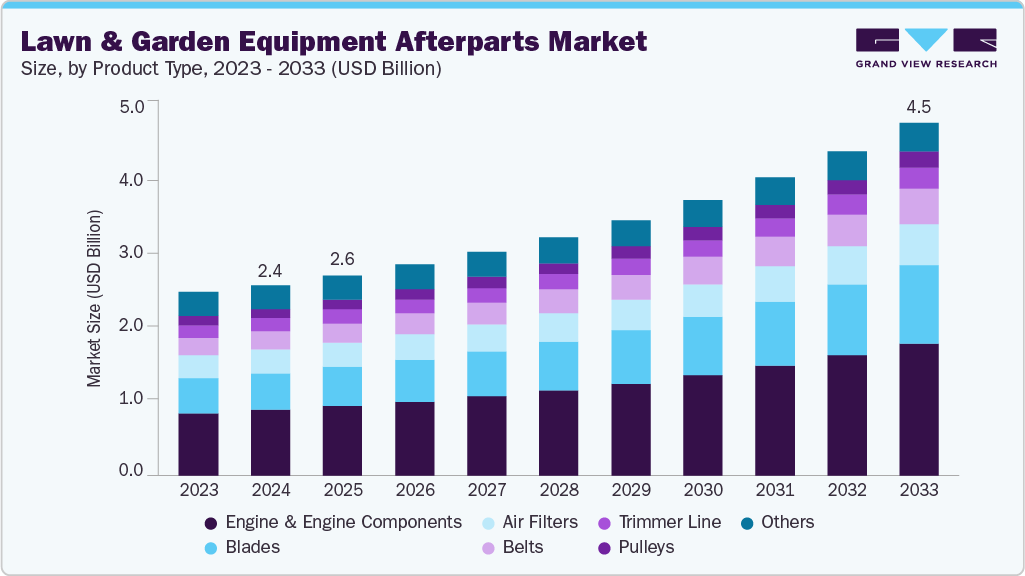

Lawn And Garden Equipment Afterparts Market Size, Share & Trends Analysis growing at a CAGR of 7.3% from 2025 to 2033

The global lawn and garden equipment afterparts market size was estimated at USD 2.43 billion in 2024 and is projected to reach USD 4.49 billion by 2033, growing at a CAGR of 7.3% from 2025 to 2033. The growth is driven by the increasing demand for equipment maintenance and replacement components across residential, commercial, and agricultural sectors.

Key Market Trends & Insights

- North America dominated the lawn and garden equipment afterparts market with a revenue share of 35.9% in 2024.

- The U.S. lawn and garden equipment afterparts industry held a dominant position in North America in 2024.

- By product type, the engine & engine components segment dominated the market with the largest share of 34.5% in 2024.

- By equipment type, the lawn mowers segment dominated the market in 2024.

- By distribution channel, the brick and mortar stores segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.43 Billion

- 2033 Projected Market Size: USD 4.49 Billion

- CAGR (2025-2033): 7.3%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/lawn-garden-equipment-afterparts-market-report/request/rs1

The expansion of suburban housing, coupled with rising consumer interest in home gardening and landscaping, has contributed to sustained equipment usage, leading to a consistent need for aftermarket parts. In addition, seasonal wear and frequent usage of tools such as lawnmowers, trimmers, and blowers have necessitated regular part replacements, further supporting market expansion. Furthermore, an increasing focus on cost-efficiency and sustainability has encouraged end users, particularly residential and small commercial users, to extend the lifespan of their lawn and garden equipment through regular maintenance. This shift in consumer behavior has driven up demand for afterparts such as filters, blades, and belts.

The lawn and garden equipment afterparts industry’s growth is further driven by ongoing advancements in manufacturing and materials technologies, particularly in the development of durable, high-performance components. The integration of smart diagnostics and predictive maintenance tools in newer equipment models has created demand for compatible, tech-enabled aftermarket solutions. Innovations in 3D printing and additive manufacturing have enabled more localized and efficient production of custom parts. This has improved availability and reduced lead times for end users. Thus, technological integration in equipment and diagnostics can be attributed to the market growth.

The growing adoption of digital platforms for parts procurement has significantly influenced the aftermarket landscape. Manufacturers and third-party sellers have increasingly leveraged e-commerce to enhance accessibility and product availability, particularly in fragmented markets. The convenience of online catalogs, compatibility tools, and doorstep delivery has strengthened consumer preference for digital purchasing channels. As a result, market penetration has accelerated in both urban and rural areas.

Lawn And Garden Equipment Afterparts Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.55 billion |

|

Revenue forecast in 2033 |

USD 4.49 billion |

|

Growth rate |

CAGR of 7.3% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, equipment type, material type, distribution channel, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Briggs & Stratton; Husqvarna AB; STIHL LIMITED; Deere & Company; Rotary Corporation; Oregon Tool, Inc.; Stens; MTD Products LLC; Sunbelt; Ballard Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |