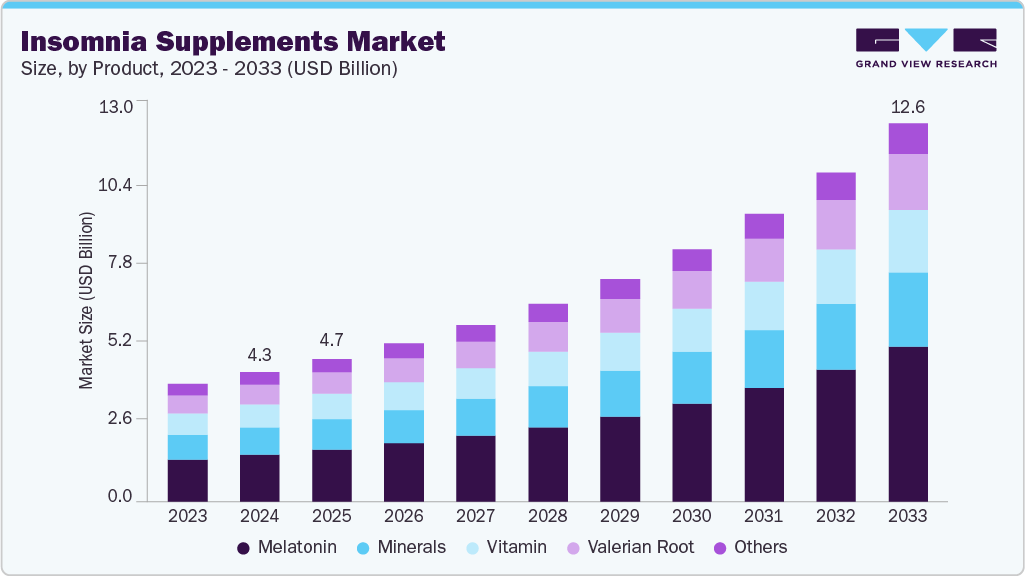

Insomnia Supplements Market growing at a CAGR of 12.94% from 2025 to 2033

The global insomnia supplements market size was estimated at USD 4.29 billion in 2024 and is projected to reach USD 12.55 billion by 2033, growing at a CAGR of 12.94% from 2025 to 2033. Growing awareness around the impact of poor sleep on overall health has become a major catalyst for insomnia supplement demand.

Key Market Trends & Insights

- The North America insomnia supplements market held the largest share of 36.54% of the global market in 2024.

- The insomnia supplements industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the melatonin segment held the highest market share of 36.05% in 2024.

- Based on source, the natural segment held the highest market share in 2024.

- By distribution channel, the retail pharmacies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.29 Billion

- 2033 Projected Market Size: USD 12.55 Billion

- CAGR (2025-2033): 12.94%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/insomnia-supplements-market-report/request/rs1

As more people deal with stress, long work hours, and digital-screen exposure, sleep disruption has become almost a daily reality across age groups.

Rising Global Prevalence of Sleep Disorders

The steady rise in sleep-related problems worldwide has become a central force behind the growing demand for insomnia supplements. Longer working hours, digital overload, chronic stress, and lifestyle pressures are pushing more people into irregular sleep patterns. Many individuals now experience frequent nighttime awakenings, trouble falling asleep, or poor sleep quality, issues that often go untreated because they don’t always meet the threshold for clinical intervention. As these symptoms become more common across both developed and emerging markets, consumers are increasingly looking for accessible, low-barrier solutions to manage daily sleep challenges. For instance, in the U.S., around 30% of adults report symptoms such as difficulty falling or staying asleep, while about 10% live with chronic insomnia that has daytime consequences. Meanwhile, about 12% of Americans have been medically diagnosed with chronic insomnia, according to a recent survey by the American Academy of Sleep Medicine.

This widespread prevalence has also made people more aware of the long-term health consequences of poor sleep, including fatigue, mood disturbances, cardiovascular risks, and cognitive decline. With healthcare systems emphasizing preventive wellness and individuals wanting to avoid prescription sleep medications, when possible, supplements are viewed as a gentler, more natural alternative. This shift in mindset, combined with a large and growing population affected by sleep issues, has created a sustained, global pull for sleep-support supplements, turning everyday sleep struggles into a strong market driver.

Insomnia Supplements Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.74 billion |

|

Revenue forecast in 2033 |

USD 12.55 billion |

|

Growth rate |

CAGR of 12.94% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, source, dosage form, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait |

|

Key companies profiled |

Nature’s Bounty; Herbalife Nutrition Ltd.; Hims & Hers Health, Inc.; NOW Foods; Bayer; Nestlé; Zarbee’s; Naturals; Olly; Herb Pharm; Natrol, LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |