Network Security Market Size, Share & Trends Analysis growing at a CAGR of 12.7% from 2025 to 2033

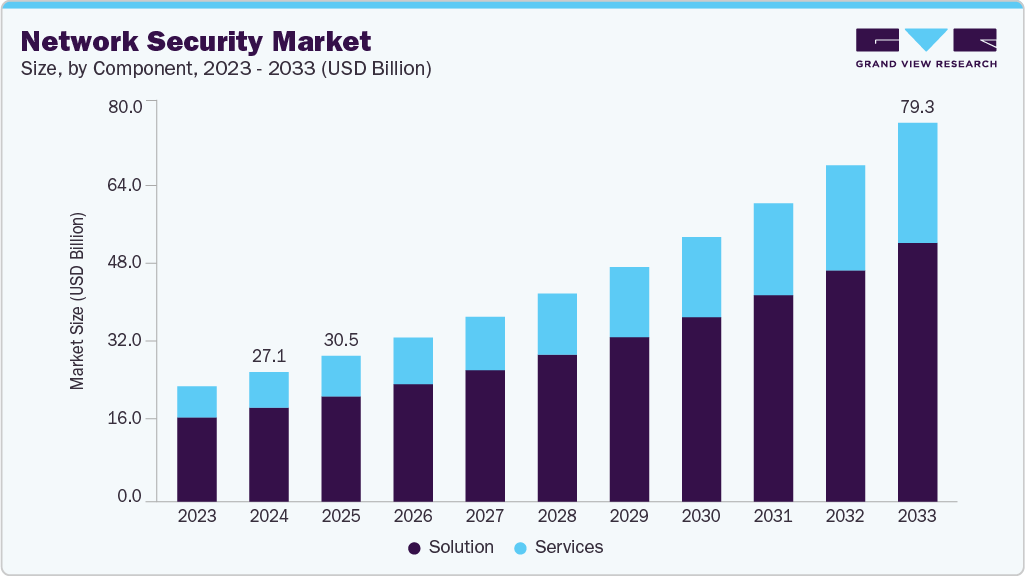

The global network security market size was valued at USD 27.11 billion in 2024 and is projected to reach USD 79.29 billion by 2033, growing at a CAGR of 12.7% from 2025 to 2033. The market is witnessing steady growth, driven by the increasing demand for smart warehousing, autonomous delivery, and last-mile logistics solutions.

Key Market Trends & Insights

- North America held 35.9% revenue share of the global Network Security market.

- In the U.S., the rising trends of bring-your-own-devices, hybrid work culture, and remote working are key factors driving the growth of the network security market.

- By component, the solution segment held the largest revenue share of 72.6% in 2024.

- By deployment, the cloud-based segment held the largest revenue share in 2024.

- By enterprise size, the large enterprises segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 27.11 Billion

- 2033 Projected Market Size: USD 79.29 Billion

- CAGR (2025-2033): 12.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/network-security-market/request/rs1

The rising incidents of unsecured devices hampering organizational networks and affecting privacy laws demand that businesses invest significant costs and resources to ensure network security. It provides a higher level of authorization, authentication, and compliance policies across the users’ network. Furthermore, network security solutions also enable users to instantly identify and block devices, endpoints, and users from forming unwanted connections. Thus, network security solutions offer higher protection against security breaches, safeguard critical information, help minimize malicious activities, and provide greater visibility on the security positioning of connected devices.

The growing adoption of IoT devices, web applications, and industrial software across verticals such as IT and telecommunication, BFSI, and healthcare contains highly sensitive information related to vendors, customers, and employees. These organizations need to maintain strict security regulatory compliance and verification guidelines and spend a significant amount to install network security solutions. For instance, in June 2023, Fortinet, a networking and security solutions company, announced that its Secure SD-WAN solution was adopted by 11 renowned managed security service providers named as a solution by STC, Claro Empresas, KT Corporation, Globe Business, Kyndryl, InfiniVAN, Inc., SPTel, 11:11 Systems, Sify Technologies, Tata Teleservices, and Neurosoft S.A. to provide superior user experience and drive better security outcomes without compromising security positioning.