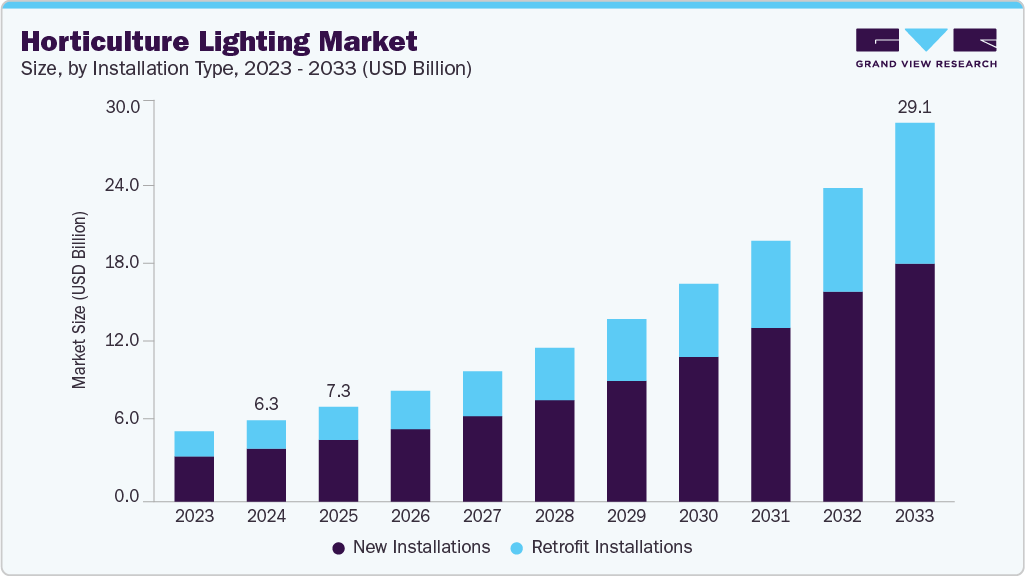

Horticulture Lighting Market Size, Share & Trends Analysis growing at a CAGR of 18.9% from 2025 to 2033

The global horticulture lighting market size was estimated at USD 6.26 billion in 2024 and is projected to reach USD 29.12 billion by 2033, growing at a CAGR of 18.9% from 2025 to 2033. The market is driven by the increasing adoption of controlled environment agriculture (CEA), including greenhouses, indoor farms, and vertical farms.

Key Market Trends & Insights

- North America held a 36.7% revenue share of the global horticulture lighting market in 2024.

- In the U.S., significant growth is driven by vertical farming, cannabis cultivation, and greenhouse expansion.

- By offering, the hardware segment held the largest revenue share of 67.6% in 2024.

- By installation type, the new installations segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.26 Billion

- 2033 Projected Market Size: USD 29.12 Billion

- CAGR (2025-2033): 18.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/horticulture-lighting-market-report/request/rs1

A key trend shaping the industry is the rapid adoption of LED-based smart lighting systems integrated with IoT, spectral optimization, and precision farming platforms. These advanced systems enable growers to precisely control light intensity, wavelength, and photoperiod in real time, tailored to specific crop types, growth stages, and environmental conditions. By dynamically adjusting light spectra, especially in the red and blue ranges critical for photosynthesis, these technologies enhance plant growth, improve crop yield and quality, and reduce energy consumption. IoT connectivity allows remote monitoring and automation, synchronizing lighting with other farming inputs for optimized resource use and labor savings. This convergence of LED efficiency, smart control, and data-driven farming is driving strong market growth globally, fostering more sustainable and productive horticulture practices.

The market is driven by the integration of horticulture lighting with digital farm management systems, enabling growers to synchronize lighting with key environmental factors like climate control, irrigation, and CO₂ levels to create fully optimized crop environments. Advanced systems incorporate remote monitoring, AI-based automation, and machine learning algorithms that analyze real-time and historical data to adjust lighting intensity, spectrum, and duration based on crop growth patterns, stress signals, and external conditions. This intelligent coordination allows growers to reduce energy consumption, improve crop yield and consistency, and streamline labor through centralized, data-driven control platforms, transforming lighting from a static utility into a dynamic, precision agriculture tool.

For instance, in December 2024, Heliospectra launched its new dynamic multi-channel LED solution, designed specifically for precision crop growth and efficacy, allowing growers to finely tune spectral output across multiple light channels in real time based on crop needs and growth stages. This intelligent coordination enables producers to reduce energy use, increase yield consistency, and streamline operations through centralized, data-driven lighting control, thereby driving horticulture lighting as a core component of next-generation precision agriculture.

Offering Insights

The hardware segment accounted for the largest revenue share of over 67.0% in 2024, driven by the fundamental need for physical infrastructure such as LED fixtures, grow lamps, ballasts, and reflectors in both new installations and retrofitting projects. These components are critical for delivering precise light intensity and spectrum tailored to different crops and growth stages, making them indispensable across greenhouses, indoor farms, and vertical farming facilities. Additionally, the rising demand for high-performance, energy-efficient LED grow lights capable of reducing power consumption by up to 40% compared to traditional HID systems is further fueling hardware sales. Moreover, LED fixtures-based toplighting and interlighting units are increasingly designed with features like modular construction, passive cooling, and precision optics to cater to a variety of crops and greenhouse structures. For instance, in March 2022, GE Current expanded its horticulture portfolio with the launch of the Arize Element L1000 and L2000 toplighting fixtures, offering photon outputs up to 3,600 µmol/s and tailored beam angles to maximize canopy penetration and uniformity. These next-generation fixtures were designed for 1:1 HPS replacement in high-intensity greenhouse environments, enabling growers to reduce fixture count, lower energy consumption, and improve yield quality through optimized spectral delivery.