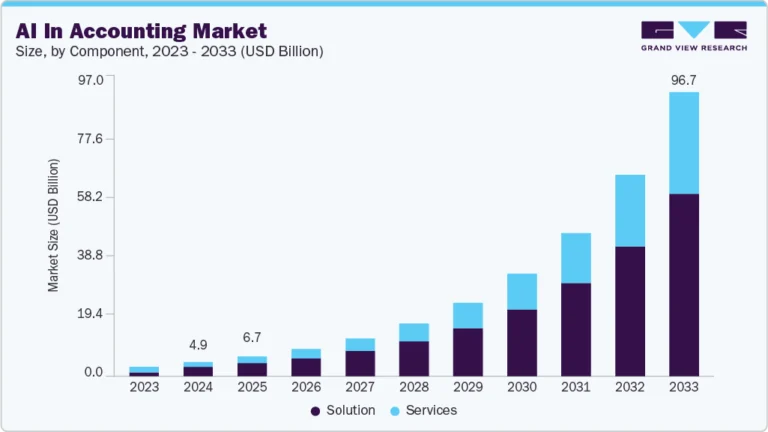

Fluoroelastomer Market growing at a CAGR of 5.7% from 2025 to 2030

The global fluoroelastomer market size was estimated at USD 1.69 billion in 2024 and is expected to grow at a CAGR of 5.7% from 2025 to 2030. The fluoroelastomer market is driven by rising demand from the automotive and aerospace sectors for high-performance sealing solutions and increasing usage in chemical processing due to superior chemical and heat resistance.

Key Highlights:

- Asia Pacific dominated the market and accounted for the largest revenue share of over 45.0% in 2024.

- China’s fluoroelastomer market is experiencing robust growth primarily due to its massive automotive, electronics, and industrial manufacturing ecosystem.

- By type, the fluorocarbon segment recorded the largest market revenue share of over 76.0% in 2024 and is projected to grow at the fastest CAGR of 5.8% during the forecast period.

- By end-use, the automotive segment recorded the largest market share of over 39.0% in 2024 and is projected to grow at the fastest CAGR of 6.2% during the forecast period.

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/fluoroelastomer-market/request/rs1

Growing adoption in EVs and stringent emission regulations further fuel market growth. The fluoroelastomer market is driven by stringent performance requirements in automotive and aerospace applications, where high-temperature and chemical resistance are critical. For example, modern turbocharged engines and electric vehicle (EV) battery systems demand fluoroelastomer seals and gaskets to withstand extreme heat and aggressive fluids such as lithium-ion battery electrolytes. In aerospace, fluoroelastomer are used in fuel systems and O-rings for jet engines, where reliability under harsh conditions is non-negotiable. Companies such as DuPont and 3M have developed specialized grades to meet these evolving needs, pushing market growth.

Regulatory pressures, such as REACH in Europe and EPA standards in the U.S., are accelerating the adoption of fluoroelastomer as industries phase out less durable elastomers that degrade or leach harmful chemicals. For example, in oil & gas, fluoroelastomer seals are replacing nitrile rubber in offshore drilling equipment to prevent hydrocarbon leaks, complying with stricter environmental laws. Similarly, pharmaceutical manufacturing uses FDA-compliant fluoroelastomer for sterile processing, where contamination risks must be minimized. These compliance-driven shifts create sustained demand.

The rise of renewable energy and harsh industrial environments is fueling fluoroelastomer usage. In solar and wind energy, fluoroelastomer coatings protect components from UV degradation and weathering. In chemical processing, plants rely on fluoroelastomer-lined pipes and valves to handle corrosive acids like sulfuric acid. A case in point is Solvay’s Tecnoflon FKM, which is tailored for aggressive chemical exposure in industrial settings. As energy infrastructure grows, so does the need for high-performance elastomers.

Innovation in polymer chemistry is unlocking new fluoroelastomer applications. For instance, Daikin’s development of low-temperature-resistant fluoroelastomer has expanded their use in Arctic oil exploration. Similarly, the introduction of peroxide-curable fluoroelastomer has improved sealing performance in semiconductor manufacturing, where ultra-pure conditions are essential. Custom formulations, such as Shin-Etsu’s fluorosilicone hybrids, cater to niche markets such as aerospace fuel management, demonstrating how R&D investments directly drive market expansion.

Type Insights

The fluorocarbon segment recorded the largest market revenue share of over 76.0% in 2024 and is projected to grow at the fastest CAGR of 5.8% during the forecast period. These elastomers are known for their exceptional resistance to high temperatures (up to 250°C), oils, fuels, solvents, and a wide range of chemicals, making them ideal for use in automotive, aerospace, and industrial applications. They are the most used type of fluoroelastomers due to their cost-effectiveness and versatile performance characteristics. The demand for fluorocarbon elastomers is primarily driven by the automotive industry’s need for high-performance sealing solutions in engines, fuel systems, and transmissions.

Perfluoroelastomers represent the most chemically and thermally resistant type of fluoroelastomers. Comprising fully fluorinated polymers, FFKMs can endure continuous exposure to temperatures above 300°C and virtually all chemicals, including aggressive acids, amines, and hydrocarbons. These properties make them essential in high-purity or harsh chemical processing environments, such as semiconductor manufacturing, pharmaceuticals, and chemical reactors. The demand for perfluoroelastomers is fueled by the expansion of the semiconductor and pharmaceutical industries, where ultra-pure and chemically resistant materials are critical.

End-use Insights

The automotive segment recorded the largest market share of over 39.0% in 2024 and is projected to grow at the fastest CAGR of 6.2% during the forecast period. The automotive industry is a major consumer of fluoroelastomers due to their excellent resistance to heat, chemicals, and fuels. These materials are widely used in seals, gaskets, hoses, and O-rings in engines, fuel systems, and transmissions where durability and long-term performance are crucial under extreme conditions. The increasing production of electric and hybrid vehicles, along with stricter emissions regulations, is pushing automakers to adopt advanced materials such as fluoroelastomers to ensure component longevity and system integrity. In addition, the growing preference for lightweight and high-performance materials supports their integration in modern vehicles.

Fluoroelastomers are extensively used in the chemical industry for manufacturing seals, linings, and hoses that encounter corrosive substances. Their high chemical resistance ensures safe and efficient operations in environments with aggressive solvents, acids, and bases. Rising chemical production globally and the need for robust materials to minimize equipment failure and leakage are driving adoption. The trend towards process optimization and improved safety standards in chemical plants also supports market growth for fluoroelastomers.

Fluoroelastomer Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.77 billion |

|

Revenue forecast in 2030 |

USD 2.34 billion |

|

Growth rate |

CAGR of 5.7% from 2025 to 2030 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume in tons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

The Chemours Company; DAIKIN INDUSTRIES, Ltd.; Solvay; 3M; Shin-Etsu Chemical Co., Ltd.; AGC Inc.; Gujarat Fluorochemicals Limited (GFL); DuPont; Swastik; Eagle Elastomer Inc; Zhejiang Funolin Chemical New Materials Co., Ltd. |

|

Customization scope |

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |