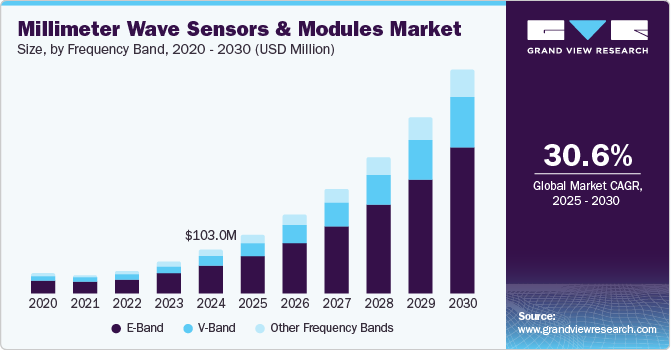

Millimeter Wave Sensors & Modules Market Size, Share & Trends Analysis grow at a CAGR of 30.6% from 2025 to 2030

The global millimeter wave sensors & modules market was valued at USD 103.0 million in 2024 and is projected to grow at a CAGR of 30.6% from 2025 to 2030. The rising demand for high-speed data transfer, driven by the proliferation of mobile broadband and high-definition multimedia applications, plays a significant role in the market’s growth. In addition, advancements in telecommunication technologies, particularly the rollout of 5G networks, are heightening the necessity for millimeter wave technologies to support bandwidth-intensive applications such as video streaming and online gaming.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/millimeter-wave-sensors-modules-market/request/rs1

Furthermore, industries such as automotive are increasingly adopting millimeter wave sensors for their superior performance in low visibility conditions and their ability to provide accurate data in real-time scenarios. The automotive industry is a significant driver as manufacturers integrate these sensors into Advanced Driver Assistance Systems (ADAS) and autonomous vehicles, enhancing safety and operational efficiency. In addition, continuous innovation in sensor technology and the growing adoption of smart devices across various sectors drive demand for millimeter-wave sensors and modules.

Moreover, expanding Internet of Things (IoT) applications necessitates enhanced connectivity solutions, further propelling the market forward. As smart cities evolve, integrating millimeter wave sensors into urban infrastructure facilitates improved traffic management, public safety monitoring, and environmental sensing. In addition, the military and defense sectors contribute significantly due to their increasing reliance on millimeter wave technology for surveillance and reconnaissance purposes. These sensors enhance target detection and tracking capabilities in challenging environments, solidifying their importance in the millimeter wave sensor and modules industry.

Frequency Band Insights

The e-band segment dominated the market with a revenue share of 63.4% in 2024, reflecting its widespread application in telecommunications and high-speed data transfer. The increasing demand for bandwidth-intensive applications, such as video streaming and online gaming, has driven the adoption of e-band frequencies, which offer high capacity and low latency. E-band frequencies, typically ranging from 60 GHz to 90 GHz, are particularly effective for point-to-point communications, enabling operators to deliver gigabit speeds over short distances. This segment’s capacity to support advanced communication technologies, such as 5G networks and backhaul solutions, makes it an essential part of the changing landscape of the millimeter wave sensors & modules industry.

The v-band segment is projected to grow at a significant CAGR during the forecast period, fueled by its extensive use in military and defense applications. As organizations seek to enhance communication capabilities and data transfer speeds, the v-band’s characteristics make it ideal for radar and satellite communications. Operating in the 57 GHz to 64 GHz range, v-band technology supports high data rates essential for modern military operations. For instance, defense contractors and original equipment manufacturers increasingly seek higher bandwidth to meet modern military and commercial needs, prompting a shift towards millimeter-wave frequencies for applications such as electronic warfare, satellite communications, and datalink systems. Manufacturers adapt their designs to leverage these higher frequencies as V-band technologies advance.

Application Insights

The telecommunications segment dominated the market with the largest share in 2024, driven by the rising demand for high-speed internet and connectivity solutions. With the adoption of smart devices and data-driven applications, telecom companies are investing heavily in millimeter wave technology to enhance their service offerings. For instance, HFCL’s advanced millimeter wave products are undergoing trials to address the increasing demand for higher bandwidth in telecommunications. Moreover, the ongoing rollout of 5G networks is a significant factor contributing to this trend, as it requires robust infrastructure capable of supporting high-frequency transmissions. This emphasis on expanding network capabilities highlights the critical role of telecommunications in shaping the future of the millimeter wave sensors & modules industry.