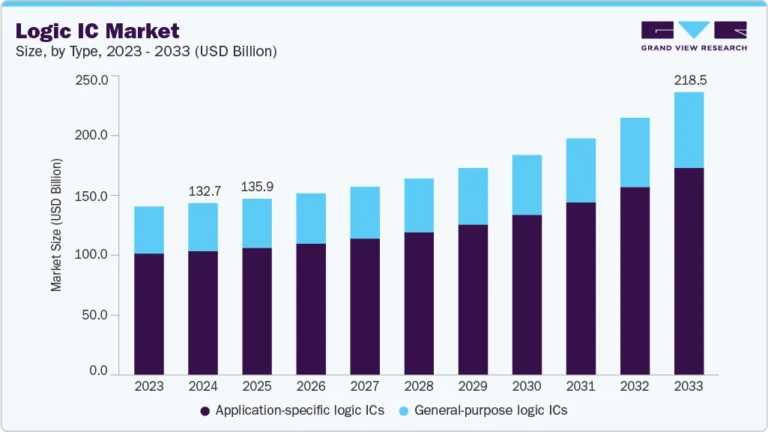

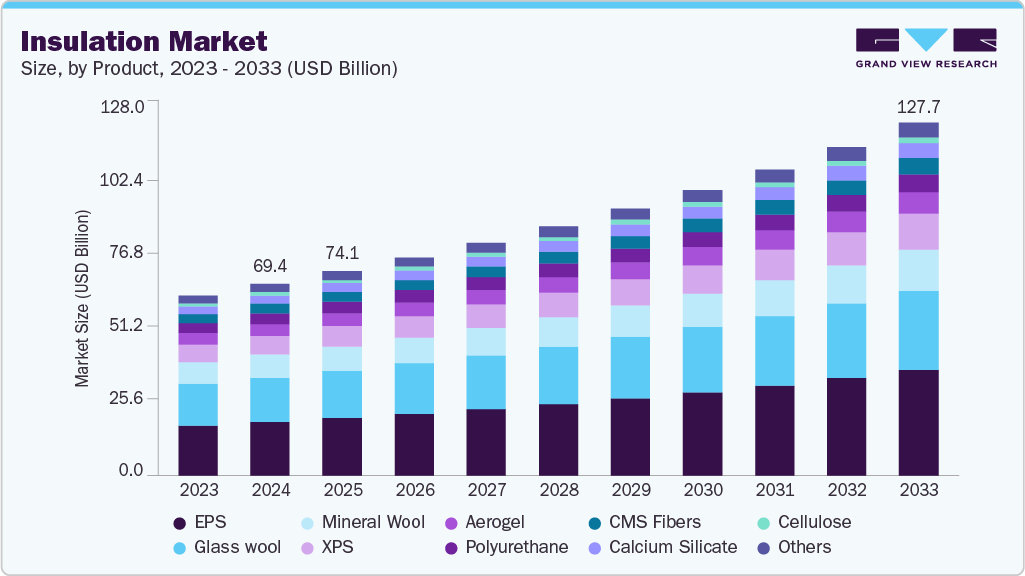

Insulation Market Size Share & Trends Analysis growing at a CAGR of 7.0% from 2025 to 2033

The global insulation market size was estimated at USD 69.43 billion in 2024 and is projected to reach USD 127.70 billion by 2033, growing at a CAGR of 7.0% from 2025 to 2033. Rising consumer awareness pertaining to energy conservation is likely to remain a crucial driving factor for the global insulation industry.

Key Market Trends & Insights

- Asia Pacific dominated the insulation market with the largest revenue share of 42.4% in 2024.

- By product, the EPS segment is expected to grow at the fastest CAGR of 7.9% over the forecast period.

- By application, the infrastructure segment is expected to grow at fastest CAGR of 7.3% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 69.43 Billion

- 2033 Projected Market Size: USD 127.70 Billion

- CAGR (2025-2033): 7.0%

- Asia Pacific: Largest and Fastest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/insulation-market/request/rs1

Favorable regulations in a majority of regions are also expected to have a positive impact on market growth. In addition, increased infrastructure spending in the emerging markets of the Asia Pacific & Latin America is expected to propel the insulation industry growth. On the other hand, fluctuating prices of the fundamental raw materials are expected to continue to pose a challenge for market participants.

Rapid urbanization and increasing construction activities across developing economies are major demand drivers. Regulatory mandates related to thermal performance and energy savings have prompted builders to use advanced insulation solutions. The rise in HVAC installations, especially in commercial and retail sectors, creates indirect demand. Innovations in material science, such as vacuum insulation panels, aerogels, and spray foam, are enabling better thermal performance at lower thicknesses. Sustainability-driven consumers and corporations are also influencing the selection of eco-friendly, recyclable insulation products. Moreover, the rising prominence of temperature-sensitive logistics, like pharmaceuticals and food, has expanded insulation needs beyond construction.

The market is witnessing a shift toward environmentally sustainable insulation materials, including sheep wool, cellulose, mycelium, and recycled denim. High-performance aerogels, vacuum insulation panels (VIPs), and phase-change materials (PCMs) are gaining ground in high-end applications. Smart insulation integrated with IoT sensors for thermal performance tracking is emerging. Modular and prefabricated construction methods are increasing the use of factory-fitted insulation panels. Companies are investing in low-emission and fire-resistant insulation materials. Digital tools are also being used to simulate energy savings pre-construction. Overall, sustainability, circularity, and performance optimization are shaping R&D in the insulation industry.

Market Concentration & Characteristics

The global insulation industry is moderately consolidated, with a few major players occupying significant shares across multiple geographies. However, several regional and niche manufacturers thrive in domestic and specialty segments, especially in eco-friendly and custom insulation. Vertical integration of raw material production and distribution is seen among key players. Intense competition in commodity insulation types (glass wool, EPS, XPS) keeps pricing pressure high. Consolidation through mergers and acquisitions is ongoing, with companies seeking portfolio diversification and regional reach, particularly in Asia Pacific and Latin America.