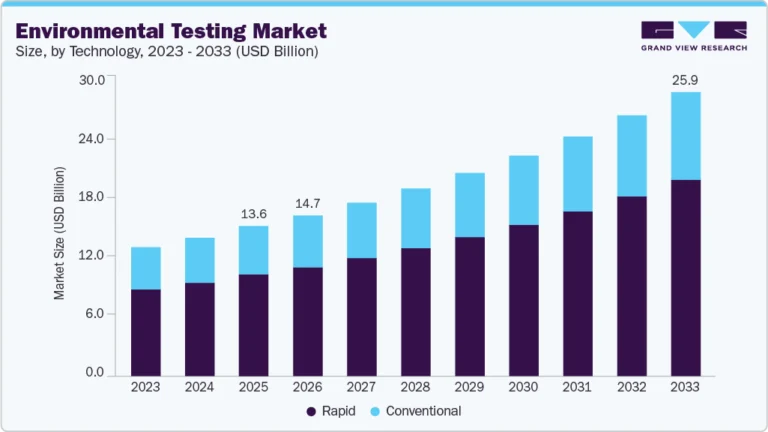

Food Coating Ingredients Market Size, Share & Trends Analysis growing at a CAGR of 7.0% from 2025 to 2033

The global food coating ingredients market size was estimated at USD 5,179.5 million in 2024 and is anticipated to reach USD 9,522.0 million in 2033, growing at a CAGR of 7.0% from 2025 to 2033. The growth of the global food coating ingredients market is primarily driven by the rising consumption of ready-to-eat and convenience food products, coupled with increasing demand for enhanced texture, taste, and visual appeal in processed foods.

Key Market Trends & Insights

- North America dominated the food coating ingredients market with the largest revenue share of 42.9% in 2024.

- The market in China is expected to grow at the fastest CAGR of 8.0% from 2025 to 2033.

- By product, the sugars & syrups segment held the largest revenue share of 31.0% in 2024 in terms of value.

- By application, the confectioneries segment held the largest revenue share of 23.9% in 2024 in terms of value

- By product, the cocoa & chocolates segment is expected to grow at the fastest CAGR of 7.8% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 5,179.5 Million

- 2033 Projected Market Size: USD9,522.0 Million

- CAGR (2025-2033): 7.0%

- North America: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/food-coating-ingredients-market/request/rs1

The rapid expansion of fast food chains and quick-service restaurants, particularly in emerging economies, is further accelerating the adoption of coating ingredients. The global food coating ingredients market is witnessing significant opportunities driven by the surging demand for clean-label, organic, and plant-based coating solutions that align with evolving consumer health preferences. Innovations in functional coatings, such as those enriched with proteins, fibers, and micronutrients, are opening new avenues across health-conscious and specialty food segments. Moreover, the growing popularity of gluten-free and allergen-free products presents a lucrative opportunity for manufacturers to diversify their product portfolios and cater to niche markets. Advancements in coating technologies, including microencapsulation and precision application, are also enhancing product performance and shelf life which is supporting the market’s growth.

Despite promising growth prospects, the market faces several challenges, including the volatility in raw material prices and supply chain disruptions, which can impact production costs and pricing strategies. Additionally, increasing regulatory scrutiny around food safety, ingredient labeling, and allergen declarations across different regions creates compliance complexities for global players. Health concerns associated with high-fat, sugar-laden, and fried coatings also pose a challenge, compelling manufacturers to reformulate without compromising sensory attributes. Maintaining product consistency, shelf stability, and texture during large-scale production remains a technical hurdle for many food processors.

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players such as Bowman Ingredients, Ashland Inc., E. I. DU Pont, DE Nemours and Company, Archer Daniels Midland Company (ADM), dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Key players in the global food coating ingredients market are adopting a multi-pronged strategy to strengthen their market position, focusing on product innovation, strategic acquisitions, and partnerships. Companies are increasingly investing in the development of clean-label, plant-based, and functional coating solutions to meet evolving consumer preferences. Strategic collaborations with food manufacturers and quick-service restaurant chains are helping expand application scope and customer reach. Additionally, leading players are enhancing their global footprint through mergers and acquisitions, while also optimizing their supply chains and production capabilities to improve cost efficiency and responsiveness to market demand.