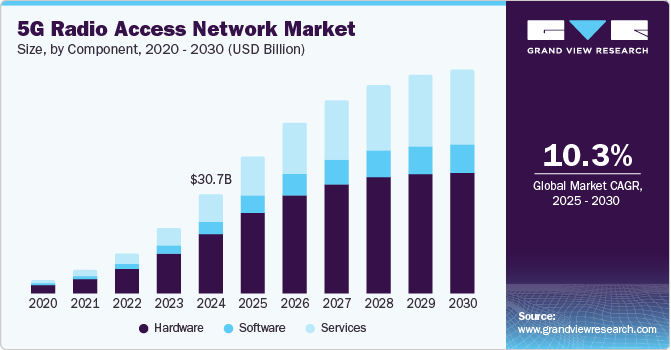

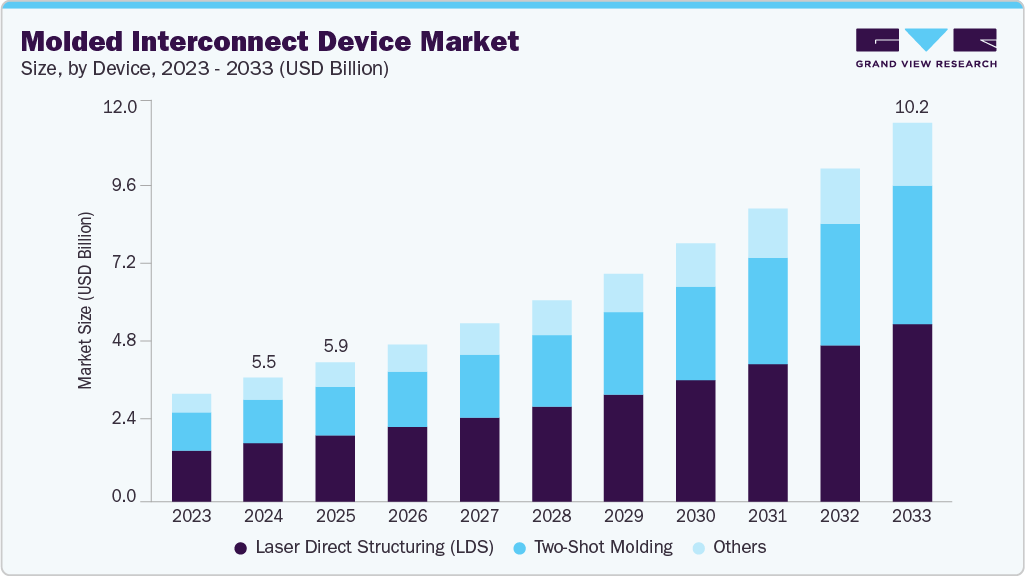

Molded Interconnect Device Market growing at a CAGR of 11.4% from 2025 to 2033

The global molded interconnect device market size was estimated at USD 5,463.2 million in 2024 and is projected to reach USD 10,200.2 million by 2033, growing at a CAGR of 11.4% from 2025 to 2033. The molded interconnect device (mid) market is expanding rapidly.

Key Market Trends & Insights

- Asia Pacific molded interconnect device industry dominated the global market with the largest revenue share of 35.0% in 2024.

- The molded interconnect device industry in the U.S. led the North America market and held the largest revenue share in the region in 2024.

- By device, Laser Direct Structuring (LDS) led the market and held the largest revenue share of 47.4% in 2024.

- By product, the sensor housings segment held the dominant position in the market and accounted for the largest revenue share of 28.0% in 2024.

- By end use, the consumer electronics segment is expected to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 5,463.2 Million

- 2033 Projected Market Size: USD 10,200.2 Million

- CAGR (2025-2033): 11.4%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/molded-interconnect-device-market-report/request/rs1

Demand is rising for compact and multifunctional electronic components. Growth is especially strong in automotive, aerospace, and consumer electronics. Advanced manufacturing technologies are enabling more complex 3D circuitry on plastic substrates. The use of advanced materials is increasingly influencing the Molded Interconnect Device (MID) market. Companies are focusing on integrating high-performance resins to improve device functionality. These materials enable heat resistance and miniaturized designs for complex applications. Automotive and ICT sectors are driving demand for such next-generation MIDs. Strategic acquisitions help firms access patented technologies and expand their product portfolios. Material innovation is supporting the growth and scalability of MID solutions. Companies are actively pursuing these initiatives to strengthen their MID offerings. For instance, in February 2025, Sumitomo Chemical, a chemical company in Japan, acquired Syensqo’s LCP neat resin business to expand its product and technology portfolio for mobility and ICT applications. Using Syensqo’s patents and technology, the company aims to supply next-generation automotive MIDs, supporting scalable production for connected and autonomous vehicles and reinforcing LCP’s role in future automotive electronics.

The trend towards smaller, more compact electronic devices necessitates advanced interconnect solutions that MID technology can provide. MIDs allow for more efficient use of space and integration of electronic components. Industries such as automotive, consumer electronics, and medical devices require high-performance yet lightweight components. MIDs, made from lightweight materials, meet these needs while maintaining performance standards.

The demand for customized electronic components is growing, and MIDs offer the flexibility to create bespoke designs that meet specific application requirements. MIDs are becoming more accessible for prototyping and low-volume production, allowing companies to experiment with innovative designs without significant upfront investment.

Government initiatives can have a significant positive impact on the molded interconnect device industry. For instance, in February 2024, the Indian government launched the “Digital India FutureLABS” at the Digital India FutureLABS Summit 2024, emphasizing India’s progress from a technology consumer to a leader in developing next-generation electronics. The summit featured the announcement of 22 Memorandums of Understanding (MoUs) with companies like NXP Semiconductors and Qualcomm Technologies, Inc., aiming to strengthen India’s Electronics System Design and Manufacturing (ESDM) sector through innovation and collaboration in key areas such as Artificial Intelligence (AI), the Internet of Things (IoT), and quantum computing. Such initiatives can accelerate technological advancements and reduce the cost barriers associated with developing innovative MID solutions.

Molded Interconnect Device Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5,954.7 million |

|

Revenue forecast in 2033 |

USD 10,200.2 million |

|

Growth rate |

CAGR of 11.4% from 2025 to 2033 |

|

Actual data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Device, product, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

TE Connectivity; KYOCERA AVX Components Corporation; LPKF; Molex; Amphenol Corporation; Taoglas; HARTING Technology Group; Sumitomo Electric Industries, Ltd.; MID Solutions GmbH; TEPROSA |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |