Luxury Car Market Size, Share & Trends Analysis growing at a CAGR of 7.2% from 2025 to 2030

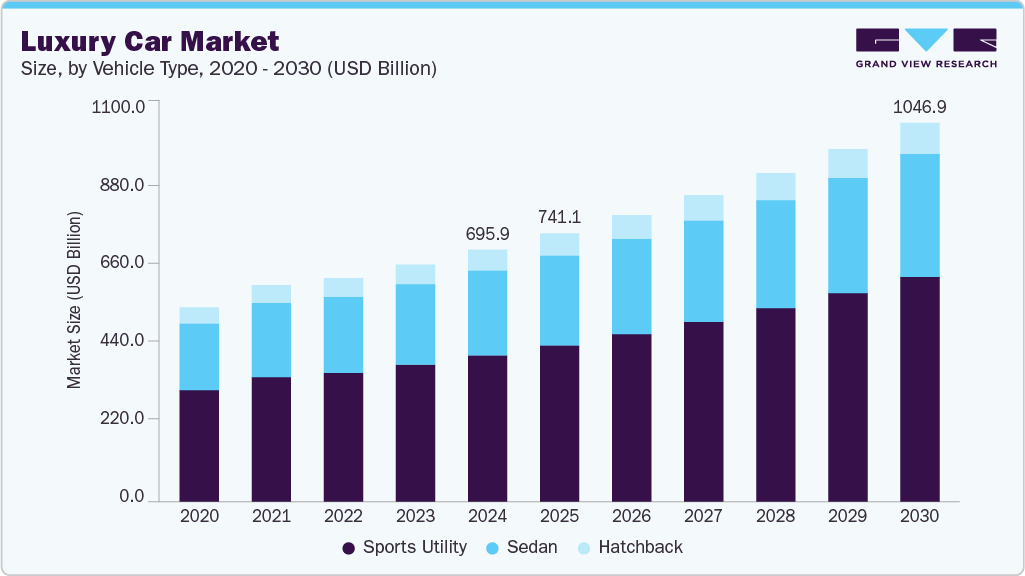

The global luxury car market size was estimated at USD 695.92 billion in 2024 and is projected to reach USD 1,046.87 billion by 2030, growing at a CAGR of 7.2% from 2025 to 2030. The electrification of luxury vehicles is driving market growth as consumer demand shifts toward high-performance EVs that offer both sustainability and advanced technology.

Key Market Trends & Insights

- The North America luxury car market accounted for the largest share of 23.0% in 2024.

- The U.S. luxury car industry held a dominant position in 2024.

- By vehicle type, the sports utility segment accounted for the largest share of 58.0% in 2024.

- By propulsion type, the Internal Combustion Engine (ICE) segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 695.92 Billion

- 2030 Projected Market Size: USD 1,046.87 Billion

- CAGR (2025-2030): 7.2%

- North America: Largest Market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/luxury-car-market-report/request/rs1

Tesla’s dominance with the Model Y as the top-selling luxury CUV in 2021 and 2022 underscores a rising consumer preference for electric luxury vehicles. The increase in U.S.-produced luxury CUVs from 37.9% of domestic sales in 2018 to 49.4% in 2022 reflects both manufacturing expansion and growing consumer trust, propelling the luxury EV segment forward. Pressure from Tesla’s success is forcing traditional luxury brands to accelerate their EV roadmaps, especially in regulated markets, thereby pushing the overall luxury market toward electrification.

Luxury automakers’ push to integrate lightweight materials is driven by the need to meet global emissions standards and enhance fuel economy. Partnerships with suppliers like Toray Industries have enabled brands such as BMW and Mercedes-Benz to reduce vehicle weight by at least 10%, increasing performance efficiency. This gives them a competitive edge in sustainability-conscious markets, and innovations like BMW’s carbon fiber-reinforced i-series vehicles extend battery range, boosting the appeal of luxury EVs and fueling the luxury car industry’s growth.

The expansion of U.S.-based luxury vehicle production from 59.3% in 2018 to 77.6% in 2022 is driven by consumer preferences for domestically assembled cars, supply chain resilience, and trade policy incentives. Facilities like BMW’s Spartanburg plant, which exports 70% of its output, illustrate how localization is positioning the U.S. as a global hub for luxury SUV manufacturing. This trend supports market growth by reducing trade risks and leveraging domestic incentives like the Advanced Technology Vehicles Manufacturing Loan Program.

Despite localization, the need to control production costs and maintain global competitiveness is driving luxury automakers to expand their global manufacturing footprints. Investments such as Audi’s USD 1.3 billion plant in Puebla and GM’s USD 600 million in Mexican operations highlight efforts to balance cost efficiency with market access. Global sourcing, like carbon fiber from Japan and batteries from Europe, enables luxury brands to maintain quality and scale, sustaining their presence in multiple regions and fueling growth through operational flexibility.

The evolution toward software-defined vehicles is reshaping consumer expectations in the luxury segment. With premium models now containing up to 100 million lines of code, features like real-time diagnostics and over-the-air updates are emerging as core differentiators. The hiring of thousands of engineers by GM to develop vehicle software shows how digital innovation is becoming a primary driver of brand competitiveness. Technologies like Tesla’s Autopilot and Mercedes’ MBUX are setting benchmarks, making software capabilities a key factor driving the demand for luxury vehicles.