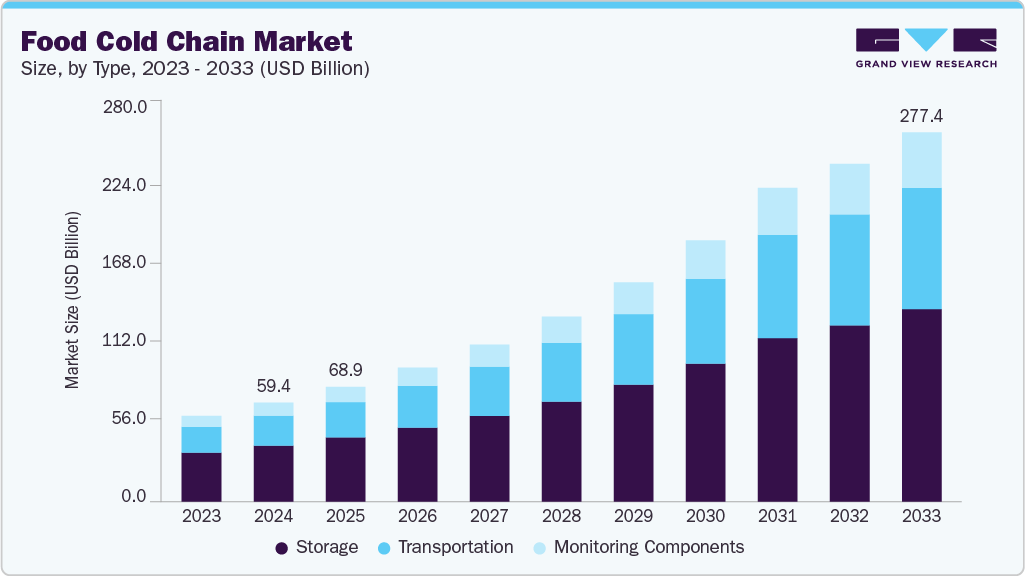

Food Cold Chain Market Size, Share & Trends Analysis growing at a CAGR of 19.0% from 2025 to 2033

The global food cold chain market size was estimated at USD 59.37 billion in 2024 and is projected to reach USD 277.43 billion by 2033, growing at a CAGR of 19.0% from 2025 to 2033. The market is witnessing a remarkable surge in demand, primarily fueled by the growing consumer preference for quality foods.

Key Market Trends & Insights

- The North America food cold chain market accounted for a global revenue share of 31.3% in 2024.

- The food cold chain industry in the U.S. held a dominant position in 2024.

- By type, the storage segment accounted for the largest revenue share of 56.5% in 2024.

- By construction types, the restaurants segment held the largest revenue share of 46.7% in 2024.

- By application, the fish, meat, and seafood segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 59.37 Billion

- 2033 Projected Market Size: USD 277.43 Billion

- CAGR (2025-2033): 19.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/food-cold-chain-market-report/request/rs1

In recent times, there has been a substantial rise in awareness among customers regarding the criticality of food safety. As a result, there is an escalating desire for refrigerated food products that are fresh and safe to consume and meet high-quality standards. The food cold chain industry includes the systems that handle and transport perishable food products under controlled temperature conditions to ensure their freshness, quality, and safety from the point of production to the point of consumption. It is a crucial logistical process that involves maintaining a specific temperature range throughout the supply chain, including during transportation, storage, and distribution.

The cold chain market plays a pivotal role in this industry, especially for products like fruits, vegetables, dairy, meat, seafood, and pharmaceuticals. By using refrigerated facilities, temperature-controlled vehicles, and advanced technologies like RFID, the cold chain ensures that perishable items remain in optimal condition, reducing the risk of spoilage, bacterial growth, and other quality issues.

Moreover, RFID technology has emerged as a pivotal driver in the cold chain market, enhancing visibility and efficiency in the entire process. Maintaining optimal product temperatures during transportation and storage is a critical concern among the challenges faced in the cold chain. Any deviation from the required temperature range poses a substantial risk, leading to bacterial growth, spoilage, and deterioration of food quality.

The food cold chain market is witnessing substantial growth, fueled by increased investments in its development. The rising demand for fresh and processed food products is a key driver spurred by population growth, urbanization, and evolving consumer preferences. Simultaneously, there is a heightened emphasis on tackling the critical issue of food waste on a global scale. This collective momentum is propelling businesses to channel resources into strengthening the cold chain infrastructure, ensuring efficient and seamless processes that preserve the quality and safety of food products while minimizing waste.

Food Cold Chain Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 68.90 billion |

|

Revenue forecast in 2033 |

USD 277.43 billion |

|

Growth rate |

CAGR of 19.0% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report construction type |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, construction type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; MEA; KSA; UAE; South Africa |

|

Key companies profiled |

Americold Logistics LLC; Agro Merchant Group; Burris Logistics, Inc.; Henningsen Cold Storage Company; Lineage Logistics, LLC; Nordic Logistics; Preferred Freezer; Wabash National; Cold Chain Technologies, Inc.; Cryopak Industries Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |