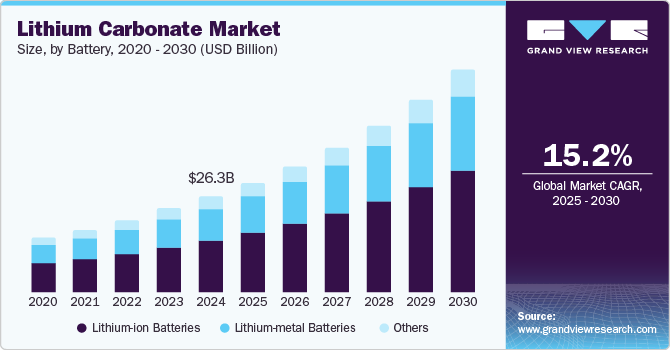

Lithium Carbonate Market growing at a CAGR of 15.2% from 2025 to 2030

The global lithium carbonate market size was estimated at USD 26,307.4 million in 2024 and is projected to reach USD 61,052.6 million by 2030, growing at a CAGR of 15.2% from 2025 to 2030. The market is experiencing robust growth, driven by the rapid expansion of the electric vehicle (EV) industry.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, Mexico is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, lithium-ion batteries accounted for a revenue of USD 16,199.7 million in 2024.

- Lithium-ion Batteries is the most lucrative battery type segment registering the fastest growth during the forecast period.

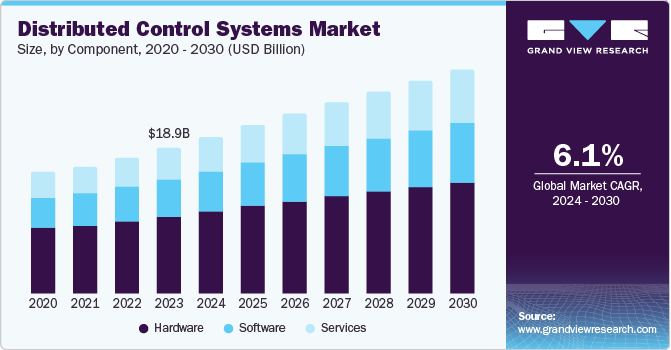

Market Size & Forecast

- 2024 Market Size: USD 26,307.4 Million

- 2030 Projected Market Size: USD 61,052.6 Million

- CAGR (2025-2030): 15.2%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/lithium-carbonate-market-report/request/rs1

It is a critical raw material for lithium-ion batteries, which are essential for EVs. As governments worldwide implement stricter environmental regulations and offer incentives to encourage the adoption of clean energy and electric vehicles, the demand for the product has surged. Major automotive manufacturers are increasingly investing in EV production, further bolstering the market’s growth trajectory.

The global push towards renewable energy storage solutions has significantly influenced the overall market. Energy storage systems (ESS) for solar and wind energy rely on lithium-ion batteries, creating a substantial demand for lithium carbonate. Urbanization and industrialization in emerging economies have also led to increased usage of electronic devices, further propelling the need for lithium-based batteries.

Furthermore, advancements in battery technologies, including solid-state and high-capacity lithium-ion batteries, are driving innovation and increasing the consumption of the product. The rising adoption of portable electronic devices and consumer preferences for lightweight, long-lasting batteries continue to fuel market growth. These trends and efforts to secure a sustainable lithium supply chain are positioning it as a cornerstone of the global energy transition.

Drivers, Opportunities & Restraints

The surging demand for consumer electronics, such as smartphones, laptops, and wearable devices, further drives the industry. Lithium-ion batteries, which rely on lithium carbonate, are essential for powering these devices due to their lightweight and high energy efficiency. Moreover, ongoing technological advancements in battery manufacturing, including innovations that enhance energy density and reduce charging times, have increased reliance on high-purity lithium carbonate to meet performance benchmarks.

Supportive government policies also contribute to market growth. Many nations are incentivizing local lithium production and processing to strengthen critical mineral supply chains and reduce import dependence. The rise of lithium-ion battery recycling initiatives, driven by sustainability goals, creates a secondary demand for lithium carbonate derived from recycled materials, further bolstering the market’s expansion.

The industry offers numerous growth opportunities, especially in the EV and renewable energy sectors. Emerging economies, particularly in Asia-Pacific and Latin America, present untapped potential due to the increasing penetration of EVs and infrastructure development. Innovations in lithium extraction technologies, such as direct lithium extraction (DLE), promise to improve efficiency and sustainability, opening new avenues for market players. Developing solid-state batteries and other advanced battery technologies is also expected to create a high demand for ultra-pure lithium carbonate. Furthermore, collaborations between battery manufacturers and mining companies and government support for critical mineral supply chains enhance growth prospects for the market.

The fluctuating prices of lithium carbonate, driven by supply-demand imbalances and geopolitical issues, can impact market stability. Environmental concerns related to lithium mining, including water usage and habitat disruption, pose regulatory and reputational risks for producers. The limited availability of high-grade lithium resources and lengthy extraction processes further constrain supply chains. Additionally, competition from alternative battery chemistries, such as sodium-ion and hydrogen fuel cells, could threaten the market long-term. Balancing sustainability with scalability remains a critical challenge for the industry’s continued expansion.

Lithium Carbonate Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 30,141.9 million |

|

Revenue forecast in 2030 |

USD 61,052.6 million |

|

Growth Rate |

CAGR of 15.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative Units |

Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Battery, grade, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Brazil, Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Albemarle Corp.; Ganfeng Lithium Co., Ltd.; SQM S.A.; Tianqi Lithium Corp.; Livent Corp.; Lithium Americas Corp.; Pilbara Minerals; Orocobre Ltd. Pty. Ltd.; Mineral Resources |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |