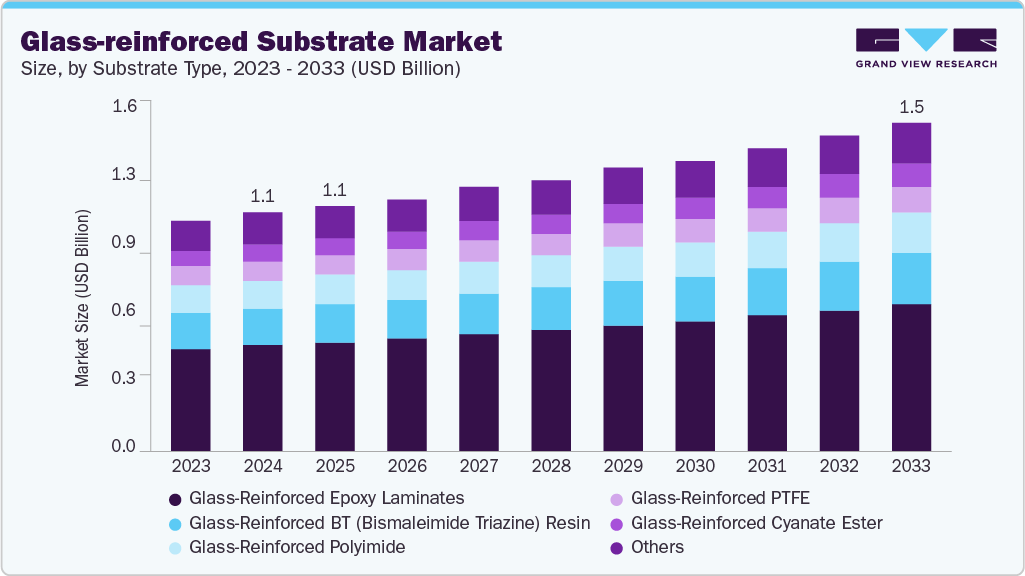

Glass-reinforced Substrate Market Size, Share & Trends Analysis growing at a CAGR of 3.8% from 2025 to 2033

The global glass-reinforced substrate market size was estimated at USD 1.12 billion in 2024, and is projected to reach USD 1.55 billion by 2033, growing at a CAGR of 3.8% from 2025 to 2033. This steady growth is attributed to the increasing adoption of high-performance substrates in automotive electronics, 5G infrastructure, and advanced consumer electronics.

Key Market Trends & Insights

- Asia Pacific accounted for a 57.8% share of the overall global market in 2024.

- The glass-reinforced substrate industry in China held a dominant position in 2024.

- By substrate type, the glass-reinforced epoxy laminates segment accounted for the largest share of 44.7% in 2024.

- By application, the printed circuit boards (PCBs) segment held the largest market share in 2024.

- By thickness, the 0.1 mm – 0.5 mm segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.12 Billion

- 2033 Projected Market Size: USD 1.55 Billion

- CAGR (2025-2033): 3.8%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/glass-reinforced-substrate-market-report/request/rs1

Glass-reinforced substrates offer superior mechanical strength, thermal stability, and dimensional reliability, making them ideal for miniaturized and high-frequency electronic devices. Moreover, as manufacturers transition toward lightweight and durable materials, the demand for glass-reinforced substrates is expected to expand across both emerging and developed economies.

The growing need for low-loss materials in 5G and future 6G infrastructure has led to the increasing adoption of glass-reinforced substrate in high-frequency electronic packages. According to the National Institute of Standards and Technology (NIST), these substrates offer exceptional performance in millimeter-wave applications due to their dielectric stability and thermal endurance. As global telecom OEMs develop higher-bandwidth modules, the material’s superior signal integrity is boosting the market, especially for radar, defense, and wireless base station technologies.

As electronic devices shrink and operating temperatures rise, maintaining thermal and mechanical stability has become critical. The International Electronics Manufacturing Initiative (iNEMI), supported by federal programs, identifies glass-reinforced substrate as a key enabler for advanced PCBs requiring low coefficients of thermal expansion (CTE) and high glass transition temperatures (Tg). Its ability to resist warpage under high-density integration is propelling the market growth, especially in automotive electronics and aerospace systems.

National-level investments such as the U.S. CHIPS and Science Act have allocated billions to rebuild domestic capabilities in semiconductor packaging. NIST highlights the importance of supporting pilot manufacturing lines specifically for advanced materials like glass-reinforced substrate. These funding efforts are directly boosting the market by encouraging substrate innovation, reducing reliance on imports, and supporting scalable production infrastructure in North America.

The rising adoption of 3D chiplet architectures in AI processors and cloud infrastructure has led to the widespread use of Glass-Reinforced Substrate for its dimensional stability and fine-line routing capabilities. Supported by the Semiconductor Research Corporation (SRC), research shows that glass-based substrates outperform traditional organic materials in co-packaged optics and heterogeneous integration. Their enhanced alignment accuracy and thermal control are propelling the market growth, particularly for cutting-edge data centers and defense-grade processors.

The development of Through-Glass Via (TGV) technology has unlocked new applications in RF communication, photonics, and sensor packaging. According to the U.S. Department of Energy (DOE), TGV-enabled glass-reinforced substrate offers a cost-effective alternative to silicon interposers, with reduced warpage and improved electrical performance. These process innovations are boosting the market by enabling compact and efficient systems for 5G antenna arrays, LiDAR modules, and optical sensors.

Substrate Type Insights

The glass-reinforced epoxy laminates segment accounted for the largest share of 44.7% in 2024. Glass-reinforced epoxy laminates, especially FR-4 grade, remain the dominant substrate type due to their cost efficiency and wide availability. Their balance of mechanical strength and electrical insulation is increasingly leveraged in consumer and industrial electronics. The trend toward miniaturization of devices in emerging markets has pushed OEMs to standardize on epoxy-based substrates, boosting the market as new product designs in wearables, IoT modules, and handheld tools continue to rely on this mature technology.

The glass-reinforced cyanate ester segment is expected to grow at the fastest CAGR during the forecast period. The high glass transition temperature and low dielectric constant of glass-reinforced cyanate ester substrates make them ideal for mission-critical applications such as aerospace navigation systems and supercomputing. These substrates resist moisture absorption and thermal cycling far better than traditional materials. With increasing investments in advanced defense electronics and quantum computing across North America and Europe, cyanate ester-based glass substrates are propelling the market growth, despite their relatively higher cost.