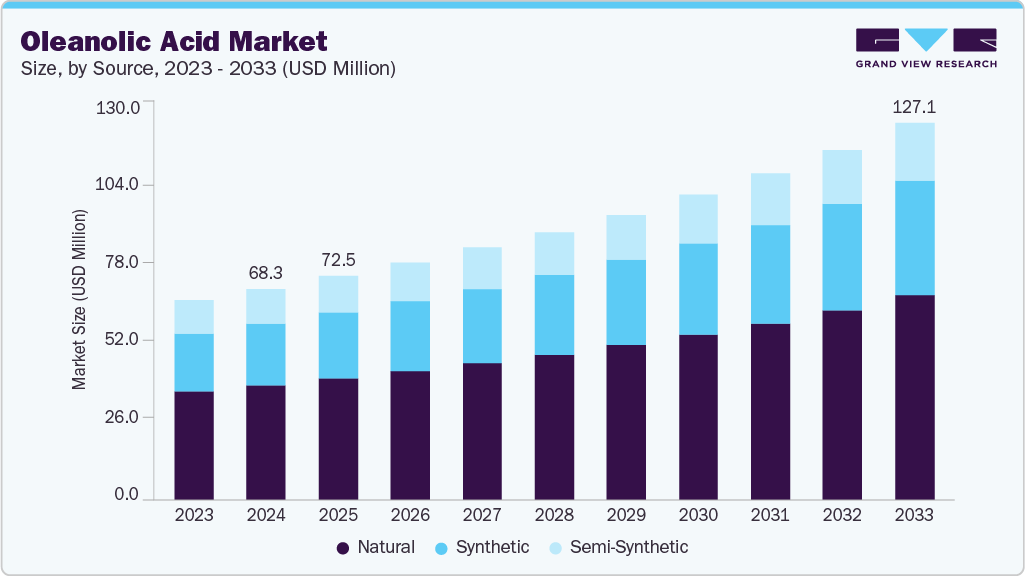

Oleanolic Acid growing at a CAGR of 7.3% from 2025 to 2033

The global oleanolic acid market size was estimated at USD 68.28 million in 2024 and is projected to reach USD 127.10 million by 2033, growing at a CAGR of 7.3% from 2025 to 2033. The industry is experiencing steady growth, mainly driven by the rising demand for natural, plant-based ingredients in pharmaceuticals and cosmetics as consumers move away from synthetic chemicals.

Key Market Trends & Insights

- Asia Pacific led the oleanolic acid market with the largest revenue share of 37.54% in 2024.

- China is expected to grow the fastest with a CAGR of 7.8% from 2025 to 2033.

- By source, the natural segment dominated the market and accounted for the largest revenue share of 54.34% in 2024.

- By end-use, the pharmaceuticals segment is expected to grow the fastest, with a CAGR of 7.4% from 2025 to 2033.

- By product, the liquid segment dominated the market with a revenue share of 40.10% in 2024.

Market Size & Forecast

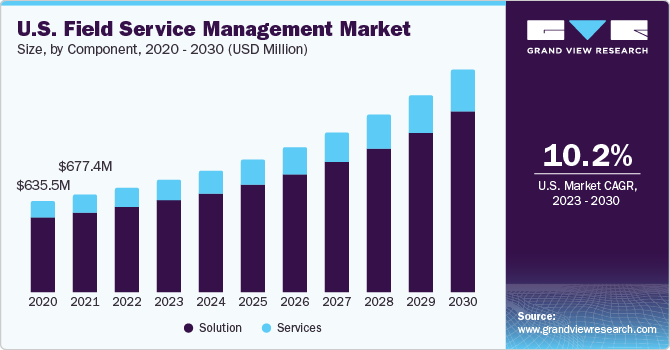

- 2024 Market Size: USD 68.28 Million

- 2033 Projected Market Size: USD 127.10 Million

- CAGR (2025-2033): 7.3%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/oleanolic-acid-market-report/request/rs1

Manufacturers are using it more for its proven health benefits, such as reducing inflammation, fighting oxidation, and protecting the liver. Growing research and clinical studies showing its potential to help with chronic diseases like diabetes and liver problems are further boosting its use and value.

The expansion of the oleanolic acid industry is being driven by the escalating use of botanical actives in nutraceutical formulations and herbal therapeutics, particularly as consumers prioritize preventive healthcare and holistic wellness. Growing interest in natural compounds that support metabolic balance and immune modulation is prompting manufacturers to integrate oleanolic acid into dietary supplements and functional beverages. In addition, the rising preference for traditional medicine systems such as Ayurveda and Traditional Chinese Medicine, where oleanolic acid-rich plant extracts are widely used, is strengthening its commercial relevance and widening its global acceptance across health and wellness sectors.

However, the market growth is challenged by the limited scalability of extraction processes and fluctuations in raw material availability due to dependence on specific plant species. Inefficient supply chain management and the seasonal nature of cultivation often disrupt continuous production, resulting in inconsistent pricing and product shortages. Furthermore, the lack of global regulatory harmonization regarding purity standards and clinical safety validation acts as a major constraint, reducing market entry opportunities for small and medium-sized producers and restricting product penetration in highly regulated regions such as North America and Europe.

Despite existing challenges, emerging technological innovations in bioengineering and green chemistry are opening new avenues for sustainable and high-yield synthesis of oleanolic acid. The adoption of enzyme-assisted extraction and molecular modification techniques is expected to improve product efficacy and stability, enhancing its potential use in advanced pharmaceuticals and cosmeceuticals. Furthermore, expanding applications in anti-aging skincare, metabolic health supplements, and chronic disease management create a fertile ground for product diversification, while the growing investments in natural ingredient research across the Asia Pacific present significant opportunities for strategic collaborations and market expansion.

Market Concentration & Characteristics

The industry shows moderate concentration, led by integrated manufacturers managing sourcing, extraction, and formulation to ensure quality and scale. It is highly research-driven, with companies focusing on purity improvement, clinical validation, and regulatory compliance to enhance credibility. Strategic partnerships between research institutes and industry players are expanding therapeutic applications. Overall, competition is shifting toward innovation and standardized quality rather than volume-based production.

SimSon Pharma Limited and Chemicea Limited are among the prominent global manufacturers leading the oleanolic acid industry, known for their advanced extraction capabilities and strict quality control standards. Their consistent supply of high-purity oleanolic acid supports a broad spectrum of pharmaceutical, nutraceutical, and cosmetic applications worldwide. The overall market is shaped by increasing emphasis on product standardization, regulatory compliance, and evidence-based validation of natural actives. Manufacturers are focusing on enhancing production efficiency through green extraction technologies and traceable sourcing systems. These advancements collectively strengthen the reliability and global competitiveness of oleanolic acid, driving its wider adoption across therapeutic and preventive health formulations.

Oleanolic Acid Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 72.47 million |

|

Revenue forecast in 2033 |

USD 127.10 million |

|

Growth rate |

CAGR of 7.3% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Source, end-use, product, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

SimSon Pharma Limited; Chemicea Limited; Otto Chemie Pvt. Ltd.; Fengchen Group Co.,Ltd; Xi’an Fengzu Biological Technology Co.,Ltd; Nutragreenlife Biotechnology Co.,Ltd; Symrise AG; Martin Bauer GmbH & Co. KG; Sensient Technologies Corporation; Euromed S.C.A. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |