Pen And Injector Drug Delivery Devices Market growing at a CAGR of 9.6% from 2026 to 2033

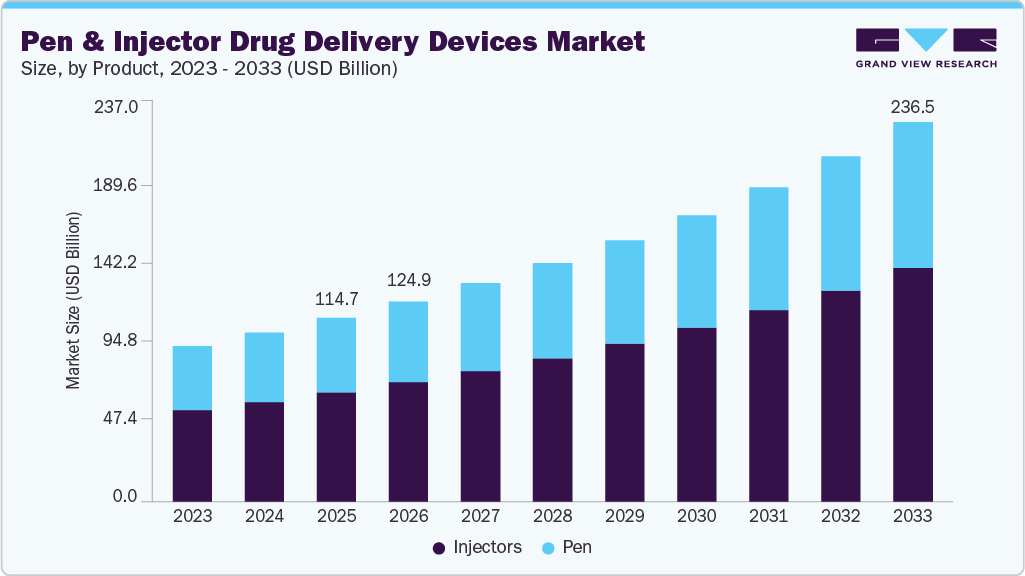

The global pen and injector drug delivery devices market size was estimated at USD 114.67 billion in 2025 and is projected to reach USD 236.54 billion by 2033, growing at a CAGR of 9.6% from 2026 to 2033. This strong growth is driven by the rising demand for advanced, effective, and user-friendly drug delivery solutions across healthcare settings..

Key Market Trends & Insights

- The North America pen and injector drug delivery devices market held the largest revenue share of 50.0% in 2025.

- U.S. dominated the North America market with a revenue share of 86.2% in 2025.

- By product, the injectors segment held the largest market share of 59.3% in 2025.

- Based on therapeutic use, the diabetes mellitus segment held the largest market share of 44.5% in 2025.

- Based on end use, the homecare settings segment dominated the market with a revenue share of 72.5% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 114.67 Billion

- 2033 Projected Market Size: USD 236.54 Billion

- CAGR (2026-2033): 9.6%

- North America: Largest market in 2025

- Asia: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/pen-injector-drug-delivery-devices-market-report/request/rs1

Key drivers include the increasing prevalence of chronic conditions such as diabetes, cancer, and autoimmune disorders that require frequent injections; growing adoption of user-friendly injection tools such as autoinjectors and pen injectors; and continuous technological advancements that enhance safety, accuracy, and patient comfort. In addition, growing biological development, the shift toward home-based care, and greater focus on reducing hospital visits are further supporting market growth.

One of the major drivers of the pen and injector drug delivery devices market is the increasing prevalence of chronic diseases, along with the rapid growth of the geriatric population. Chronic conditions such as diabetes, cancer, cardiovascular diseases, and autoimmune disorders often require regular or long-term medication delivered through injections for fast and effective therapeutic action. According to the IDF’s 2021 report, about 537 million people around the world had diabetes, which means roughly 1 in 10 people were affected. The number is expected to rise sharply, reaching 783 million people by 2045. As these diseases become more common in the world, the demand for reliable and easy-to-use injectable devices continues to increase. In addition, the aging population faces multiple health issues and typically requires frequent medical treatments, including injectable drugs.

According to the recent population estimates and projections by UN DESA’s Population Division, the number of people aged 60 and older is projected to reach 1.5 billion by 2050, representing about 1 in 6 people globally. This demographic shift is supporting the need for convenient, safe, and precise delivery systems that support both clinical use and home-based care, thereby contributing significantly to market growth.

Technological advancements in drug delivery systems are driving the growth of pen and injector drug delivery devices. Innovations have made injection devices safer, more efficient, and easier for patients to use. Features such as smart autoinjectors with digital monitoring, needle-free injection technologies, and improved safety mechanisms help ensure accurate dosing and reduce the risk of needle injuries. Advancements in materials and device design also enhance comfort and support self-use at home, which is becoming increasingly important for people managing chronic diseases.

Market Concentration & Characteristics

The global pen and injector drug delivery devices industry is concentrated, with major multinational companies holding significant market shares due to strong brand portfolios, extensive R&D teams, and broad geographic presence. Market competition is characterized by continuous innovation in self-injectors, autoinjectors, prefilled syringes, and wearable injectors, with a noticeable shift toward patient-centric devices that enable self-administration. The top market participants dominate through organic growth and strategic partnerships, benefiting from technological advancements, such as smart, connected injectors and AI-powered delivery systems, to maintain a competitive advantage. The market entry for new companies is challenging, as strict rules must be followed and advanced manufacturing systems are required. Overall, the market shows moderate to high concentration, rapid innovation cycles, and significant investments in global supply chains and digital health integration.

Innovation is very high in the market. New technologies and patient-focused designs are driving this growth. Smart connected injectors with Bluetooth and AI help track doses and improve treatment adherence. Wearable injectors, ultra-thin needle autoinjectors, and reusable devices make treatment easier and more comfortable. For instance, in October 2024, Nemera launched a reusable autoinjector at CPHI Milan. The device features durable electronics and a long-life design to improve patient comfort, support sustainable self-administration, and reduce costs. Advances in drug formulations, such as sustained-release and needle-free systems, further increase safety and patient outcomes. Innovation remains a key force shaping this market.

End use concentration in the industry is medium, as the devices serve a diversified set of end users, including hospitals, home healthcare settings, specialty clinics, and long-term care facilities. While hospitals still represent a significant share of market demand due to their role in acute and complex treatments, there is a growing trend toward decentralization of care, with increased adoption of self-administration and home-based treatments. This evolution diversifies the market’s end use landscape, reducing reliance on any single user segment. This diversity encourages manufacturers to develop versatile product portfolios catering to different environments and patient needs.

Pen And Injector Drug Delivery Devices Market Report Scope

|

Report Attribute |

Details |

|

Market value size in 2026 |

USD 124.91 Billion |

|

Revenue forecast in 2033 |

USD 236.54 Billion |

|

Growth rate (revenue) |

CAGR of 9.6% from 2026 to 2033 |

|

Actuals |

2021 – 2025 |

|

Forecast period |

2026 – 2033 |

|

Quantitative (revenue) units |

Revenue in USD million/billion, volume in units, and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, therapeutic use, end use, region |

|

Regional scope |

North America; Europe; Asia |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Sweden; Denmark; China; India; Japan; Thailand; South Korea; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Novo Nordisk A/S; Sanofi; Eli Lilly and Company; AstraZeneca plc; Pfizer, Inc.; Merck KGaA; Teva Pharmaceuticals; Amgen, Inc.; Ferring Pharmaceuticals; AbbVie Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |