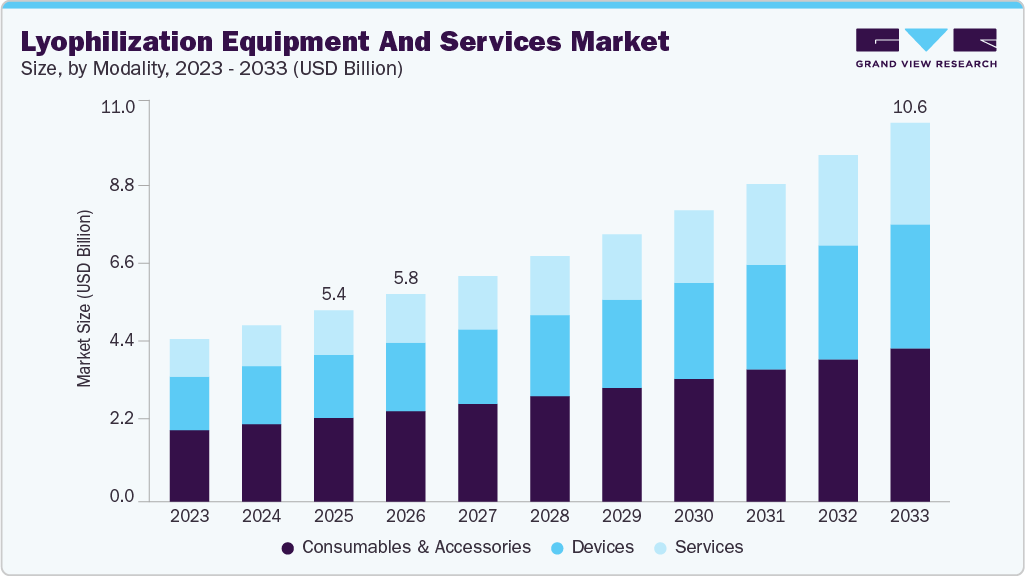

Lyophilization Equipment And Services Market growing at a CAGR of 8.98% from 2026 to 2033

The global lyophilization equipment and services market estimated for USD 5.36 billion in 2025 and is projected to reach USD 10.63 billion by 2033, growing at a CAGR of 8.98% from 2026 to 2033. Market growth is driven by increasing use of freeze-drying in pharmaceutical and biotechnology manufacturing for biologics, vaccines, and injectables, alongside rising CDMO outsourcing and adoption of automated, high-efficiency lyophilization systems.

Key Market Trends & Insights

- North America lyophilization equipment and services industry held the largest global market share of 39.65% in 2025.

- The lyophilization equipment and services industry in the U.S. is expected to grow over the forecast period due to the expanding aging population.

- Based on modality, the consumables & accessories segment dominated the market with a share of 43.82% in 2025.

- Based on scale of operation, the industry scale segment dominated the market in 2025, holding a share of 46.15%.

- Based on application, the pharmaceutical and biotechnology companies segment dominated the market with revenue share of 39.97% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.36 Billion

- 2033 Projected Market Size: USD 10.63 Billion

- CAGR (2026-2033): 8.98%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/lyophilization-equipment-services-market-report/request/rs1

Rising Pipeline of Biologics

The increasing demand for lyophilization equipment and service solutions derives from the growth of the biologics pipeline, which drives drug development toward more complex molecules that include monoclonal antibodies, vaccines, and cell and gene therapies. The products require lyophilization because they show extreme sensitivity to environmental changes, which damages their stability and effectiveness, and their shelf life. The process of freeze-drying has developed into an essential step for processing various injectable and parenteral biologics.

The increasing number of regulatory approvals for biologics and specialty injectables creates ongoing commercial production needs. The new regulatory standards require companies to implement validated lyophilization processes through either establishing advanced equipment or using external CDMO services. The demand for lyophilization systems and contract freeze-drying services has increased because products are entering their final development and commercial stages.

Technological Advancements

The implementation of continuous lyophilization and advanced automation and PAT technology provides businesses with improved control over essential processes while decreasing the time needed for production, the variability of results, and the loss of product. The manufacturing process uses these systems to handle high-value biologics while maintaining compliance with regulatory standards through Quality by Design methods.

Modern freeze-drying solutions become more appealing because they enable faster scale-up operations while requiring less manual work and delivering better energy performance, which leads to equipment purchases and technology-sharing partnerships with advanced CDMO companies. Equipment upgrades and specialized services experience increased demand because this phenomenon drives both established and developing markets to adopt new technologies.

Market Concentration & Characteristics

The lyophilization equipment and services industry exhibits a high degree of innovation, driven by advances in automation, continuous freeze-drying, and integrated PAT that enhance efficiency, scalability, and process control. The equipment suppliers and CDMOs now prefer QbD-based digital energy-saving solutions to improve their operational efficiency by decreasing production time and increasing output for their biologic and advanced treatment processes.

The lyophilization equipment and services industry experiences moderate to high merger and acquisition activity. Equipment suppliers and CDMOs use acquisitions to develop stronger capabilities in automation and process analytical technology and lyophilization operations, which help them meet the rising demand for biologics and injectable products.

Regulations strongly influence the lyophilization equipment and services industry by driving demand for GMP-compliant, validated systems that ensure product stability and consistent quality. Although compliance increases costs, it accelerates the adoption of advanced equipment and specialized CDMO services aligned with QbD and data integrity requirements.

Product expansion in the lyophilization equipment and services industry is driven by higher-capacity, automated, and energy-efficient systems designed for biologics and injectables. Companies are broadening portfolios with modular designs, PAT integration, and flexible offerings to support clinical-to-commercial scale-up.

Modality Insights

In 2025, the consumables & accessories segment accounted for the largest market share of 43.82%. This is primarily driven by the rising volume of lyophilized pharmaceutical and biotechnology products, particularly injectable drugs, vaccines, and biologics that require high-quality vials, stoppers, trays, filters, and packaging components. As pharma and biotech companies scale up production and move more complex, sensitive formulations into clinical and commercial stages, the need for consistent, compliant, and contamination-free consumables & accessories increases with every batch cycle. In parallel, stricter regulatory requirements around sterility, validation, and single-use components are encouraging manufacturers to replace reusable parts more frequently, supporting recurring demand. Growth in outsourced lyophilization services and CDMO activity further boosts consumable usage, as service providers operate at higher utilization rates and prioritize standardized, high-turnover accessories to ensure process reliability and regulatory compliance.

Scale of Operation Insights

The industry scale segment dominated the market in 2025, holding a share of 46.15%, due to the high demand for large capacity lyophilizers in commercial pharmaceutical and biotech production, where efficiency, throughput, and regulatory compliance are critical.

The laboratory scale segment is experiencing the fastest growth, because research and development needs small-scale lyophilization while biotech startups increase and researchers require quick testing for new biologic and vaccine formulations. The market segment is experiencing increased adoption because of better miniaturized lyophilization equipment and cost savings for testing experiment batches, and rising research activities in academic and contract research settings.

Application Insights

In 2025, the pharmaceutical and biotechnology companies segment held the largest share of 39.97% in the market, supported by extensive R&D pipelines, growing biologics manufacturing, and the adoption of advanced preservation technologies to maintain product stability and shelf life.

The food industry segment is expected to register the fastest CAGR over the forecast period, driven by the growing demand for freeze-dried foods, increasing consumer preference for long-shelf-life and ready-to-eat products, and the adoption of lyophilization for preserving flavor, nutrients, and texture in beverages, fruits, and snacks.

Lyophilization Equipment And Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 5.82 billion |

|

Revenue forecast in 2033 |

USD 10.63 billion |

|

Growth rate |

CAGR of 8.98% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Modality, scale of operation, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

SP Industries (SP Scientific); GEA Group, Labconco Corporation, Tofflon Science and Technology Co., Ltd., Martin Christ Freeze-Drying Systems GmbH, Azbil Corporation, I.M.A. Industria Macchine Automatiche S.p.A., Millrock Technology, Inc., OPTIMA Packaging Group GmbH, Thermo Fisher Scientific Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |