Middle East Waterproofing Chemicals Market growing at a CAGR of 5.2% from 2025 to 2033

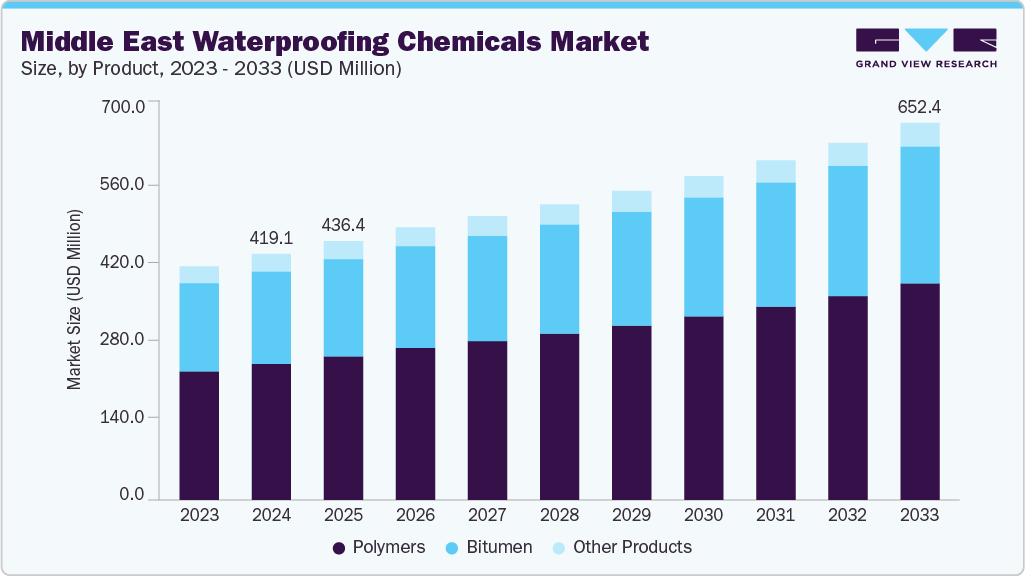

The Middle East waterproofing chemicals market size was estimated at USD 419.1 million in 2024 and is projected to reach USD 652.4 million by 2033, growing at a CAGR of 5.2% from 2025 to 2033. The market is driven by the rapid expansion of infrastructure and construction projects across the Middle East, particularly in Saudi Arabia and the UAE, supported by mega-projects under Vision 2030 and large-scale urban development plans.

Key Market Trends & Insights

- The waterproofing chemicals market in Oman is expected to grow at the fastest CAGR of 6.1% from 2025 to 2033 in terms of revenue.

- By product, the polymers segment is expected to grow at the fastest CAGR of 5.6% from 2025 to 2033 in terms of revenue.

- By product, the polymers segment dominated the market with the largest revenue share of 55.8% in 2024.

- By application, the roofing segment captured the largest revenue share of 29.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 419.1 Million

- 2033 Projected Market Size: USD 652.4 Million

- CAGR (2025-2033): 5.2%

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/middle-east-waterproofing-chemicals-market-report/request/rs1

Rising demand for durable, energy-efficient, and climate-resilient structures is accelerating the adoption of advanced waterproofing solutions, including PVC and TPO membranes. Refurbishing aging infrastructure, increasing investments in water conservation projects such as desalination plants and reservoirs, and stricter regulations on building sustainability and safety standards propel steady market growth. Significant opportunities lie in the rising penetration of polymer-based waterproofing systems, driven by their superior performance in extreme heat and UV conditions prevalent in the Middle East. Growth in logistics hubs, data centers, and industrial complexes offers a high-value segment for single-ply membranes and spray-applied solutions. Moreover, the shift towards green building certifications, reflective roof systems, and sustainable materials creates avenues for innovative products with enhanced energy efficiency and reduced VOC emissions. Expanding geomembrane demand in landfills, tunnels, and water-retaining structures further strengthens long-term market prospects.

The market faces challenges related to high installation costs of advanced polymer systems compared to traditional bitumen, coupled with fluctuating raw material prices for polymers and bitumen derivatives. A shortage of skilled applicators for specialized systems such as TPO, PVC, and spray-applied membranes often leads to inconsistent application quality and warranty claims. In addition, hot-weather constraints, strict hot-works regulations at critical sites, and complex logistics for giga-project deliveries can delay project execution and impact margins for suppliers and contractors.

Market Concentration & Characteristics

The Middle East waterproofing chemicals industry is moderately fragmented. Key players such as BASF SE, Sika AG, Dow, Carlisle Companies Inc., and DuPont dominate the market through extensive product portfolios and strong regional networks. BASF and Sika focus on advanced bitumen-modified and cementitious systems, backed by strong technical services and applicator networks, while Dow and DuPont emphasize high-performance polymer-based solutions, particularly TPO and PVC membranes aligned with green building regulations. Carlisle Companies leverages its expertise in single-ply roofing systems to cater to logistics parks, commercial buildings, and data centers in Saudi Arabia and the UAE.

These players focus on local manufacturing, innovation, and partnerships to strengthen their market share. BASF and Sika invest in regional production and R&D to meet specific climatic and regulatory demands, while Dow and DuPont develop reflective, low-VOC materials to support sustainable construction initiatives. Carlisle enhances market penetration through collaborations with contractors and comprehensive warranty programs. Across the board, training initiatives, digital project support, and warranty-backed systems are central to their strategy in both new-build and refurbishment projects.

Middle East Waterproofing Chemicals Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 436.4 million |

|

Revenue forecast in 2033 |

USD 652.4 million |

|

Growth rate |

CAGR of 5.2% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, country |

|

Country scope |

Oman; Kuwait; Saudi Arabia; UAE; Qatar; Bahrain; Isael; Rest of Middle East |

|

Key companies profiled |

Sika AG; BASF SE; Dow; Carlisle Companies Inc.; DuPont; Mitsubishi Chemical Group Corporation; Evonik Industries AG; Bostik; Wacker Chemie AG; MAPEI S.p.A. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |