Fixed Commercial Gas Detection Market growing at a CAGR of 9.6% from 2025 to 2033

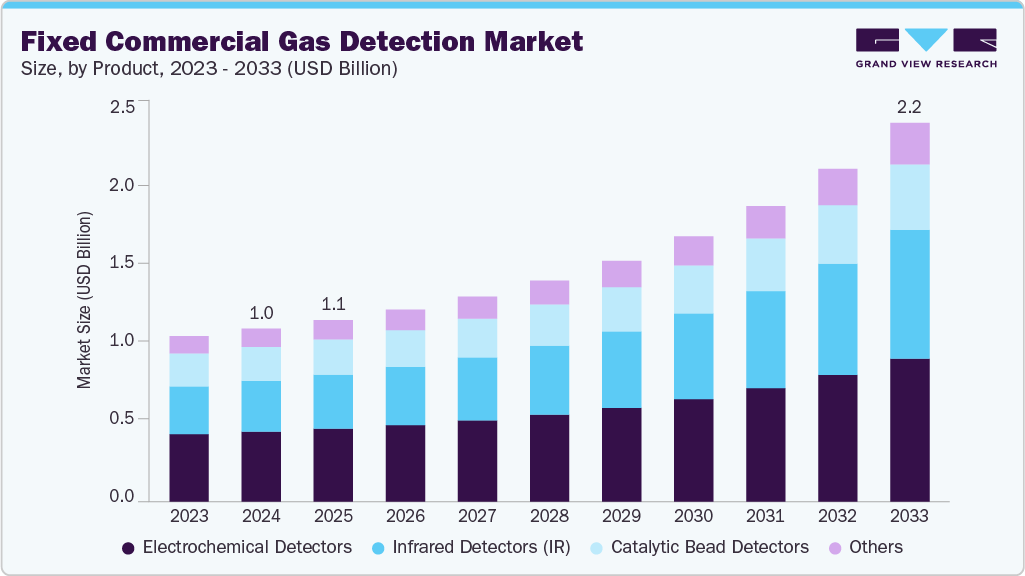

The global fixed commercial gas detection market size was estimated at USD 1.02 billion in 2024 and is projected to reach USD 2.24 billion by 2033, growing at a CAGR of 9.6% from 2025 to 2033. The increasing emphasis on workplace safety, environmental protection, and operational risk management across industrial and commercial sectors primarily drive the market growth.

Key Market Trends & Insights

- Asia Pacific dominated the fixed commercial gas detection industry with a revenue share of 35.2% in 2024

- By type, the electrochemical detectors segment dominated the market with the largest revenue share of 40.5% in 2024.

- By gas type, the toxic/combustible gases segment dominated the market in 2024.

- By application, the vehicle exhaust systems segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.02 Billion

- 2033 Projected Market Size: USD 2.24 Billion

- CAGR (2025-2033): 9.6%

- Asia Pacific: Largest Market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/fixed-commercial-gas-detection-market-report/request/rs1

Stringent safety regulations and occupational health standards are driving widespread adoption of fixed gas detection systems across industrial and commercial environments. Agencies such as OSHA, EPA, and NFPA in the U.S. have enforced strict compliance norms mandating continuous monitoring of toxic and combustible gases in facilities. This has led to increased installations in manufacturing plants, refineries, chemical storage sites, and commercial buildings. Businesses are prioritizing proactive safety measures to mitigate risks of gas leaks, fires, and explosions, fueling demand for reliable, permanently mounted detection systems that ensure round-the-clock monitoring and regulatory compliance.

Significant technological advancement has been witnessed in the development of fixed gas detection systems, driven by the integration of IoT, AI, and cloud-based monitoring technologies. Smart detection devices are increasingly being equipped with real-time data communication, predictive analytics, and remote maintenance capabilities. Sensor technologies such as infrared (IR), electrochemical, and ultrasonic detection have been refined to deliver enhanced accuracy and durability in harsh industrial environments. Furthermore, the convergence of gas detection systems with building management systems and industrial automation platforms has been facilitating centralized safety control, contributing to operational efficiency and reduced downtime.

Industrial facilities are increasingly adopting automation and advanced process control systems to enhance safety and efficiency, which directly supports the demand for fixed gas detectors. These devices play a critical role in monitoring hazardous gases in oil & gas, petrochemical, and power generation sectors, where automation reduces human intervention in high-risk environments. Modern fixed gas detection systems are now being designed to integrate seamlessly with SCADA and DCS platforms, enabling real-time data sharing and rapid incident response. The growth of automated industrial infrastructure is thus reinforcing the importance of fixed detection systems as an integral safety layer.

Fixed Commercial Gas Detection Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.07 billion |

|

Revenue forecast in 2033 |

USD 2.24 billion |

|

Growth rate |

CAGR of 9.6% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, gas type, application, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Macurco Inc.; Honeywell International Inc.; BELIMO AIRCONTROLS (USA), Inc.; Greystone Energy Systems Inc.; MSA Safety Incorporated; INTEC Controls (BC Solutions, LLC); Critical Environment Technologies Canada Inc.; TOXALERT International, Inc.; American Gas Safety LLC; Senva Inc.; Quatrosense Environmental Limited (QEL) |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |