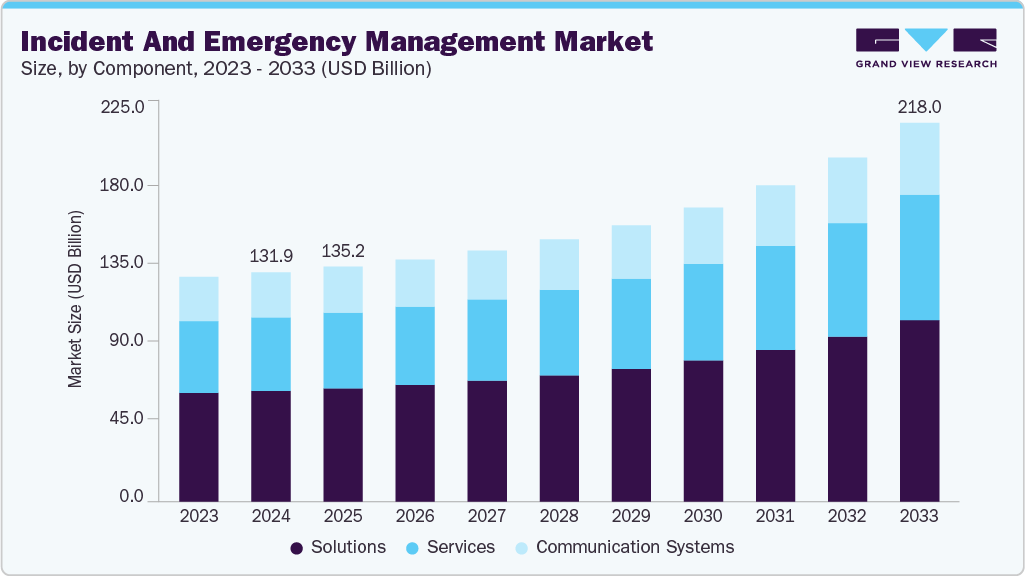

Incident And Emergency Management Market Size, Share & Trends Analysis growing at a CAGR of 6.2% from 2025 to 2033

The global incident and emergency management market size was estimated at USD 131.92 billion in 2024, and is projected to reach USD 218.04 billion by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The growth is attributed to the increasing number of natural disasters, terrorist threats, industrial accidents, and public health emergencies.

Key Market Trends & Insights

- The North America incident and emergency management market accounted for a 37.6% revenue share in 2024.

- The incident and emergency management industry in the U.S. held a dominant position in 2024.

- By component, the solutions segment accounted for the largest revenue share of 48.3% in 2024.

- By system type, the emergency/mass notification systems segment held the largest revenue share in 2024.

- By deployment mode, the on-premise segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 131.92 Billion

- 2033 Projected Market Size: USD 218.04 Billion

- CAGR (2025-2033): 6.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/incident-emergency-management-market-report/request/rs1

Governments and organizations are prioritizing the development of resilient infrastructures and disaster response strategies to minimize casualties and economic disruption. Rising urbanization, climate change, and geopolitical instability further contribute to the demand for robust emergency preparedness and response systems across the public and private sectors. Technological advancements are transforming the landscape of emergency management. Key trends include the integration of artificial intelligence (AI), machine learning, geospatial tools, and IoT sensors to enable real-time situational awareness and decision-making. Cloud-based emergency management platforms are gaining popularity for their scalability, accessibility, and integration capabilities. Mobile-based alert systems and wearable technologies are also being used increasingly to support field responders and ensure rapid communication during emergencies. Furthermore, AI-powered surveillance and predictive analytics are helping organizations detect, assess, and respond to incidents proactively.

Investments in this sector are rising globally, both from government agencies and private enterprises. Countries are allocating substantial budgets for disaster risk reduction, homeland security, and public health response systems. Smart city projects, particularly in regions such as Asia Pacific and the Middle East, are embedding emergency management systems as a core component of urban planning. Meanwhile, enterprises across sectors such as healthcare, energy, and transportation are investing in risk and incident management tools to ensure operational resilience and compliance with safety standards.

The regulatory landscape plays a crucial role in shaping the incident and emergency management market. Governments and international bodies have introduced strict guidelines related to emergency preparedness, data protection, occupational safety, and disaster recovery. Standards such as ISO 22320 (Emergency Management) and OSHA regulations mandate organizations to establish and test emergency response protocols. In addition, public safety initiatives such as FEMA guidelines in the U.S. and the EU Civil Protection Mechanism in Europe further enforce the deployment of compliant emergency systems.

Despite strong growth potential, the incident and emergency management industry faces several restraints. High implementation costs, particularly for small and medium enterprises, limit widespread adoption. Integration challenges with legacy systems, lack of trained personnel, and data privacy concerns related to surveillance and mass notification systems also pose significant hurdles. Moreover, in some developing regions, limited infrastructure and insufficient funding further impede the effective deployment of comprehensive emergency management solutions. These challenges highlight the need for scalable, cost-effective, and user-friendly systems to broaden market reach.

Incident and Emergency Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 135.20 billion |

|

Revenue forecast in 2033 |

USD 218.04 billion |

|

Growth rate |

CAGR of 6.2% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, system type, deployment mode, end user, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Honeywell International Inc; Motorola Solutions, Inc.; Siemens; International Business Machines Corporation; NEC Corporation; Hexagon AB; Everbridge; Collins Aerospace; BlackBerry Limited; Esri |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |