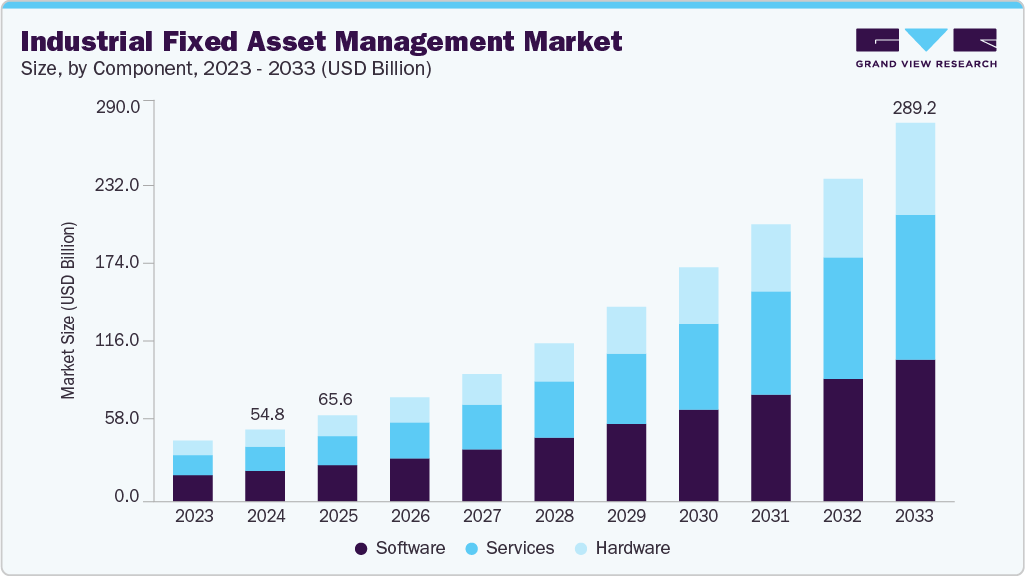

Industrial Fixed Asset Management Market growing at a CAGR of 20.4% from 2025 to 2033

The global industrial fixed asset management market size was estimated at USD 54.83 billion in 2024 and is projected to reach USD 289.21 billion by 2033, growing at a CAGR of 20.4% from 2025 to 2033. The digital transformation of industries is driving the growth of the industry.

Key Market Trends & Insights

- North America industrial fixed asset management market dominated the global market with the largest revenue share of 32.9% in 2024.

- The industrial fixed asset management industry in the U.S. is expected to grow significantly over the forecast period.

- By component, software led the market and held the largest revenue share of 42.6% in 2024.

- By asset type, the IT asset segment held the dominant position in the market and accounted for the largest revenue share in 2024.

- By end use, the manufacturing segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 54.83 Billion

- 2033 Projected Market Size: USD 289.21 Billion

- CAGR (2025-2033): 20.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/industrial-fixed-asset-management-market-report/request/rs1

With Industry 4.0, IoT-enabled sensors, cloud computing, artificial intelligence, and predictive analytics are being integrated into asset management systems to provide deeper insights into asset conditions and performance. This enables predictive and preventive maintenance strategies, where issues can be identified before they escalate into failures, reducing costly unplanned downtime.

Industrial Fixed Asset Management (IFAM) systems are undergoing a significant evolution, driven by advancements in AI, edge computing, IoT, and digital twin technologies that are fundamentally reshaping how organizations manage asset-intensive operations. A pivotal shift lies in the integration of AI-driven predictive analytics directly into asset management platforms, allowing enterprises to forecast equipment failures, optimize maintenance intervals, and reduce total cost of ownership, transforming asset oversight from reactive to predictive. These systems leverage real-time sensor data, contextual analytics, and machine learning models to enable faster, data-backed decisions. Increasingly, this intelligence is processed locally using edge computing nodes, especially in remote industrial environments where cloud latency or connectivity is a concern.

In parallel, the deployment of digital twins has gained traction in sectors such as energy, mining, and manufacturing. These dynamic models simulate asset behavior under varied conditions, enabling scenario-based performance optimization, downtime risk forecasting, and lifecycle extension. For example, in June 2022, Siemens launched an updated version of its Xcelerator platform with enhanced digital twin orchestration across multi-plant industrial networks, allowing real-time visibility into asset condition, performance deviations, and carbon footprint tracking. Furthermore, OEMs like Caterpillar have deepened native equipment integration with platforms such as VisionLink, which now enables unified asset monitoring across mixed fleets, predictive alerting, and role-based dashboards. This integration is reshaping equipment value propositions, embedding service-based models around uptime and efficiency.

Industrial Fixed Asset Management Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 65.56 billion |

|

Revenue forecast in 2033 |

USD 289.21 billion |

|

Growth rate |

CAGR of 20.4% from 2025 to 2033 |

|

Actual data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report enterprise size |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, asset type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

ABB; AMCS Group; Assertive Industries, Inc.; Bentley Systems; Incorporated; CPCON Group; Honeywell International Inc.; Radiant RFID; Regal Rexnord; Rockwell Automation; RSM US LLP; Schneider Electric; Siemens AG; Verasset; WSP; Zebra Technologies Corp. |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |