Fiber Optic Connectors Market growing at a CAGR of 6.6% from 2025 to 2033

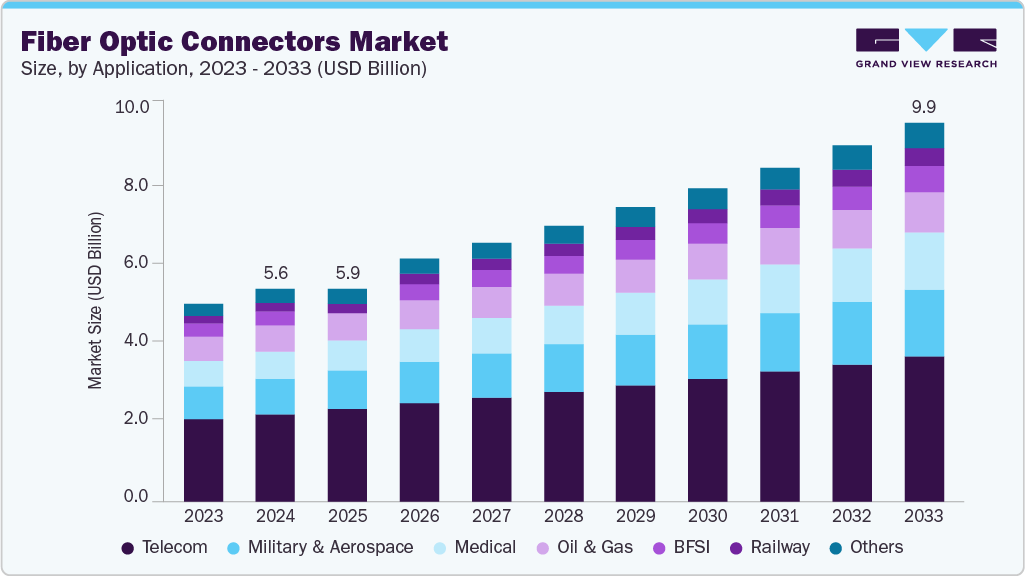

The global fiber optic connectors market size was estimated at USD 5.56 billion in 2024 and is projected to reach USD 9.93 billion by 2033, growing at a CAGR of 6.6% from 2025 to 2033. The market is primarily driven by the rapid growth of cloud computing and Artificial Intelligence (AI), telecommunications industry developments, and the surge in deployment of IoT-based and smart tech solutions.

Key Market Trends & Insights

- North America dominated the global fiber optic connectors market with the largest revenue share of 30.8% in 2024.

- The fiber optic connectors market in the U.S. led the North America market and held the largest revenue share in 2024.

- By product, the LC connector led the market, holding the largest revenue share of 35.43% in 2024.

- By application, telecom segment held the dominant position in the market.

Market Size & Forecast

- 2024 Market Size: USD 5.56 Billion

- 2033 Projected Market Size: USD 9.93 Billion

- CAGR (2025-2033): 6.6%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/fiber-optic-connectors-foc-industry/request/rs1

The rapid growth of cloud computing and AI is transforming into how data is processed and shared. These technologies require faster data transmission and highly reliable connectivity. To address this growing demand, data centers and subsea cable projects are expanding globally. These systems must efficiently manage large volumes of data with minimal signal degradation. This creates a need for efficient and durable fiber optic connections. As a result, high-performance, low-loss connectors such as MTP/MPO and LC are increasingly used in dense network environments. For instance, in February 2024, Cisco Systems, Inc., a U.S.-based technology company, and Microsoft completed an 800Gbps transmission trial on the Amitie transatlantic cable to meet the rising demand for cloud and AI services. This initiative shows how subsea networks are improving, allowing faster speeds and more data to support growing global digital needs.

The telecommunications industry’s transition to fiber optic networks is a significant factor driving the growth of Fiber Optic Connectors. As telecom providers move away from legacy copper infrastructure, they are opting for fiber optics to offer faster, more reliable communication services. Fiber optic networks enable the transfer of data at much higher speeds than traditional copper-based networks, with reduced signal loss and greater bandwidth capacity. This is particularly important as consumer demand for high-speed internet and data-intensive services such as video streaming and cloud computing continues to increase. Moreover, fiber optics provide lower latency, ensuring quicker and more efficient communication for real-time applications. The upgrade to fiber optic technology by telecom providers is, therefore, directly fueling the demand for fiber optic connectors to link network products.

The increasing adoption of Internet Things (IoT) devices and smart technologies is significantly driving the demand for fiber optic connectors. IoT devices, such as smart home gadgets, industrial sensors, and wearable technology, are becoming more prevalent, generating vast amounts of data. This data must be transmitted quickly and reliably to centralized processing hubs, often located in the cloud, for analysis and real-time decision-making. Fiber optics provide the high-speed, low-latency communication needed to support this data transfer. As more devices connect to networks, the demand for fast and efficient data transmission grows. Fiber optic connectors are critical in ensuring that this data is transferred seamlessly and with minimal delay across complex IoT networks.

Fiber Optic Connectors Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.95 billion |

|

Revenue forecast in 2033 |

USD 9.93 billion |

|

Growth rate |

CAGR of 6.6% from 2025 to 2033 |

|

Actual data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

3M; Broadcom; Corning Incorporated; ALE International, ALE USA Inc.; Arris Group (CommScope); STL Tech; OFS Fitel, LLC; TE Connectivity; Optical Cable Corporation; FURUKAWA ELECTRIC CO., LTD. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |