Industrial WLAN growing at a CAGR of 8.8% from 2025 to 2033

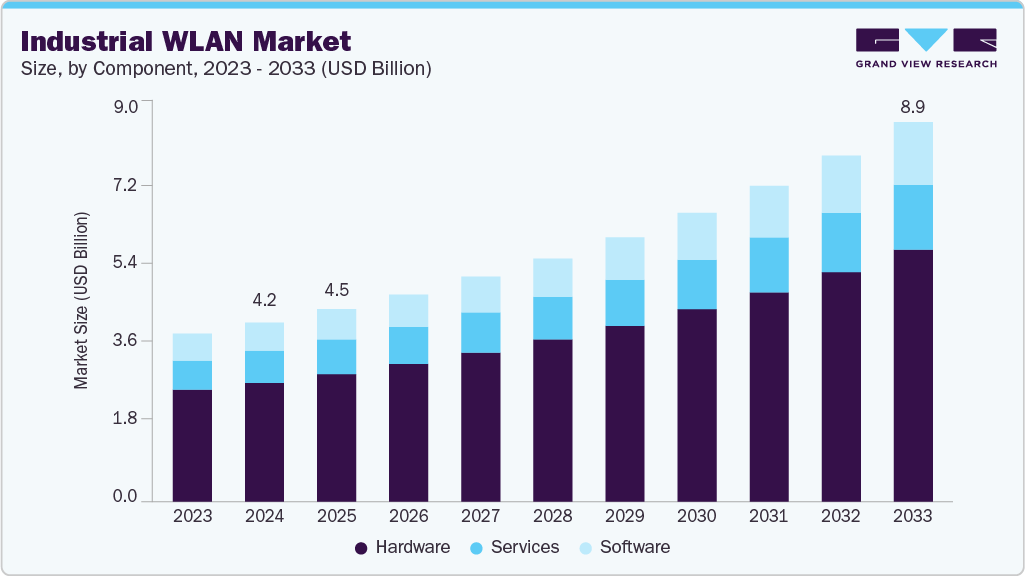

The global industrial WLAN market size was estimated at USD 4.23 billion in 2024, and is projected to reach USD 8.94 billion by 2033, growing at a CAGR of 8.8% from 2025 to 2033. The adoption of high-speed wireless connectivity and advanced WLAN standards such as Wi-Fi 6 has emerged as a significant trend in the global industrial WLAN market, driven by the rise of Industry 4.0, the proliferation of IIoT devices, and the growing need for real-time data exchange in smart manufacturing environments.

Key Market Trends & Insights

- The Asia Pacific industrial WLAN market accounted for a 31.9% share of the overall market in 2024.

- The industrial WLAN industry in China held a dominant position in 2024.

- By component, the hardware segment accounted for the largest share of 66.5% in 2024.

- By technology standard, the 802.11ax (Wi-Fi 6/6E) segment held the largest market share in 2024.

- By deployment type, the on-premise segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.23 Billion

- 2033 Projected Market Size: USD 8.94 Billion

- CAGR (2025-2033): 8.8%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/industrial-wlan-market-report/request/rs1

The development and adoption of standardized wireless protocols serve as a fundamental driver propelling the industrial WLAN market growth. Institutions like the National Institute of Standards and Technology (NIST) have been instrumental in establishing best-practice frameworks through partnerships with industry leaders, including the 2017 IEEE-NIST joint workshop focused on wireless technology selection, spectrum management, and testing procedures.

This collaboration has resulted in standardized industrial wireless protocols such as ISA100.11a and IEEE 802.11 variants optimized for industrial applications. For example, the IEEE 802.11ax amendment incorporates orthogonal frequency-division multiple access (OFDMA) to enhance deterministic communication, which is essential for real-time robotic control and motion-critical tasks. By reducing interoperability issues and offering validated network architectures, this standardization is accelerating the deployment of WLAN systems in legacy industrial infrastructure, thereby boosting market growth.

The Industrial WLAN market is further propelled by the surge in IIoT applications that require ultra-reliable, low-latency communications (URLLC). The 5G Alliance for Connected Industries and Automation (5G-ACIA) has set stringent operational technology (OT) benchmarks for industrial wireless, such as achieving latencies below 10 milliseconds for robotic assembly and real-time monitoring.

To meet these demands, industrial WLAN protocols like Wireless Network for Industrial Automation, Factory Automation (WIA-FA) have integrated time-division multiple access (TDMA) techniques, providing deterministic performance once limited to wired systems. For instance, WIA-FA supports data rates of up to 250 Mbps with latency under 2 milliseconds, enabling seamless wireless connectivity for collaborative robots in automotive production. This trend, highlighted by the IEEE Industrial Electronics Society, is expanding wireless use cases from basic process automation to complex, dynamic manufacturing operations, thereby driving market adoption.

Regulatory policies expanding the availability of unlicensed spectrum are significantly boosting industrial WLAN capabilities and market growth. The Federal Communications Commission’s (FCC) 2020 ruling to open the 6 GHz band (5.925-7.125 GHz) for unlicensed use has been a game changer, offering 1.2 GHz of additional bandwidth. This spectrum expansion enables IEEE 802.11ax (Wi-Fi 6E) networks to utilize wide 160 MHz channels, delivering multi-gigabit speeds essential for bandwidth-heavy industrial applications such as augmented reality (AR) maintenance and 4K video surveillance.

Industrial WLAN Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.54 billion |

|

Revenue forecast in 2033 |

USD 8.94 billion |

|

Growth rate |

CAGR of 8.8% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, technology standard, deployment type, application, end user industry, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; and South Africa |

|

Key companies profiled |

Cisco Systems, Inc.; Commscope Inc.; D-Link Limited; Extreme Networks; Fortinet, Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; Juniper Networks, Inc.; Ruckus Wireless; Siemens |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |