GCC Specialty Chemicals Market Projected to Reach USD 54.06 Billion by 2034, Growing at a CAGR of 4.0%.

Global GCC Specialty Chemicals Market size and share is currently valued at USD 36.66 billion in 2024 and is anticipated to generate an estimated revenue of USD 54.06 billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 4.0%Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 – 2034

Market Definition

The GCC Specialty Chemicals Market refers to the production and application of high-value, performance-based chemicals used in specific end-use industries within the Gulf Cooperation Council (GCC) nations: Saudi Arabia, UAE, Kuwait, Qatar, Bahrain, and Oman. These chemicals include additives, adhesives, surfactants, catalysts, pigments, polymers, and agrochemicals. Unlike commodity chemicals, specialty chemicals are tailored for particular functions in sectors such as construction, oil & gas, agriculture, automotive, water treatment, and personal care. The market is evolving from traditional petrochemical dominance to more diversified specialty segments, driven by industrial diversification strategies like Saudi Vision 2030. Government support, R&D investments, and international collaborations are boosting innovation and local manufacturing capacity. Demand is rising due to expanding downstream industries, infrastructure projects, and environmental regulations encouraging sustainable formulations. However, the market faces challenges from global supply chain volatility and feedstock price fluctuations. Key players include SABIC, Tasnee, and international chemical giants with GCC operations.

Key Report Highlights

- The report highlights the key region that accounts for the highest revenue share in the global GCC Specialty Chemicals market.

- It identifies the leading country within this region that makes a significant contribution to the market’s overall performance.

- The report outlines the dominant segment that holds a major share of the market.

- It also emphasizes the fastest-growing segment projected to gain strong traction during the forecast period.

- Qualitative and quantitative market analysis have been used to provide an in-depth understanding of the market.

Market Overview: Key Figures at a Glance

Market Size Value in 2024 USD 36.66 billion

Revenue Forecast in 2025 USD 38.05 billion

Revenue Forecast by 2034 USD 54.06 billion

CAGR 4.0% from 2025 to 2034

Get access to the full report or request a complimentary sample for in-depth analysis:

Market Growth Drivers

The GCC Specialty Chemicals Market is experiencing significant growth as Gulf countries diversify away from oil-dependent economies and invest in value-added manufacturing. Driven by industrialization, construction booms, and expanding consumer markets, there is rising demand for performance chemicals in coatings, water treatment, personal care, food additives, and agrochemicals. Governments across Saudi Arabia, UAE, and Qatar are promoting downstream petrochemical development under strategic plans like Saudi Vision 2030, fueling investments in specialty chemicals production. The region’s access to low-cost hydrocarbon feedstocks provides a competitive advantage for local manufacturing. Moreover, growing environmental regulations are creating opportunities for green and bio-based chemical innovations. Partnerships between local players and multinational corporations are enhancing technological capabilities and product portfolios. Export-oriented growth is supported by infrastructure developments like industrial parks and logistics hubs. Rising demand from construction, automotive, and packaging sectors in neighboring regions, including Africa and South Asia, also drives cross-border trade.

Market Key Players

The competitive landscape features a mix of long-standing companies and emerging contenders. GCC Specialty Chemicals Market Leading players are actively pursuing R&D initiatives and strategic moves to strengthen their market position. Notable participants include

- Arkema Chemicals

- Colonial Chemical

- EVONIK

- Fayfa Chemical Factory

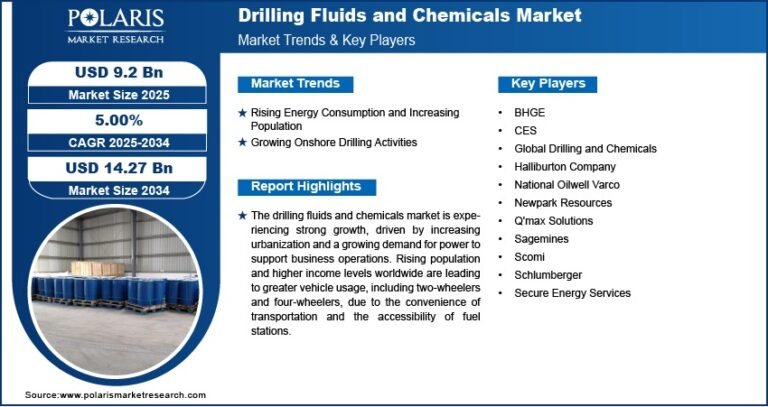

- Halliburton

- Horizon Chemicals

- Huntsman

- Nouryon

- Professional Specialty Chemicals Factory

- SABIC

- Sadara Chemical Company

- Sika Group

- Tricom LLC