Levulinic Acid Market growing at a CAGR of 9.4% from 2025 to 2030

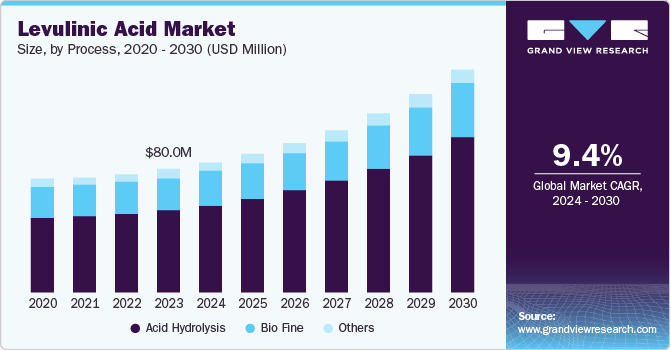

The global levulinic acid market size was valued at USD 84.6 million in 2024 and is projected to grow at a CAGR of 9.4% from 2025 to 2030. The market growth is primarily driven by the increasing preference for levulinic acid derivatives over synthetic counterparts due to their superior properties.

Key Market Trends & Insights

- North America levulinic acid market is anticipated to grow at a CAGR of 7.1% from 2024 to 2030.

- By process, the acid hydrolysis process segment accounted for a revenue share of 67.1% in 2023.

- By application, the food additive segment dominated the market in 2023.

Market Size & Forecast

- 2024 Market Size: USD 84.6 Million

- 2030 Projected Market Size: USD 144.7 Million

- CAGR (2025-2030): 9.4%

- North America: Largest market in 2023

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/levulinic-acid-market/request/rs1

Moreover, rising consumer adoption of levulinic acid-containing products is anticipated to fuel market expansion. A key factor contributing to this growth is the emergence of cost-effective levulinic acid production capabilities, particularly in the Asia Pacific and European regions.

The push towards renewable chemistry and biotechnology has catalyzed the development of bio-derived products. Among these, levulinic acid has emerged as a pivotal platform chemical. Its versatility is evident in its role as a precursor to a range of specialty chemicals, including fuel additives such as MTHF and pesticides such as DALA and DPA. The relatively straightforward production process of levulinic acid further enhances its market appeal.

Currently, levulinic acid is used for diverse applications across multiple industries. It is prominently utilized in the production of cosmetics, pesticides, and pharmaceuticals. Additionally, it serves as a food additive and finds more limited use in the manufacturing of plastics, synthetic rubbers, and nylons. In the cosmetics market, levulinic acid is incorporated in approximately 98 formulations, and sodium levulinate in approximately 295 products. The maximum reported concentration of levulinic acid is approximately 4.5% in hair dyes, and sodium levulinate at a maximum of 0.62% concentration.

Government policies are increasingly supportive of levulinic acid production, reflecting a broader shift towards environmental sustainability and economic growth. These initiatives align with Europe’s bioeconomy strategy, emphasizing public sector investment, job creation, and circular economy principles.

Process Insights

The acid hydrolysis process segment accounted for a revenue share of 67.1% in 2023 attributed to the efficiency and reliability of the acid hydrolysis process in producing levulinic acid. The process involves the breakdown of cellulose, a complex carbohydrate found in all plant structures, into simpler compounds using an acid catalyst. This method is widely used due to its ability to yield a high volume of levulinic acid, thereby meeting the increasing demand in various industries such as agriculture, pharmaceuticals, and food additives.

The bio-fine process segment is anticipated to grow at a CAGR of 8.1% from 2024 to 2030. The bio-fine process is a newer method that uses biomass as a feedstock to produce levulinic acid. This process is gaining traction due to its eco-friendly nature and the global shift towards sustainable and green chemistry. The significant growth rate indicates that industries are starting to adopt this process, recognizing its potential benefits not only in terms of levulinic acid production but also in contributing to environmental sustainability.

Levulinic Acid Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 90.2 million |

|

Revenue forecast in 2030 |

USD 144.7 million |

|

Growth Rate |

CAGR of 9.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Volume in Kilo Tons, Revenue in USD thousand, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Process, Application, Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Brazil, Argentina, Saudi Arabia, UAE |

|

Key companies profiled |

Segetis; Biofine Technology LLC; DuPont; Hebei Langfang Triple Well Chemicals Co. Ltd; Hebei Shijiazhuang Worldwide Furfural & Furfuryl Alcohol Furan Resin Co. Ltd.; Jiangsu Yancheng China Flavor Chemicals Co. Ltd; Shijiazhuang Pharmaceutical Group Ouyi Pharmaceutical Co. Ltd; Shanghai Apple Flavor & Fragrance Co. Ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |