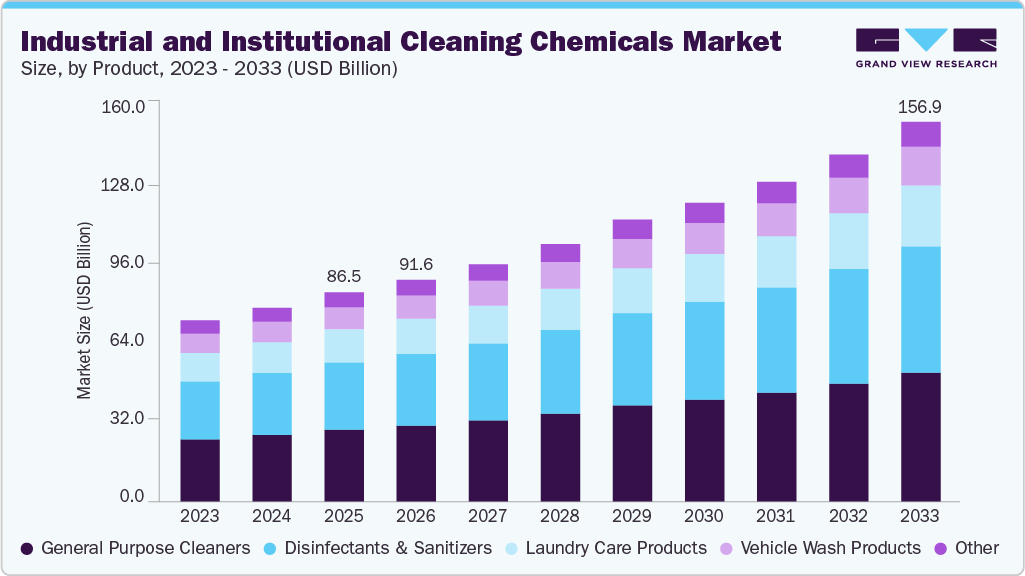

Industrial And Institutional Cleaning Chemicals Market growing at a CAGR of 8.0% from 2026 to 2033

The global industrial and institutional cleaning chemicals marketsize was estimated at USD 86.46 billion in 2025 and is projected to reach USD 156.99 billion by 2033, growing at a CAGR of 8.0% from 2026 to 2033. The market’s growth is driven by rising hygiene standards, stringent health and safety regulations, increased demand from the healthcare and food service sectors, growing awareness of sustainable cleaning solutions, and technological advancements enabling more effective, eco-friendly, and specialized cleaning chemical formulations worldwide.

Key Market Trends & Insights

- North America dominated the globalindustrial and institutional cleaning chemicals market with the largest revenue share of 33.55% in 2025.

- The industrial and institutional cleaning chemicals market in the U.S. is expected to grow at a substantial CAGR of 7.9% from 2026 to 2033.

- By raw material, the surfactants segment held the highest market share of 29.3% in 2025 in terms of revenue.

- By product, the general purpose cleaners segment led the market and accounted for the largest revenue share of 34.3% in 2025.

- By end-use, the manufacturing segment accounted for the largest revenue share of 69.8% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 86.46 Billion

- 2033 Projected Market Size: USD 156.99 Billion

- CAGR (2026-2033): 8.0%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/industrial-institutional-cleaning-chemicals-market/request/rs1

Heightened hygiene and safety concerns following the pandemic have significantly boosted global consumption of industrial and institutional cleaning chemicals. Strict health regulations in sectors like healthcare and food processing further drive demand for effective cleaners, disinfectants, and sanitizers. In countries like the U.S., a large industrial base and widespread maintenance of public spaces contribute to consistent market growth. Manufacturers are prioritizing R&D to diversify product portfolios with advanced and more efficient cleaning solutions.

There is immense potential for sustainable and eco-friendly cleaning products as consumers increasingly seek ways to lower their carbon footprint. Growing demand for plant-based, non-toxic, and biodegradable chemicals, particularly in developed markets like the U.S., presents lucrative opportunities for manufacturers. Companies investing in green innovation and transparent labeling can strengthen their market presence while supporting sustainability goals.

Despite robust growth, the market faces challenges such as the high cost of developing sustainable cleaning solutions and the complex regulatory approvals required for new chemical formulations. Overuse or misuse of harsh chemical cleaners can pose environmental risks, creating pressure on manufacturers to balance efficacy with safety and sustainability without compromising performance standards.

Market Concentration & Characteristics

The global industrial and institutional cleaning chemicals market is moderately consolidated, dominated by a mix of large multinational corporations and regional specialists. Major players such as Ecolab Inc., Diversey Holdings Ltd., BASF SE, Procter & Gamble Professional, Clorox Professional Products Company, and 3M Company hold significant market shares through extensive product lines, established distribution networks, and substantial investments in research and development. These leaders maintain their competitive edge by continuously innovating, expanding sustainable product portfolios, and leveraging global supply chains to achieve economies of scale.

The industry is marked by high regulatory compliance requirements, as manufacturers must adhere to strict health, safety, and environmental standards, especially for products used in healthcare, food service, and industrial facilities. Demand spans a wide array of applications-ranging from janitorial services and institutional kitchens to industrial processing plants and public infrastructure-driving the need for both broad-use and specialized cleaning formulations.

Despite the presence of large players, the market remains competitive due to the contribution of smaller, niche companies that focus on region-specific needs, green cleaning solutions, and customized service contracts. Barriers to entry include significant capital requirements for production facilities, complex regulatory approvals, and the need for robust distribution partnerships. Leading companies differentiate themselves through product performance, sustainable innovation, value-added services, and integrated hygiene management solutions, ensuring customer loyalty and compliance with evolving standards worldwide.

Industrial And Institutional Cleaning Chemicals Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 91.64 billion |

|

Revenue forecast in 2033 |

USD 156.99 billion |

|

Growth rate |

CAGR of 8.0% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Raw material, product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Procter & Gamble; BASF SE; Clariant; The Clorox Company, Inc.; Henkel AG & Co. KGaA; 3M; Kimberly-Clark Corporation; Reckitt Benckiser Group plc; Croda International PLC; Albemarle Corporation; Eastman Chemical Corporation; Huntsman International LLC; Stepan Company; Westlake Chemicals Corporation; SOLVAY; Dow; Sasol |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |