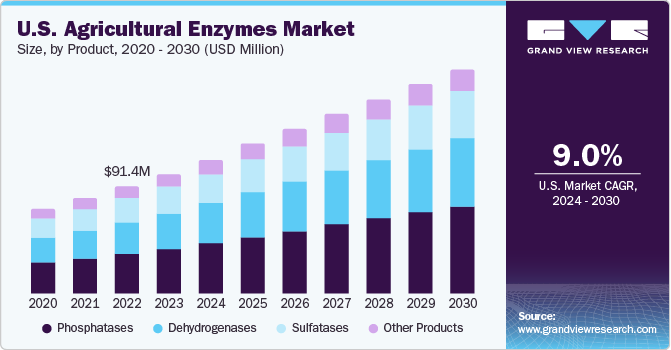

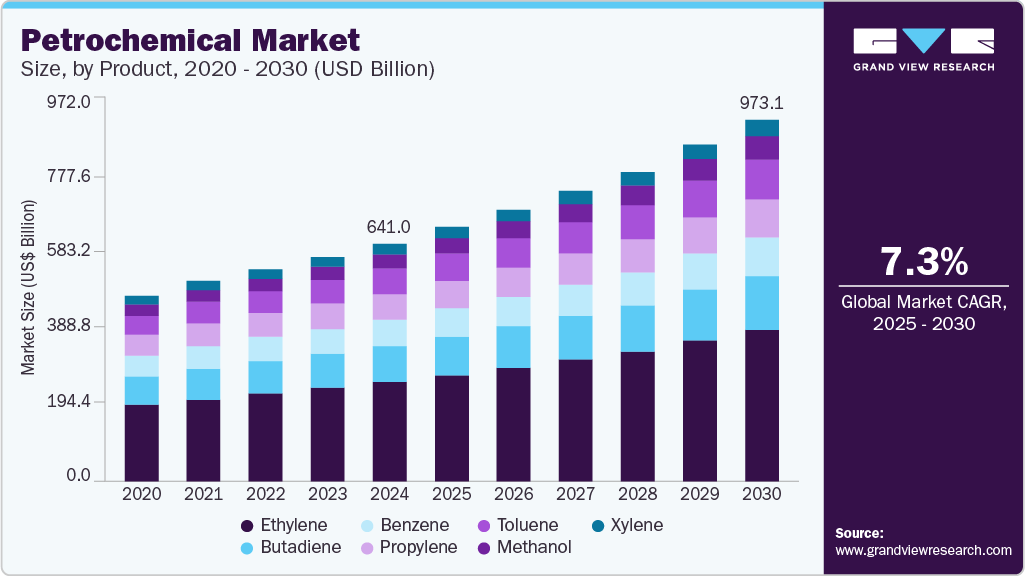

Petrochemical Market growing at a CAGR of 7.3% from 2025 to 2030

The global petrochemicals market size was estimated at USD 641.01 million in 2024 and is projected to reach USD 973.10 million by 2030, growing at a CAGR of 7.3% from 2025 to 2030. The global petrochemical market is primarily driven by the rising demand for plastics.

Key Market Trends & Insights

- Asia Pacific held the largest market share 46.9% in 2024 the global petrochemical market due to its rapidly expanding industrial base.

- China held over 35.4% revenue share of the overall Asia Pacific petrochemical market in 2024.

- Based on product, ethylene segment is anticipated to hold the largest market share during forecast period.

Market Size & Forecast

- 2024 Market Size: USD 641.01 Million

- 2030 Projected Market Size: USD 973.10 Million

- CAGR (2025-2030): 7.3%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/petrochemical-market/request/rs1

Synthetic fibers, and industrial chemicals across key end-use industries such as packaging, automotive, construction, and consumer goods. Additionally, the availability of low-cost feedstock’s, particularly in regions like North America and the Middle East, has enhanced production economics, prompting significant capacity expansions and strategic investments.

The petrochemical market encompasses the production, distribution, and application of chemical products derived primarily from petroleum and natural gas. These chemicals, including ethylene, propylene, benzene, toluene, xylene, methanol, and butadiene, serve as essential building blocks for a wide range of downstream products. The market plays a critical role within the broader chemical industry, driven by its deep integration into manufacturing, transportation, infrastructure, and consumer goods sectors globally.

Petrochemical are vital to the modern economy, as they form the foundation for countless products such as plastics, synthetic rubber, fertilizers, solvents, textiles, detergents, and pharmaceuticals. Their versatility and cost-effectiveness make them indispensable in supporting industrialization, technological advancement, and urban development. As global consumption patterns evolve, the strategic importance of Petrochemical continues to grow, especially in enabling innovations in packaging, mobility, energy storage, and sustainable materials.

Drivers, Opportunities & Restraints

The petrochemical market is fundamentally propelled by the increasing demand from various end use industries, such as packaging, automotive, construction, and consumer goods, fueled by rapid urbanization and industrial growth worldwide. Additionally, the availability of abundant and cost-competitive feedstocks-particularly natural gas liquids in North America and crude oil derivatives in the Middle East-has significantly improved production economics, incentivizing capacity expansions and technological advancements. The growing emphasis on lightweight and high-performance materials further fuels the need for petrochemical derivatives, reinforcing sustained market growth.

Despite its robust growth trajectory, the petrochemical market faces notable challenges including price volatility in crude oil and natural gas, which directly impact feedstock costs and profit margins. Increasing regulatory scrutiny concerning environmental impact, greenhouse gas emissions, and plastic waste management is imposing stricter compliance requirements and operational costs. Moreover, the rise of bio-based alternatives and intensified focus on circular economy models are creating competitive pressure on traditional petrochemical producers, potentially limiting market expansion.

The petrochemical sector stands at the cusp of transformative opportunities driven by innovations in green chemistry and sustainable production methods, including chemical recycling and bio-based feedstocks such as bio-ethylene and green methanol. Emerging markets in Asia-Pacific, the Middle East, and Africa present significant growth potential due to expanding industrial bases and infrastructure development. Furthermore, digitalization and Industry 4.0 adoption within petrochemical manufacturing offer pathways to enhance operational efficiency, reduce costs, and improve environmental performance, thereby unlocking new avenues for value creation.

Product Insights

The ethylene segment is anticipated to hold the largest market share in the petrochemical market by product during the forecast period due to its extensive application base and high-volume consumption across multiple end-use industries. Ethylene is a key feedstock in the production of polyethylene (HDPE, LDPE, LLDPE), ethylene oxide, ethylene dichloride, and other essential chemicals used in packaging, construction materials, automotive components, textiles, and consumer goods. The rising global demand for lightweight, durable, and cost-effective packaging materials-especially in the food and e-commerce sectors-continues to fuel the consumption of polyethylene, which in turn drives the dominance of ethylene in the overall market.

Additionally, ethylene production has become increasingly cost-effective in regions with abundant feedstocks such as ethane from shale gas in North America and naphtha in the Middle East, enabling large-scale investments and capacity expansions. Technological advancements in steam cracking and the emergence of integrated petrochemical complexes have further optimized ethylene output. With the global push for industrialization, urban infrastructure development, and consumer product manufacturing, ethylene’s versatility and strong demand fundamentals position it as the most commercially significant product within the petrochemical value chain, supporting its leading market share through the forecast period.

The ethylene segment held the largest market share in the petrochemical market, owing to its critical role as a foundational building block for high-demand derivatives such as polyethylene, ethylene oxide, and ethylene dichloride. These downstream products are widely used across key industries, including packaging, construction, automotive, and consumer goods. The surge in global demand for lightweight, durable, and cost-effective materials, particularly in food packaging and industrial applications, continues to drive ethylene consumption. Moreover, cost advantages derived from abundant feedstocks like ethane in North America and naphtha in the Middle East have spurred capacity expansions and technological innovation in ethylene production, reinforcing its dominance within the global petrochemical value chain.

Petrochemical Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 685.47 billion |

|

Revenue forecast in 2030 |

USD 973.10 billion |

|

Growth rate |

CAGR of 7.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative Units |

Revenue in USD million/billion, Volume in Million tons and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East; Africa |

|

Country scope |

US; Canada; Mexico; Germany; UK; Italy; Netherlands; Belgium; France; Russia; China; India; Japan; Malaysia; Indonesia; Vietnam; Australia; New Zealand; Brazil; Argentina; Columbia; Peru; Saudi Arabia; Iran; Oman; UAE; Qatar; Kuwait; South Africa; Angola; Nigeria |

|

Key companies profiled |

BASF SE; Chevron Corporation; China National Petroleum Corporation (CNPC); China Petrochemical Corporation; ExxonMobil Corporation; INEOS Group Ltd.; LyondellBasell Industries Holdings B.V.; Royal Dutch Shell PLC; SABIC; Dow |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |