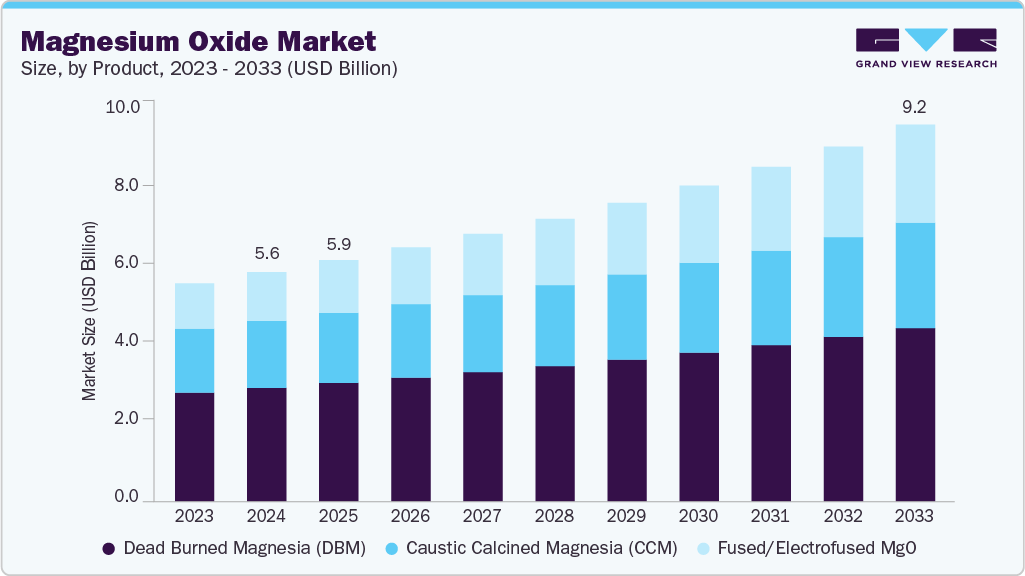

Magnesium Oxide Market growing at a CAGR of 5.7% from 2025 to 2033

The global magnesium oxide market size was estimated at USD 5.63 billion in 2024 and is projected to reach USD 9.25 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033. This growth is driven by the increasing/growing demand of the steel, cement, and ceramics sectors, particularly in emerging economies, which continues to drive magnesium oxide (MgO) consumption through its use in high-temperature refractory linings.

Key Market Trends & Insights

- Asia Pacific dominated the magnesium oxide market with the largest revenue share of 52.9% in 2024.

- The China magnesium oxide industry is expected to grow at the fastest CAGR of 5.0% from 2025 to 2033.

- By product, the fused/electrofused MgO segment is expected to grow at the fastest CAGR of 8.1% from 2025 to 2033 in terms of revenue.

- By application, the agriculture segment held the largest revenue share of 32.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.63 Billion

- 2033 Projected Market Size: USD 9.25 Billion

- CAGR (2025-2033): 5.7%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/magnesium-oxide-market-report/request/rs1

Moreover, the global shift toward sustainable manufacturing, environmental protection, and agricultural productivity elevated the demand for reactive and high-purity MgO in water treatment, emissions control, and soil enhancement. Furthermore, increasing innovation in pharmaceuticals, specialty chemicals, and advanced materials is expanding its functional scope. Backed by continuous technological advancement, process optimization, and vertical integration, magnesium oxide remains a strategically vital material enabling durability, efficiency, and sustainability across global value chains.

Key opportunities in the magnesium oxide industry are increasing due to demand across various end-use industries, including environmental, construction, agriculture, and healthcare. With the increasing global emphasis on sustainable materials, MgO’s eco-friendly profile plays a significant role in carbon capture, wastewater treatment, and soil enhancement, presenting major growth opportunities. The construction industry’s shift toward fire-resistant and energy-efficient materials further fuels the adoption of MgO boards and cement. Additionally, its use in animal feed, fertilizers, and pharmaceuticals benefits from the growing focus on nutrition and health. Technological advancements in production efficiency and the development of high-purity, reactive grades also open new possibilities in electronics, refractories, and specialty chemicals, making MgO a key material in the transition toward greener and high-performance applications.

The global MgO market continues to face a range of structural and operational challenges that influence its long-term growth trajectory. A key concern is the volatility in magnesite prices, which directly impacts production economics and pricing stability. Stringent environmental regulations governing mining and calcination processes have increased compliance costs and restricted supply in several regions. Persistent quality inconsistencies among producers, particularly in developing markets, affected product performance and end-user confidence. Moreover, competition from alternative materials such as calcium oxide and other refractory substitutes presents an ongoing threat to market share.

Market Concentration & Characteristics

The presence of several multinational chemical companies with well-established production, distribution, and purification capabilities characterizes the global magnesium oxide market. Leading players, such as Israel Chemical Ltd. (ICL), Martin Marietta Magnesia Specialties, Premier Magnesia, and Grecian Magnesite, dominate the market through their extensive product portfolios, diverse magnesia offerings, and global supply networks. These companies leverage advanced technologies and regulatory compliance expertise to cater to the demand.

The market demonstrates limited price elasticity, as production costs are closely tied to raw material and energy inputs. Product standardization is moderate, with differentiation largely based on purity, reactivity, and end-use specialization. Regional markets often operate in supply clusters near resource bases, leading to localized competition and logistical interdependence. Overall, the industry combines high capital intensity, resource dependency, and technological specialization, creating a structure that favors scale efficiency and long-term contractual relationships over short-term price competition.

Application Insights

The agriculture segment dominated the global magnesium oxide industry with the largest revenue share of 32.9% in 2024. Agriculture is the largest application segment for magnesium oxide, due to its critical dual role in both crop and livestock production. In farming, MgO serves as an effective soil amendment, improving acidic soils by raising the pH and supplying essential magnesium, a key element in chlorophyll production and photosynthesis. Its high reactivity and neutralizing value make it particularly valuable in regions facing soil magnesium depletion, such as parts of Asia, Latin America, and sub-Saharan Africa. Additionally, the global shift toward sustainable agriculture and precision nutrition has driven up demand for consistent, high-quality magnesium inputs-making MgO an indispensable part of modern agricultural systems.

Magnesium Oxide Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.93 billion |

|

Revenue forecast in 2033 |

USD 9.25 billion |

|

Growth rate |

CAGR of 5.7% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Middle East & Africa; Latin America |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

Israel Chemical Ltd. (ICL); Martin Marietta Magnesia Specialties; Premier Magnesia; Grecian Magnesite; NEDMAG B.V.; Magnezit Group; Haicheng Guangling Refractory; Yingkou Magnesite Chemical Industrial Group; Bhavani Chemicals; Ube Material Industries Ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |