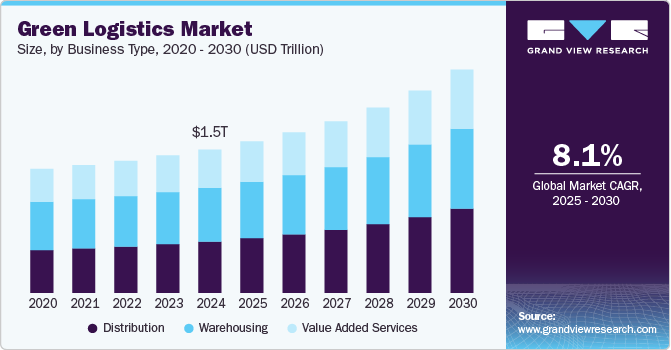

Green Logistics Market Size, Share & Trends Analysis growing at a CAGR of 8.1% from 2025 to 2030

The global green logistics market size was estimated at USD 1,506,990.5 million in 2024 and is projected to reach USD 2,347,222.4 million by 2030, growing at a CAGR of 8.1% from 2025 to 2030. The green logistics market is experiencing significant growth, driven by stringent environmental regulations, technological advancements, and shifting consumer and corporate preferences.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- The U.S. government is implementing stringent policies to promote sustainable logistics.

- By business type, the warehousing segment led the market and accounted for more than 37% share of the global revenue in 2024.

- By mode of transportation, the roadways segment dominated the market and accounted for more than a 40% share of the global revenue in 2024.

- By end-use, the retail and e-commerce segment led the market and accounted for 30.8% share of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,506,990.5 Million

- 2030 Projected Market Size: USD 2,347,222.4 Million

- CAGR (2025-2030): 8.1%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/green-logistics-market-report/request/rs1

Governments worldwide are implementing stricter policies to reduce carbon emissions, with initiatives such as the EU Green Deal, the U.S. Clean Energy Plan, and China’s Carbon Neutrality Goal pushing logistics providers to adopt sustainable practices. Regulations related to fuel efficiency, packaging waste reduction, and emission control are compelling businesses to transition towards greener supply chain solutions. Companies that fail to comply with these evolving standards risk facing legal penalties and losing competitive ground.

In addition, the rising demand for carbon-neutral supply chains, as corporations set ambitious Net-Zero targets to align with global sustainability goals. Industry giants such as Amazon, Walmart, and Maersk are investing in electric trucks, hydrogen-powered fleets, and green warehouses to reduce their environmental impact. This shift is further fueled by the rapid growth of e-commerce, which demands efficient yet sustainable last-mile delivery models. Logistics companies are increasingly adopting electric delivery vans, bicycle couriers, and urban micro-fulfillment centers to meet consumer expectations for environmentally responsible delivery options.

Technological advancements are also reshaping the green logistics landscape. The development of electric and hydrogen-powered trucks, AI-based route optimization software, and IoT-enabled smart warehouses is significantly improving operational efficiency while reducing emissions. Blockchain technology is being leveraged to enhance supply chain transparency and track carbon footprints, ensuring compliance with sustainability goals. In addition, warehouse automation solutions are helping logistics providers cut energy consumption by integrating AI-driven energy management systems and renewable energy sources such as solar and wind power.

Investment in renewable energy and alternative fuels is another key factor propelling the green logistics market forward. The increasing use of biofuels, hydrogen fuel cells, and liquefied natural gas (LNG) in transportation is significantly reducing emissions in freight logistics. Furthermore, the adoption of Sustainable Aviation Fuel (SAF) in air freight is gaining momentum, as airlines and logistics providers seek to reduce their carbon footprint. Alongside fuel innovations, governments are providing substantial incentives such as tax credits, subsidies, and green financing options to accelerate the adoption of sustainable logistics solutions.