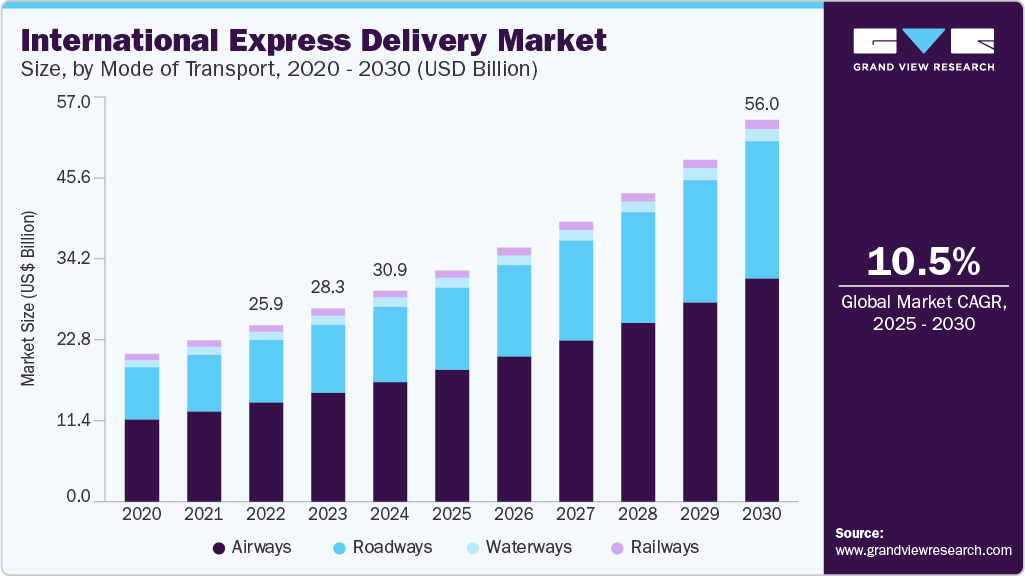

International Express Delivery Market Size, Share & Trends Analysis growing at a CAGR of 10.5% from 2025 to 2030

The global international express delivery market size was estimated at USD 30.96 billion in 2024 and is projected to reach USD 56.00 billion by 2030, growing at a CAGR of 10.5% from 2025 to 2030. Several key macroeconomic and sector-specific factors have driven the market.

Key Market Trends & Insights

- Asia Pacific leads the international express delivery market with a share of 44.66% in 2024.

- The international express delivery market in India held the highest revenue market share.

- Based on mode of transport, the airways segment accounted for the largest share of 56.7% in 2024 due to its unmatched speed and global reach.

- In terms of end user, B2C is expected to register the highest CAGR of 12.5% during the forecast period fueled by the exponential rise of cross-border e-commerce.

- Based on industry, the retail & E-commerce segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 30.96 billion

- 2030 Projected Market Size: USD 56.00 billion

- CAGR (2025-2030): 10.5%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/international-express-delivery-market-report/request/rs1

The rise of cross-border e-commerce, increasing globalization of trade, and consumer demand for faster delivery times have collectively propelled market growth. Supply chain optimization strategies and growing import-export activities across both developed and emerging economies have also contributed to demand. Enhanced business-to-consumer (B2C) fulfillment expectations have intensified reliance on express logistics services, especially in the retail, pharmaceutical, and electronics sectors. Technological advancements have been rapidly integrated into the express delivery ecosystem. Innovations such as automated sorting systems, AI-powered route optimization, and real-time tracking solutions have been adopted to increase operational efficiency.

The use of drones and autonomous delivery vehicles is being explored to reduce last-mile delivery costs, while blockchain is being tested to enhance parcel traceability and data security. These technologies have enabled service providers to offer differentiated and value-added solutions in a competitive environment.

Incumbents and new entrants are investing significant capital into the sector. Major logistics companies are expanding their global networks through mergers, acquisitions, and infrastructure development. They are prioritizing investment in regional hubs, distribution centers, and IT platforms to support volume scalability. Venture capital firms are backing digital logistics startups, driving innovation in cross-border shipping platforms and last-mile fulfillment technologies. Companies are also forming strategic partnerships to streamline customs clearance and reduce delivery timeframes.

The market is subject to a complex regulatory framework that varies significantly across jurisdictions. Logistics providers must navigate customs regulations, trade tariffs, and import-export compliance requirements. Enhanced data protection and consumer rights policies, especially in the EU and North America, have imposed stricter operational standards. Sustainability regulations are being enforced more rigorously, compelling firms to report on emissions and adopt greener practices across their supply chains.

International Express Delivery Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 33.92 billion |

|

Revenue forecast in 2030 |

USD 56.00 billion |

|

Growth rate |

CAGR of 10.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Mode of transport, end user, industry, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

DHL Group; FedEx; United Parcel Service, Inc. (UPS); SF Express; CJ Logistics Corporation; La Poste Group; US Postal Service; Correos Express; Blue Dart Express Ltd.; Aramex |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |