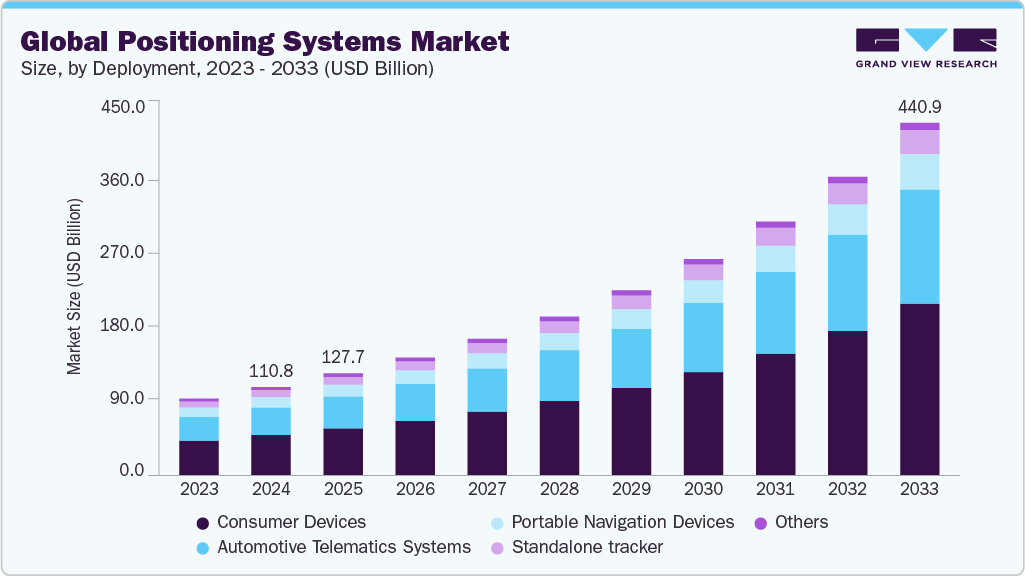

Global Positioning Systems Market Size, Share & Trends Analysis growing at a CAGR of 16.8% from 2025 to 2033

The global positioning systems market size was estimated at USD 110.76 billion in 2024 and is projected to reach USD 440.91 billion by 2033, growing at a CAGR of 16.8% from 2025 to 2033. This growth is due to the increasing adoption of GPS technology in smartphones and consumer electronics.

Key Market Trends & Insights

- Asia Pacific GPS market dominated the global industry with the largest revenue share of 37.3% in 2024.

- The global positioning systems industry in the U.S. is expected to grow significantly over the forecast period.

- By deployment, consumer devices led the market and held the largest revenue share of 45.8% in 2024.

- By application, location based services are expected to grow significantly over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 110.76 Billion

- 2033 Projected Market Size: USD 440.91 Billion

- CAGR (2025-2033): 16.8%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/gps-market/request/rs1

With the rise of location-based services (LBS), navigation apps, and augmented reality (AR) applications, demand for high-precision GPS has surged. Continuous technological advancements have improved the accuracy, reliability, and speed of global positioning systems (GPS). Innovations such as multi-constellation GNSS support, real-time kinematics (RTK), and precise point positioning (PPP) are enabling high-precision applications in sectors like agriculture, mining, surveying, and autonomous systems. Moreover, the integration of GPS with Internet of Things (IoT) devices is exposing new possibilities for asset tracking, smart logistics, and fleet management, leading to increased adoption across various industries.

The rise of autonomous technologies in vehicles and unmanned aerial vehicles (UAVs) is a significant growth driver of the global positioning systems industry. Self-driving cars and commercial drones require advanced navigation and real-time positioning data to operate safely and efficiently. As automotive and drone manufacturers increase R&D in autonomous systems, the demand for high-precision GPS solutions is expected to surge in the coming years. For instance, in July 2025, Lucid Group, Nuro Inc., and Uber Technologies announced a strategic partnership to launch a next-generation premium robotaxi program exclusively for Uber’s global ride-hailing platform. The collaboration aims to deploy over 20,000 Lucid vehicles integrated with Nuro’s autonomous driving technology, the Nuro Driver, over the next six years. The rollout is set to begin in 2026 in U.S. cities, with plans to expand across dozens of international markets.

The global push toward smart city initiatives is encouraging the deployment of GPS technologies for traffic monitoring, public safety, and infrastructure management. GPS-enabled solutions are helping urban planners optimize routes, monitor public transportation, and reduce congestion. Furthermore, as construction and infrastructure projects increase globally, especially in emerging economies, the need for geolocation-based planning and mapping is boosting the demand for GPS-enabled tools and systems.

Deployment Insights

The consumer devices segment dominated the market and accounted for the revenue share of 45.8% in 2024. The rapid proliferation of wearable devices, such as smartwatches, fitness bands, and health trackers, has significantly increased the demand for embedded GPS capabilities. These wearables increasingly include features like route tracking, activity logging, and geofencing for fitness and safety purposes. As consumers prioritize health, outdoor activity, and wellness monitoring, GPS-enabled wearables from brands like Apple, Garmin, Fitbit, and Samsung have witnessed widespread adoption, fueling growth in the consumer GPS device market.

The automotive telematics systems segment is anticipated to grow at a CAGR of 17.2% during the forecast period. GPS-powered telematics systems are crucial for fleet management, enabling real-time location tracking, route optimization, fuel monitoring, and driver behavior analysis. Logistics and transportation companies are increasingly adopting these solutions to improve operational efficiency and reduce costs. Moreover, insurers are offering usage-based insurance (UBI) models that rely on telematics data-collected through GPS to assess driver risk and set personalized premiums.