Flexible Packaging Market growing at a CAGR of 5.3% from 2026 to 2033

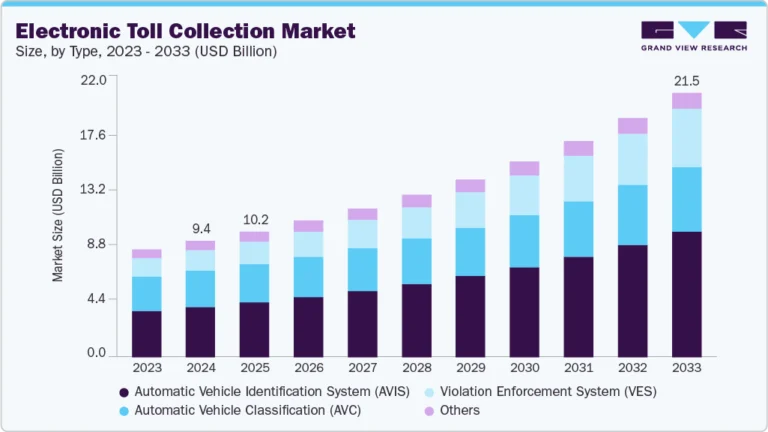

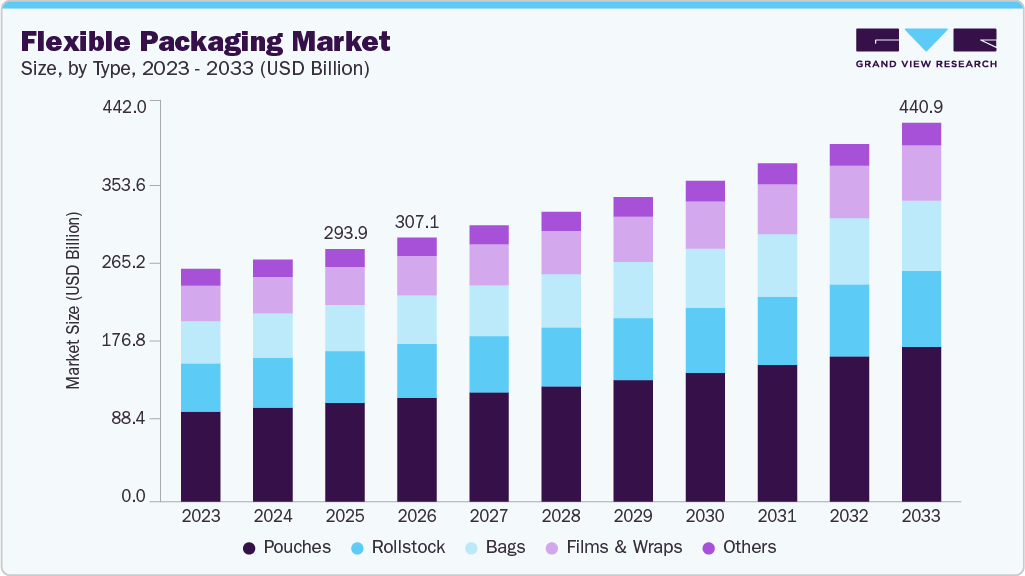

The global flexible packaging market size was estimated at USD 293.92 billion in 2025 and is projected to reach USD 440.88 billion by 2033, growing at a CAGR of 5.3% from 2026 to 2033. The market is driven by rising demand for convenient, lightweight, and cost-efficient packaging from food & beverage, pharmaceuticals, and personal care sectors, supported by e-commerce growth.

Key Market Trends & Insights

- Asia Pacific flexible packaging industry dominated the global market with the largest revenue share of over 39.0% in 2025.

- The flexible packaging industry in the U.S. is expected to grow at a substantial CAGR of 4.6% from 2026 to 2033.

- By material, the bioplastics segment is expected to grow at a considerable CAGR of 6.7% from 2026 to 2033 in terms of revenue.

- By type, the pouches segment is expected to grow at a considerable CAGR of 5.9% from 2026 to 2033 in terms of revenue.

- By application, the pharmaceutical segment is expected to grow at a considerable CAGR of 6.1% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 293.92 Billion

- 2033 Projected Market Size: USD 440.88 Billion

- CAGR (2026-2033): 5.3%

- Asia Pacific: Largest Market in 2025

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/global-flexible-packaging-market/request/rs1

In addition, sustainability trends, including recyclable mono-material structures, downgauging, and reduced carbon footprint compared to rigid packaging, are accelerating adoption worldwide. Flexible packaging provides effective barrier performance, longer shelf life, portion control, and lightweight formats such as pouches, sachets, and wraps. These advantages make it highly suitable for packaged foods, snacks, dairy, beverages, and frozen products. Rapid urbanization, rising disposable incomes, and the expansion of organized retail and e-commerce channels, particularly in emerging economies, continue to accelerate market demand.

Cost efficiency and supply chain optimization are key factors supporting the adoption of flexible packaging over rigid alternatives. Flexible formats require lower material consumption, reduce transportation and storage costs due to lighter weight, and enable high-speed manufacturing. Brand owners increasingly adopt flexible packaging to enhance shelf presence through advanced printing and customization while improving operational efficiency. Technological advancements in digital printing and smart packaging further support faster product launches, shorter production cycles, and improved brand communication.

Sustainability considerations and regulatory requirements are also significant drivers of market growth. Increasing emphasis on recyclability, waste reduction, and carbon footprint management is encouraging the development of mono-material structures, recyclable films, bio-based plastics, and paper-based flexible solutions. Flexible packaging is often favored for its lower material usage and its role in minimizing food waste, supporting its adoption across food, pharmaceutical, personal care, and household product applications.

Market Concentration & Characteristics

The industry demonstrates a high degree of innovation and customization, with continuous developments in materials, barrier properties, sealing technologies, and printing quality. Manufacturers focus on lightweighting, downgauging, and functional enhancements such as resealability and shelf-life extension to meet brand owner requirements. Shorter product life cycles and frequent design changes necessitate flexible manufacturing capabilities and close collaboration between converters, brand owners, and retailers.

Regulatory compliance and sustainability requirements significantly influence industry structure and investment priorities. Companies are increasingly aligning their portfolios with recyclable and mono-material solutions while investing in recycling infrastructure and sustainable sourcing. In February 2024, Amcor plc signed a deal with Cadbury to source 1,000 tons of post-consumer recycled plastic to wrap its core Cadbury chocolate range, accelerating Cadbury’s ambitions to reduce its virgin plastic needs. Cadbury aims to use 50% recycled plastic for its wrappers across its chocolate blocks, bars and pieces range produced in Australia.

Flexible Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 307.15 billion |

|

Revenue forecast in 2033 |

USD 440.88 billion |

|

Growth rate |

CAGR of 5.3% from 2026 to 2033 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD billion, Volume in Kilotons, and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, material, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Amcor plc; Mondi; Huhtamaki; Sealed Air; DS Smith; Constantia Flexibles; ProAmpac; Winpak Ltd.; Cosmo Films; Coveris; American Packaging Corporation; Inteplast Group; Graphic Packaging International, LLC; Bischof+Klein SE & Co. KG; Südpack; Glenroy, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |