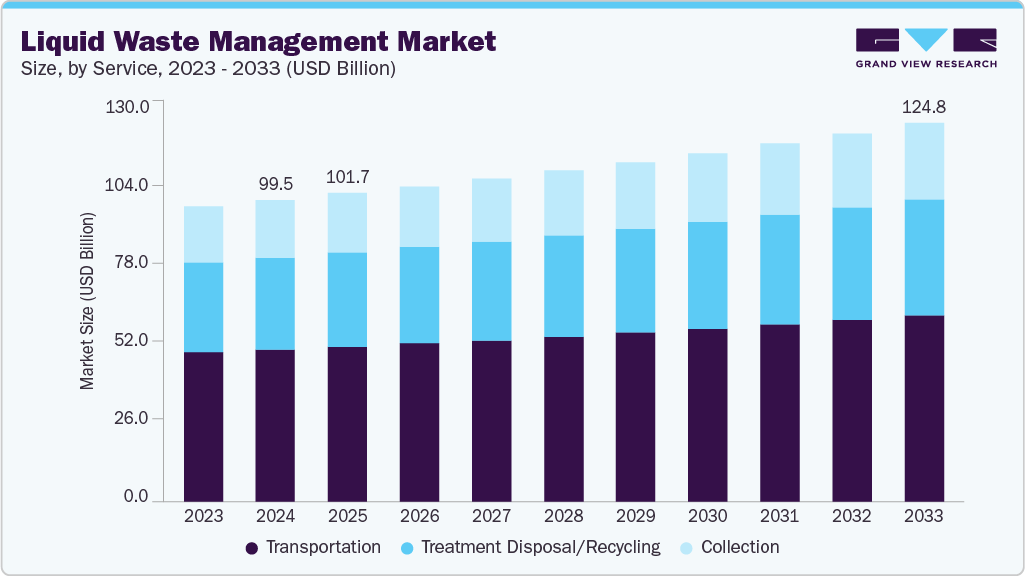

Liquid Waste Management growing at a CAGR of 2.6% from 2025 to 2033

The global liquid waste management market size was estimated at USD 99.49 billion in 2024 and is projected to reach USD 124.83 billion by 2033, growing at a CAGR of 2.6% from 2025 to 2033. Rising demand for wastewater treatment plants, driven by urbanization and industrial growth, is boosting the need for effective liquid waste management.

Key Market Trends & Insights

- North America dominated the liquid waste management market with the largest revenue share of 42.1% in 2024.

- By source, the commercial segment is expected to grow at the fastest CAGR of 2.9% from 2025 to 2033.

- By service, the collection segment is expected to grow at the fastest CAGR of 3.1% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 99.49 Billion

- 2033 Projected Market Size: USD 124.83 Billion

- CAGR (2025-2033): 2.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/liquid-waste-management-market/request/rs1

Growing concerns over environmental toxicity, public health, and regulatory compliance are pushing industries and municipalities to adopt advanced treatment solutions. The growing population, expansion of new housing projects, and a rising number of users connecting to centralized wastewater treatment systems are expected to drive demand for secondary wastewater treatment equipment significantly.

As urban infrastructure develops and environmental regulations tighten, the need for efficient treatment solutions will increase, further propelling market growth over the coming years across residential and municipal sectors.

Market Concentration & Characteristics

The liquid waste management industry is moderately fragmented, with a mix of global corporations, regional service providers, and specialized local firms competing. Large players offer end-to-end waste treatment solutions, while smaller companies focus on niche services or specific regions. Despite a few dominant firms, no single company holds overwhelming market control. Varying local regulations, infrastructure needs, and customer preferences allow multiple providers to coexist, creating competitive diversity.

The liquid waste management industry is witnessing significant innovation, driven by advancements in biological treatment, membrane technologies, and real-time monitoring systems. Companies are developing eco-friendly, energy-efficient solutions to meet rising environmental concerns. Smart automation, AI-based analytics, and zero-liquid discharge technologies are also gaining traction, enhancing efficiency, compliance, and sustainability across industrial, municipal, and residential waste treatment processes.

Mergers and acquisitions in the liquid waste management industry are driven by the need to expand service portfolios, enter new regions, and enhance technological capabilities. Larger firms acquire niche or regional players to strengthen market presence and access specialized expertise. These consolidations improve operational scale, streamline logistics, and help companies better address rising environmental and regulatory demands across diverse sectors.

Stringent environmental regulations are a major force shaping the liquid waste management industry. Governments and environmental bodies are enforcing strict discharge standards, pollution control norms, and water reuse mandates. Compliance with these regulations compels industries and municipalities to invest in advanced treatment systems. Regulations also encourage the adoption of sustainable practices, driving demand for more efficient and compliant waste management solutions.

Liquid Waste Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 101.67 billion |

|

Revenue forecast in 2033 |

USD 124.83 billion |

|

Growth rate |

CAGR of 2.6% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Source, service, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Russia; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Veolia; SUEZ S.A.; Evoqua Water Technologies Corporation; Biffa plc; Waste Management Inc.; Clean Harbors Inc.; Clean Water Environmental; Liquid Environmental Solutions (LES); DC Water; Covanta Holding Corp.; Stericycle, Inc.; U.S. Ecology, Inc.; Republic Services, Inc.; Hazardous Waste Experts; Xylem, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |