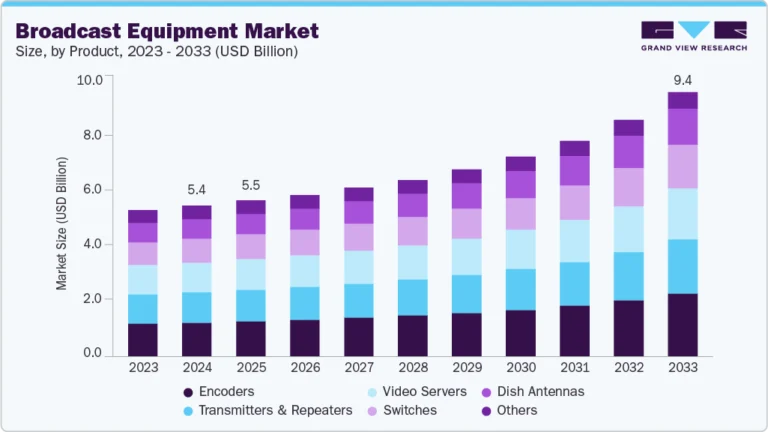

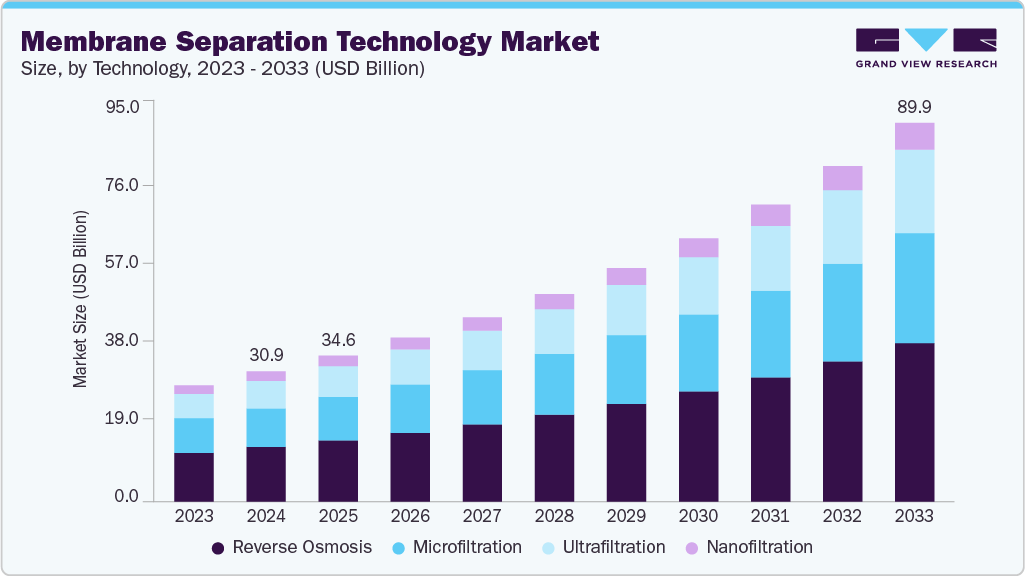

Membrane Separation Technology Market Size, Share & Trends Analysis growing at a CAGR of 12.7% from 2025 to 2033

The global membrane separation technology market size was estimated at USD 30,900.5 million in 2024 and is projected to reach USD 89,879.5 million by 2033, growing at a CAGR of 12.7% from 2025 to 2033. The market is propelled by rising demand for water treatment and industrial gas separation, along with increasingly stringent environmental regulations.

Key Market Trends & Insights

- Asia Pacific dominated the membrane separation technology market with the largest revenue share of 36.7% in 2024.

- The membrane separation technology market in the U.S. is expected to grow at a CAGR of 10.5% from 2025 to 2033.

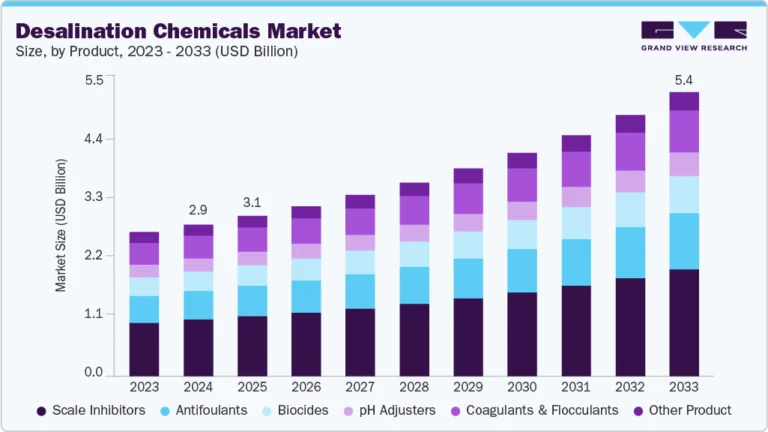

- By technology, reverse osmosis segment is expected to grow at a considerable CAGR of 12.6 % from 2025 to 2033 in terms of revenue.

- By application, water & wastewater treatment segment is expected to grow at a considerable CAGR of 12.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 30,900.5 Million

- 2033 Projected Market Size: USD 89,879.5 Million

- CAGR (2025-2033): 12.7%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/membrane-separation-technology-market/request/rs1

Technological advancements in membrane materials and a growing focus on energy-efficient separation processes further accelerate market expansion and innovation across key industries. In addition, the growing adoption of membrane separation technology in the dairy processing and beverage industry is expected to drive significant market growth. As demand for efficient filtration methods increases, membrane technology helps improve product quality, extend shelf life, and reduce energy consumption. Its applications in separating proteins, fats, and water in dairy and beverage production will further accelerate market expansion over the forecast period.

Market Concentration & Characteristics

The global membrane separation technology industry is moderately fragmented, with numerous companies offering a variety of solutions across different industries. While large multinational corporations dominate in high-capital sectors like water treatment and desalination, smaller players often focus on niche applications like food and beverage processing. Market diversity in product types, materials, and industries leads to a competitive landscape, where innovation and regional preferences influence growth, preventing dominance by a few major players.

The global membrane separation technology industry exhibits a high degree of innovation, driven by advancements in membrane materials, such as nanocomposites and polymer blends. Continuous R&D aims to improve efficiency, selectivity, and durability. Innovation also focuses on reducing energy consumption and expanding applications in biotechnology, pharmaceuticals, and wastewater treatment.

Mergers and acquisitions in the membrane separation technology industry have increased to expand service capabilities, geographic reach, and technology portfolios over the years. Key players are acquiring smaller, specialized firms to strengthen their position in water treatment, food processing, and pharmaceuticals. They also foster innovation and increase competitiveness in a rapidly evolving industry landscape. For instance, in March 2025, True North Venture Partners merged Nanostone Water and Solecta to form Acuriant Technologies, aiming to solve complex separation challenges across industries like dairy, life sciences, and water treatment. Acuriant combines polymeric and ceramic membrane technologies, offering a broad, advanced membrane portfolio with tailored solutions and single-point accountability for filtration and separation processes.

Regulations play a crucial role in shaping the membrane separation technology industry by setting strict standards for water quality, industrial emissions, and food safety. Compliance requirements drive demand for advanced, efficient membrane systems in wastewater treatment, pharmaceuticals, and food processing, encouraging innovation and ensuring sustainable and environmentally responsible operations.