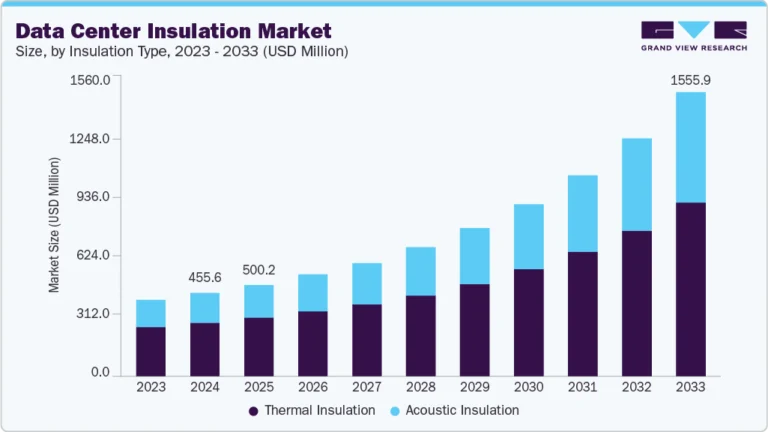

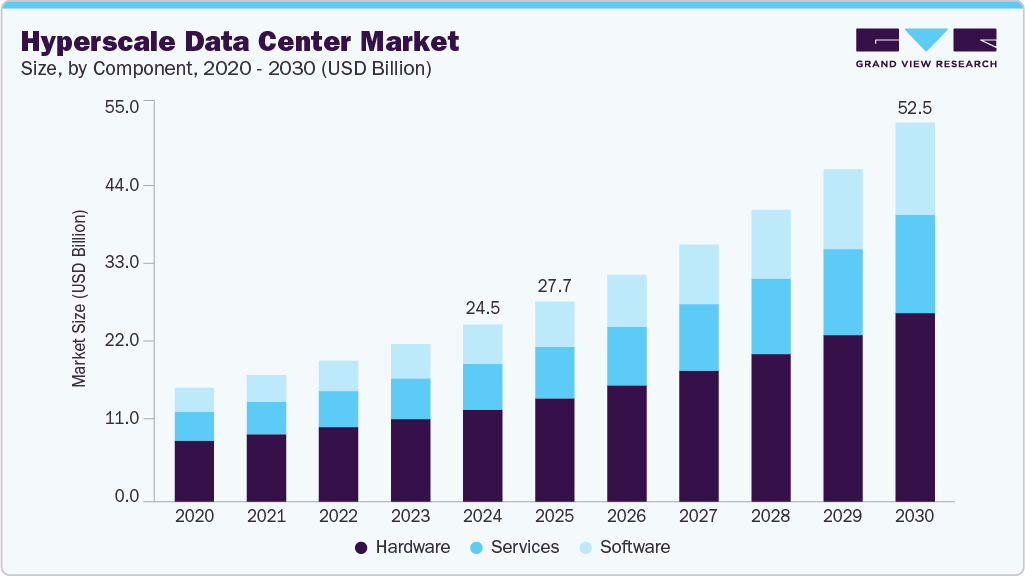

Hyperscale Data Center Market Size, Share & Trends Analysis growing at a CAGR of 13.6% from 2025 to 2030

The global hyperscale data center market size was estimated at USD 24.54 billion in 2024 and is projected to reach USD 52.54 billion by 2030, growing at a CAGR of 13.6% from 2025 to 2030, driven by the rapid expansion of cloud computing, artificial intelligence (AI), and big data analytics. As organizations shift from traditional data centers to cloud-based infrastructure, the demand for large-scale, high-performance computing environments has surged.

Key Market Trends & Insights

- North America hyperscale data center market dominated globally with a share of nearly 38.0% in 2024.

- The hyperscale data center market in the U.S. is expected to grow significantly at a CAGR of 13.6% from 2025 to 2030.

- By component, the hardware segment dominated the market with a revenue share of over 50.0% in 2024.

- By power capacity, the 50 MW to 100 MW segment dominated the market with a revenue share of over 33.0% in 2024.

- By enterprise size, the large enterprises segment dominated the market with the largest revenue share of over 73.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 24.54 Billion

- 2030 Projected Market Size: USD 52.54 Billion

- CAGR (2025-2030): 13.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/hyperscale-data-center-market/request/rs1

Hyperscale data centers, known for their ability to scale efficiently and support vast volumes of data and computing workloads, are the backbone of cloud service providers such as Amazon Web Services, Microsoft Azure, and Google Cloud. These providers continue to invest heavily in building and expanding their global data center footprints to meet escalating user demand and ensure low-latency, high-availability services.

The proliferation of digital services and content consumption also contributes significantly to the hyperscale data center industry. The rise of video streaming, gaming, e-commerce, and social media platforms has created a need for infrastructure that can support massive amounts of data storage and real-time processing. Hyperscale facilities offer the scalability, redundancy, and energy efficiency needed to meet these demands while reducing operational costs per unit of computing. Moreover, the rollout of 5G networks and the growth of Internet of Things (IoT) applications are generating more data at the edge, prompting hyperscale operators to invest in edge data centers and hybrid architectures to process data closer to the source.

Companies across industries are undergoing digital transformation, moving core operations to the cloud to improve agility, scalability, and cost-efficiency. This shift fuels demand for Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and hybrid cloud models, all of which rely on the capacity and scale of hyperscale data centers. Enterprises are increasingly relying on hyperscalers for hosting and also for analytics, security, and business continuity.

Sustainability and energy efficiency are also shaping the growth of the hyperscale data center industry. Operators are increasingly prioritizing renewable energy sources, advanced cooling techniques, and automation to reduce carbon footprints and operational costs. Governments and regulatory bodies are supporting these efforts with favorable policies and incentives, further fueling market expansion. Moreover, advancements in server technologies, storage solutions, and virtualization are enabling greater efficiency and higher density deployments, making hyperscale models more attractive across various industries, including finance, healthcare, and retail.