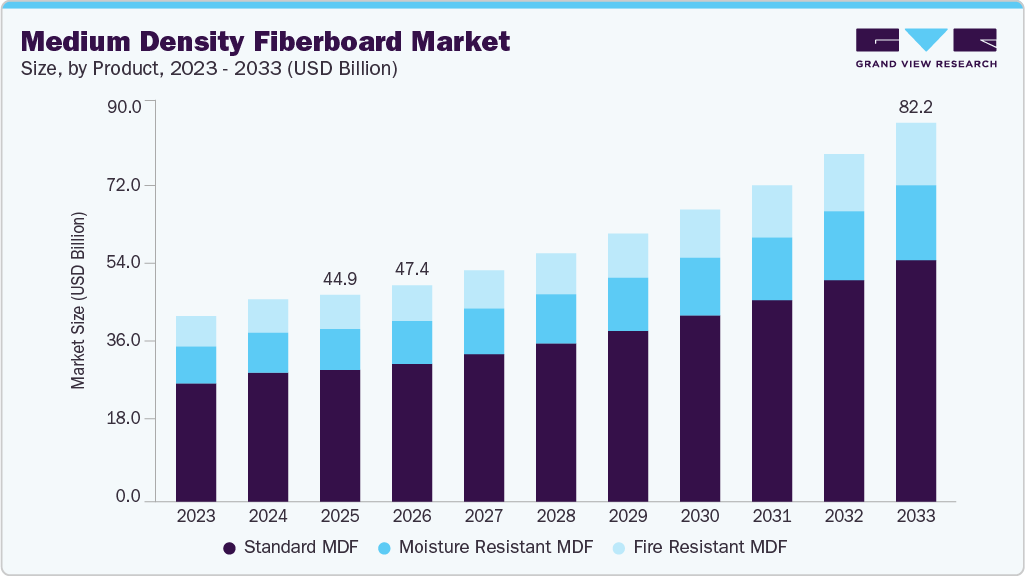

Medium Density Fiberboard Market growing at a CAGR of 8.2% from 2026 to 2033

The global medium density fiberboard market size was valued at USD 44.96 billion in 2025 and is projected to reach USD 82.24 billion by 2033, growing at a CAGR of 8.2% from 2026 to 2033. This growth is attributed to the increasing demand for products in the construction, furniture, and interior decoration sectors.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for a revenue share of 59.4% in the global market in 2025.

- By product, the standard medium density fiberboard segment led the market and accounted for the largest revenue share of 66.0% in 2025.

- By type, the E1 medium density fiberboard segment led the market and accounted for the largest revenue share of 75.1% in 2025.

- By application, the furniture segment led the market and accounted for the largest revenue share of 59.7% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 44.96 Billion

- 2033 Projected Market Size: USD 82.24 Billion

- CAGR (2026-2033): 8.2%

- Asia Pacific: Largest market in 2025

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/medium-density-fiberboard-market/request/rs1

Furthermore, the low product cost and the availability of several varieties of application-specific panels are factors that are likely to compel manufacturers to opt for these products in construction and furniture applications. The U.S. dominates the North American medium-density fiberboard (MDF) panel market, accounting for the highest revenue share in terms of consumption. This is attributed to the increased penetration of the product in the residential sector, coupled with the growing number of single-family homes. Moreover, major companies in the U.S. are increasingly opting for smart wood packaging products to meet strict guidelines laid by government bodies regarding the safe storage of food products over a long duration and to improve medical compliance rates.

The demand for the product is further anticipated to increase due to its superior qualities, including high strength, durability, and resistance to moisture and fire, supporting the growth of the fire-rated medium density fiberboard market. Additionally, technical innovations and improvements in the production process have resulted in the manufacturing of medium density fiberboard with superior durability and extended lifespan. Superior adhesion techniques with low-emission formaldehyde-based resins have spurred product innovations in the industry.

Medium density fiberboard panels are used in a variety of production processes in the construction sector, including siding, flooring, window, and door panels. In the aforementioned applications, these panels can replace conventional building materials, including cement, glass, plywood, and plastic. The demand for medium density fiberboard panels is, therefore, expected to increase throughout the course of the forecast period, along with the expansion of the building industry and the broader medium density fiberboard panel market.

The government’s initiatives to increase residential development, along with population growth and rising urbanization, are projected to fuel demand for wooden furniture. The demand for furniture is expected to increase due to remodeling and renovation projects driven by improving living standards. The development of office spaces and corporate buildings in emerging nations has impacted the demand for wood furniture as a result of the expansion of the service sector.

Market Concentration & Characteristics

The medium density fiberboard (MDF) market is moderately fragmented, with a mix of global players and regional manufacturers competing for market share. Leading companies focus on product innovation, capacity expansion, and expanding their distribution networks to strengthen their position, while smaller players often serve niche markets or meet local demands. Competitive intensity is shaped by price sensitivity, quality differentiation, and sustainability initiatives.

The MDF market is governed by strict environmental and safety regulations, including standards for formaldehyde emissions, sustainable sourcing, and workplace safety. Compliance with certifications such as FSC, CARB, and E1/E0 standards is crucial for both domestic and international sales. Regulatory frameworks influence production methods, raw material sourcing, and export potential

.Key substitutes for MDF include plywood, particleboard, and solid wood, which can impact pricing and demand dynamics. End users are primarily concentrated in furniture manufacturing, interior construction, and cabinetry sectors, making demand sensitive to trends in real estate, renovation, and home décor. Strong relationships with these end users often determine market success and customer retention.

Medium Density Fiberboard Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 47.42 billion |

|

Revenue forecast in 2033 |

USD 82.24 billion |

|

Growth rate |

CAGR of 8.2% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Volume in Thousand Cubic Meters, Revenue in USD Million, and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Russia; China; Japan; India; Brazil; Argentina; Saudi Arabia; UAE; Egypt |

|

Key companies profiled |

Dongwha Malaysia Holdings Sdn. Bhd.; Kronospan Limited; Dare Panel Group Co., Ltd.; EGGER Group; Norbord Inc.; Kastamonu Entegre; Georgia-Pacific; ARAUCO; West Fraser Timber Co. Ltd.; Nag Hamady Fiber Board Co.; Century Plyboards (India) Limited; CalPlant I, LLC; Soane Industria SGPS, S.A; An Cuong Woodworking Materials; Evergreen Fiberboard Berhad |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |