Hydrogen Generator Market growing at a CAGR of 7.0% from 2025 to 2030

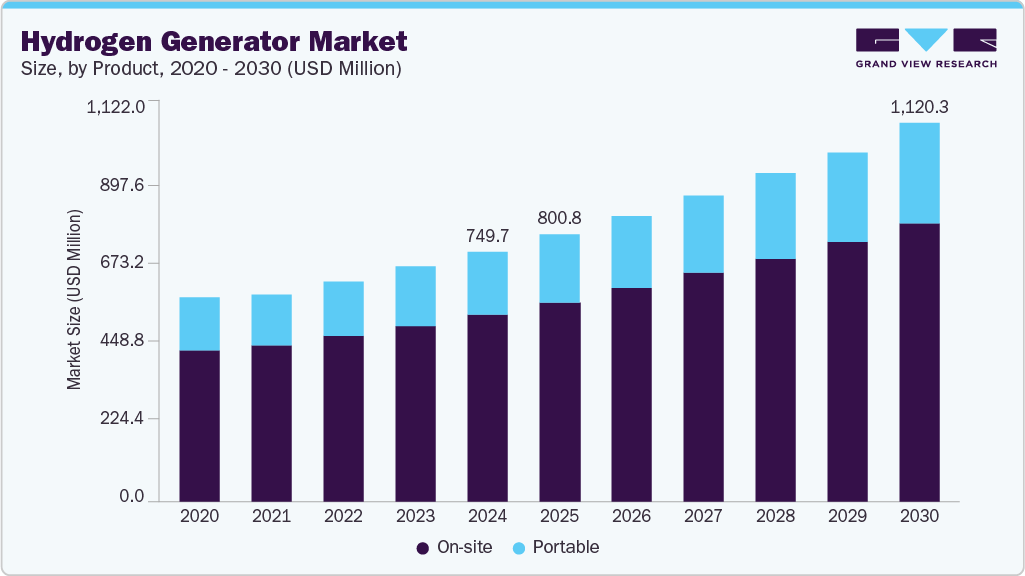

The global hydrogen generator market size was valued at USD 749.7 million in 2024 and is projected to reach USD 1,120.3 million by 2030, growing at a CAGR of 7.0% from 2025 to 2030. Market growth is expected to be driven by increasing awareness regarding sustainability and the use of renewable energy, owing to the rising global concerns over climate change and carbon emissions.

Key Market Trends & Insights

- Asia Pacific dominated the global hydrogen generator market with a revenue share of 34.9% in 2024.

- The hydrogen generator market in China held the largest share in 2024.

- By product, the on-site segment held the largest revenue share of 74.8% in 2024.

- By process, the steam reforming segment held the largest revenue share in 2024.

- By application, chemical processing, a crucial segment in the hydrogen generator industry, held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 749.7 Million

- 2030 Projected Market Size: USD 1,120.3 Million

- CAGR (2025-2030): 7.0%

- Asia Pacific: Largest market in 2024

- North American: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/hydrogen-generator-market-report/request/rs1

Governments across countries are expanding their hydrogen generation and export capabilities. For instance, under its National Green Hydrogen Mission, the Government of India aims to make the country a global hub for the production, usage, and export of green hydrogen and its derivatives by 2030. Countries across North America, Asia Pacific, and Latin America are witnessing a surge in demand for hydrogen generators. Governments worldwide are also implementing supportive policies and incentive programs to promote hydrogen as a viable alternative to fossil fuels, particularly in sectors such as transportation and industrial applications.

Ongoing advancements in hydrogen generation technologies, including steam methane reforming and electrolysis, are enhancing efficiency and reducing production costs. The rising interest in hydrogen fuel cell electric vehicles (FCEVs) is also contributing to market expansion, particularly in regions like North America, where infrastructure development for hydrogen refueling stations is underway. Furthermore, the increasing use of hydrogen in chemical processing and refining applications underscores its versatility and importance in various industries, solidifying its role in the transition to a sustainable energy future.

The market is experiencing significant growth, primarily due to the global shift toward clean and renewable energy sources, spurred by increasing concerns over climate change and the need to reduce carbon emissions. Governments of various countries are implementing supportive policies and incentive programs to promote hydrogen as a sustainable alternative to traditional fossil fuels, particularly in transportation and industrial sectors. For instance, in the U.S., hydrogen policy is guided by the U.S. Department of Energy’s Hydrogen Program Plan. The plan emphasizes innovation, commercialization, and market expansion of hydrogen technologies. This includes incentives such as tax benefits, R&D, and public-private partnership. The rising demand for hydrogen in fuel cells, especially for electric vehicles, is also a key driver, as it offers low emissions and high efficiency.

Market Concentration & Characteristics

Designing and manufacturing hydrogen generators requires sound technological capabilities and considerable capital. Hence, the market is dominated by a few key players, including Air Liquide, Linde, Air Products, and Hydrogenics. This makes the market concentration moderately high. The market is considered to have a slightly high degree of innovation due to the integration of hydrogen with renewable energy sources, EPM electrolyzers, and the development of new hydrogen storage materials. Companies are investing considerably in the development of new hydrogen generation techniques and enhancing the efficiency of existing processes. For instance, Aramco uses innovative technologies to produce blue hydrogen and transport it safely.

M&A activities are witnessing significant growth, with companies focusing on advancements to enhance hydrogen vehicles and investments in hydrogen technologies. Since hydrogen is an inflammable gas, governments are imposing strict regulations and policies to promote the safe use of hydrogen generators. For instance, the European Union defines criteria for renewable hydrogen, requiring it to achieve at least 70% greenhouse gas emissions savings compared to fossil fuels.

There are very few substitutes for hydrogen generators because other options are expensive, difficult to manage, and cannot do the same job. Alternatives like nitrogen generators, zero-air generators, and regular gas generators are available, but they serve different purposes and cannot fully replace hydrogen, especially in labs and clean energy applications.

Hence, most of the industries, including pharmaceuticals, environmental testing, and chemical processing, use hydrogen generators. Even though making, storing, and transporting hydrogen can be costly and complex, hydrogen is widely available and clean, making it a good choice for the future. Since there aren’t many good alternatives, most end users continue to depend on hydrogen generators, leading to a moderately-high end user concentration.

Product Insights

The on-site segment held the largest revenue share of 74.8% in 2024, driven by the increasing demand for clean energy solutions and the push toward decarbonization. This segment primarily focuses on centralized hydrogen production facilities that supply hydrogen to various industries, including transportation, chemical processing, and energy generation. Several hydrogen generation plants are being set up worldwide to meet the growing need for clean energy. For instance, in 2025, ENEOS, a Japanese energy company, invested USD 200 million to set up a green hydrogen demonstration plant in Brisbane, Australia. The plant is expected to produce up to 680 kilograms of green hydrogen per day from 2026, in the form of methylcyclohexane (MCH) for easy storage and transport. ENEOS plans to ship a portion of the production to Japan, collaborating with both Japanese and Australian companies on the project. Governments worldwide are also implementing incentives and supportive policies to promote the adoption of on-site hydrogen generation technologies, particularly in industrial applications.

Hydrogen Generator Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 800.8 million |

|

Revenue forecast in 2030 |

USD 1,120.3 million |

|

Growth Rate |

CAGR of 7.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030. |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends. |

|

Segments covered |

Product, process, application, region. |

|

Regional scope |

North America, Asia Pacific, Europe, Latin America, Middle East and Africa. |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Brazil, Argentina, Saudi Arabia, South Africa. UAE. |

|

Key companies profiled |

Air Liquide (L’AIR LIQUIDE S.A.); Air Products and Chemicals; Epoch Energy Technology Corporation; LNI Swissgas; Idroenergy; Linde; McPhy Energy S.A.; Nel ASA; Parker Hannifin Corp; Peak Scientific Instruments |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |