Gummy Market growing at a CAGR of 14.7% from 2026 to 2033

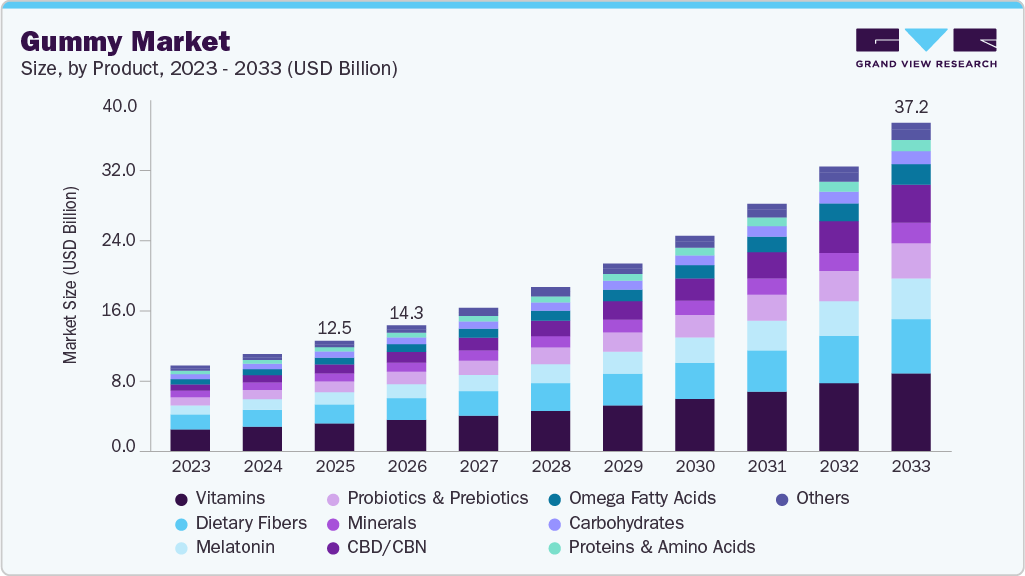

The global gummy market size was estimated at USD 12,525.2 million in 2025 and is projected to reach USD 37,161.6 million by 2033, growing at a CAGR of 14.7% from 2026 to 2033. Gummies are transitioning beyond traditional confectionery into functional supplement formats, blending enjoyable sensory experiences with health benefits.

Key Market Trends & Insights

- Asia Pacific dominated the global gummy market with the largest revenue share of 35.9% in 2025.

- Based on product, the vitamins segment led the market with the largest revenue share of 25.4% in 2025.

- Based on ingredient, the gelatine segment led the market with the largest revenue share of 67.9% in 2025.

- Based on end use, the adults segment led the market with the largest revenue share of 78.0% in 2025.

- Based on the distribution channel, the online segment is expected to grow at the fastest CAGR of 17.3% during the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 12,525.2 Million

- 2033 Projected Market Size: USD 37,161.6 Million

- CAGR (2026-2033): 14.7%

- Asia Pacific: Largest market in 2025

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/gummy-market-report/request/rs1

Formulations enriched with vitamins, probiotics, adaptogens, collagen, and botanicals have risen sharply, reflecting consumer interest in multifunctional wellness solutions such as immunity support, digestive health, cognition, and mental well-being.

Growing awareness of health has led consumers to prefer food products with vitamins, proteins, and minerals that offer added health benefits. Various awareness campaigns regarding healthy eating by government agencies, non-governmental organizations, and companies across the globe have helped consumers understand the importance of the nutritional benefits of dietary supplements, which, in turn, is projected to fuel the market growth in the coming years.

Nutraceuticals are likely to replace pharmaceutical products in managing and preventing chronic and acute health problems such as cardiovascular diseases, diabetes, and gastrointestinal issues. In addition, dietary supplements have both preventive and curative properties; therefore, they have great potential to succeed. Gummy supplements are gaining high traction among consumers in the U.S., contributing to increased sales of gummy supplements.

According to the CRN Consumer Survey 2024, approximately 75% of Americans reported using dietary supplements. Increasingly, consumers list sleep health (22%) and mental health (19%) as reasons to take supplements (compared to 17% and 16% in 2021, respectively).

Growing consumer awareness regarding health and wellness will likely shift consumer attention from medical treatments to preventive care products. Medical treatments often lead to several negative side effects. Therefore, consumer preference is shifting toward dietary supplements that can prevent disease occurrence and reduce the need for medical treatment. This has led more consumers to rely on nutraceuticals to lead healthy & disease-free lives.

Product Insights

The vitamins segment led the market with the largest revenue share of 25.4% in 2025. The rising prevalence of vitamin deficiencies is driving the demand for vitamin gummies. Several consumers are deficient in vitamins such as Vitamin D and Vitamin B12 owing to a lack of a balanced diet and a hectic lifestyle. Vitamin gummies offer a convenient way for consumers to maintain their vitamin intake. Furthermore, the rise of effective marketing campaigns and the expansion of the e-commerce industry have fueled the demand for vitamin gummies.

The CBD/CBN segment is expected to grow at the fastest CAGR of 19.8% during the forecast period. CBD/CBN-based gummies are gaining popularity among consumers as they help alleviate the symptoms of anxiety and depression and relieve pain. Increased stress levels due to a hectic lifestyle drive the demand for gummies. In addition, the regulations on CBD and CBN make it difficult to diversify product offerings by manufacturers. The use of CBD/CBN in gummies is an ideal way for manufacturers to control the dosage and cater to the rising demand for these gummies.

Ingredient Insights

The gelatin ingredient segment led the market with the largest revenue share of 67.5% in 2025. Gelatin-based gummies are the most common supplements provided by manufacturers. Factors such as the ideal texture, cost-effectiveness, and compatibility with other ingredients drive the demand for gelatin-based gummies. These attributes allow manufacturers to create functional gummies with added health benefits. Furthermore, gelatin-based gummies possess a chewy texture that appeals to consumers. For instance, in October 2023, Cargill shared its consumer research at a trade show in Las Vegas, U.S. As per its survey, 50% of respondents prefer the harder texture of gummies produced due to gelatin.

End Use Insights

The adults segment led the market with the largest revenue share of 78.0% in 2025. The taste and texture of gummies are their major demand drivers. The wide variety of gummy flavors makes them more appealing than traditional supplements like pills or capsules. Furthermore, gummies are also easier to consume, especially for consumers who have difficulty swallowing pills or capsules.

The kids segment is expected to grow at the fastest CAGR of 16.5% over the forecast period. The sweet taste of gummies and their availability in different flavors, shapes, and colors are among the key factors driving the demand for gummies among kids. Many parents opt for gummies that provide essential nutrients and supplements, such as vitamins or minerals. The pleasant taste and attractive presentation of gummies make it easier for parents to convince their kids to consume these essential nutrients.

Distribution Channel Insights

The offline segment led the market with the largest revenue share of 78.3% in 2025. Offline channels typically offer a diverse range of health and wellness products, catering to various consumer preferences and needs. The availability of gummy supplements, popular for their taste and ease of consumption, enhances the appeal of these stores. The presence of global brands in offline stores enhances the credibility and reliability of the products available. Global brands often invest in marketing and promotion to build awareness and drive consumer trust, which, in turn, boosts sales.

The online stores segment is expected to grow at the fastest CAGR of 17.3% over the forecast period. The growing demand for gummy supplements through e-commerce and other online channels can be attributed to the wide availability of multiple brands. These channels allow market players to showcase their products and gain global consumer traction, which might not be possible in other offline channels. Moreover, these channels often use dynamic pricing and discounts to drive sales. These factors are considered highly favorable among consumers, encouraging them to purchase gummy supplements.

Gummy Market Report Scope

|

Report Attribute |

Details |

|

Market value size in 2026 |

USD 14,260.7 million |

|

Revenue Forecast in 2033 |

USD 37,161.6 million |

|

Growth rate |

CAGR of 14.7% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, ingredient, end use, distribution channel, region |

|

Regional Scope |

North America; Europe; Asia-Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; Australia; India; South Korea; Brazil; Saudi Arabia |

|

Key companies profiled |

Bayer AG; Church & Dwight Co., Inc.; Nature’s Bounty; Haleon plc; Pharmavite, LLC; Procaps Group, S.A.; Garden of Life; SmartyPants Vitamins; Herbaland Gummies; Prime Health Ltd.; SMP Nutra |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |