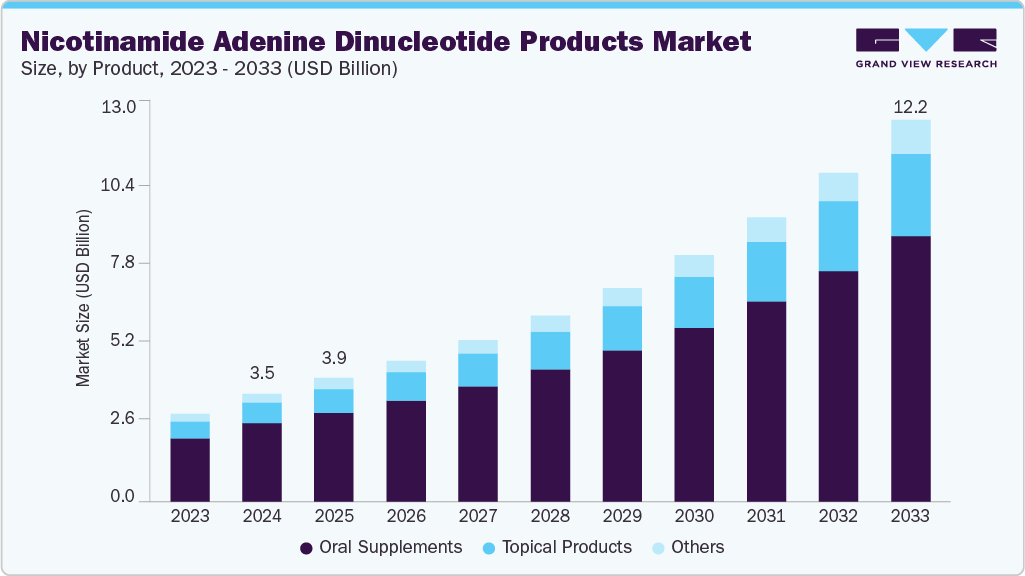

Nicotinamide Adenine Dinucleotide Products Market growing at a CAGR of 15.1% from 2025 to 2033

The global nicotinamide adenine dinucleotide products market size was valued at USD 3,451.16 million in 2024 and is expected to reach USD 12,187.24 million by 2033, growing at a CAGR of 15.1% from 2025 to 2033. The nicotinamide adenine dinucleotide (NAD) products industry is driven by increasing awareness of its role in cellular energy production, DNA repair, and healthy aging.

Key Market Trends & Insights

- Asia Pacific held the largest share of the global nicotinamide adenine dinucleotide (NAD) products market in 2024, accounting for a 58.85% share.

- The Middle East & Africa nicotinamide adenine dinucleotide (NAD) products market is experiencing significant growth, with a projected CAGR of 14.7%.

- By product, oral nicotinamide adenine dinucleotide (NAD) products held the largest share of 72.36% in 2024.

- Topical nicotinamide adenine dinucleotide (NAD) products are experiencing significant growth, with a projected CAGR of 16.6%.

- The sales of nicotinamide adenine dinucleotide (NAD) products through online channels held the largest market share of 57.43% in 2024.

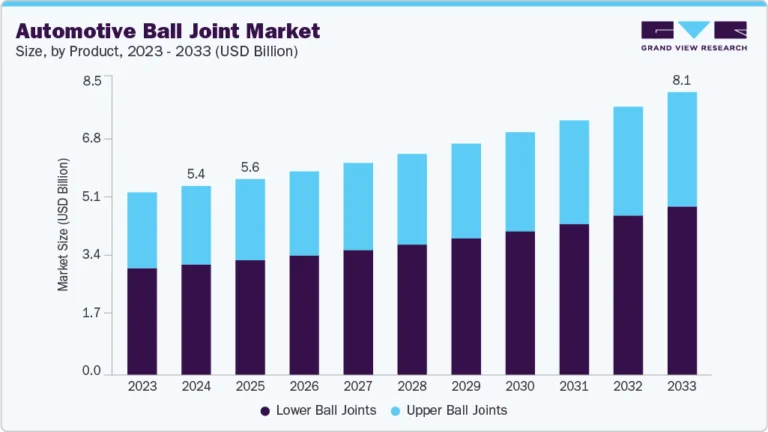

Market Size & Forecast

- 2024 Market Size: USD 3,451.1 Million

- 2033 Projected Market Size: USD 12,187.2 Million

- CAGR (2025-2033): 15.1%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Significantly growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/nicotinamide-adenine-dinucleotide-products-market-report/request/rs1

Consumers are seeking supplements that support vitality, cognitive function, and metabolic health, especially as interest in longevity and preventive wellness grows. Additionally, ongoing research linking NAD levels to age-related conditions has further fueled demand in the nutraceutical and wellness markets.

The popularity of NAD-boosting supplements like NR (Nicotinamide Riboside) and NMN (Nicotinamide Mononucleotide) has increased, driven by interest in healthy aging and cognitive support. Brands such as Tru Niagen and Elysium Health have capitalized on this trend, offering products that claim to enhance energy, focus, and resilience against age-related decline.

NAD products are also seeing wider use beyond supplements, appearing in IV therapy, skincare, and functional beverages, making them more accessible and appealing to a broader audience. As clinical research and consumer demand continue to grow, NAD is becoming a key ingredient in the evolving wellness and anti-aging space. For instance, in May 2025, Eden, a leading metabolic health platform, launched U.S.-wide access to a prescription-only NAD+ 10% Face Cream through its telehealth service.

The NAD products industry is expanding well beyond traditional oral supplements, with brands exploring new delivery formats to improve efficacy, user experience, and market appeal. While capsules and tablets containing precursors like Nicotinamide Riboside (NR) and Nicotinamide Mononucleotide (NMN) remain the most common format, newer options such as liposomal formulations, sustained-release tablets, and sublingual powders are gaining popularity for their potential to enhance bioavailability. These innovations not only cater to consumer demand for more effective dosing but also allow brands to differentiate in a crowded market.

For instance, in January 2025, Renue by Science introduced a new skincare line called Renue Blue, which focuses on skin wellness and longevity through the use of liposomal NAD (Nicotinamide Adenine Dinucleotide). The product line aims to leverage the benefits of NAD, a coenzyme crucial for cellular functions, in a topical format to promote skin health. The liposomal delivery system is designed to enhance the absorption and effectiveness of NAD in the skin.

Product Insights

Oral nicotinamide adenine dinucleotide (NAD) products accounted for the largest share of 72.36% in 2024. The segment is primarily driven by the rising consumer awareness regarding the health benefits of NAD, a crucial coenzyme involved in cellular energy metabolism and anti-aging processes. Capsules and tablets remain the most popular oral dosage forms due to their convenience, precise dosing, and extended shelf life. Consumers prefer these formats for their ease of use and portability, making them suitable for daily supplementation routines. According to the data published in June 2024, NAD supplementation improves age-related condition symptoms and enhances metabolic disorders, and also promotes muscle recovery.

Topical nicotinamide adenine dinucleotide (NAD) products are projected to grow at the fastest CAGR of 16.6% from 2025 to 2033. Topical products such as creams and serums are a significant growth driver in the NAD market due to increasing consumer demand for effective anti-aging and skin-repair solutions. NAD plays a key role in cellular repair and energy metabolism, which translates into visible benefits such as improved skin texture, reduced wrinkles, and enhanced skin radiance when applied topically. According to the National Institutes of Health (NIH) data published in September 2021, topical administration of NAD is used to improve healing and regeneration post-surgery. The NAD+ restoration can positively impact symptoms of cellular aging.

Nicotinamide Adenine Dinucleotide Products Market Report Scope

|

Report Attribute |

Details |

|

Market value size in 2025 |

USD 3,942.9 million |

|

Revenue Forecast in 2033 |

USD 12,187.24 million |

|

Growth rate (revenue) |

CAGR of 15.1% from 2025 to 2033 |

|

Actuals |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative (revenue) units |

Revenue in USD million/billion, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America; Europe; Asia-Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Taiwan; South Korea; Brazil; UAE |

|

Key companies profiled |

Niagen Bioscience, Inc.; Elysium Health; Thorne; Cata-Kor NAD; Life Extension; Wonderfeel; Nutricost; RENUE BY SCIENCE, Inc.; Codeage LLC; HPN SUPPLEMENTS; Core Med Science |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |