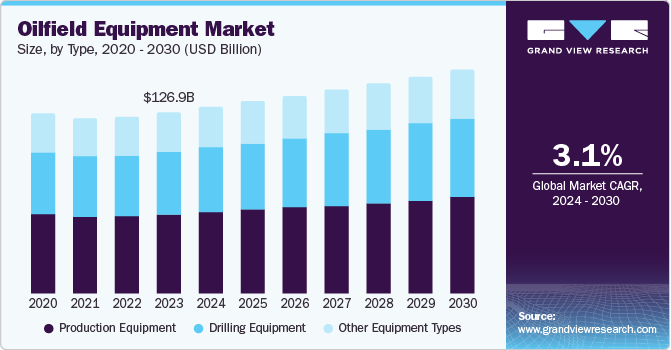

Fiber Laser Market Size, Share & Trends Analysis growing at a CAGR of 11.1% from 2025 to 2033

The global fiber laser market size was estimated at USD 6,874.7 million in 2024 and is projected to reach USD 17,549.1 million by 2033, growing at a CAGR of 11.1% from 2025 to 2033. The global fiber laser market is growing steadily due to increasing automation across manufacturing industries.

Key Market Trends & Insights

- Asia Pacific Fiber Laser dominated the global market with the largest revenue share of 45.4% in 2024.

- The Fiber Laser market in U.S. led the North America market and held the largest revenue share in 2024.

- By laser type, infrared fiber lasers led the market and held the largest revenue share of 42.1% in 2024.

- By power output, the high power segment held the dominant position in the market and accounted for the largest revenue share of 47.9% in 2024.

- By operation mode, the Continuous Wave (CW) segment held the dominant position in the market and accounted for the largest revenue share of 51.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6,874.7 Million

- 2033 Projected Market Size: USD 17,549.1 Million

- CAGR (2025-2033): 11.1%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/fiber-laser-market-report/request/rs1

Integration with Industry 4.0 systems allows fiber lasers to perform precise, high-speed tasks such as welding and marking in real time. This compatibility with smart factory operations is accelerating their adoption and expanding market. There is growing interest in high-power fiber lasers across industrial sectors. These systems enable faster processing of thicker and harder materials. Manufacturers benefit from improved productivity and reduced cycle times. Higher power levels also support more complex applications with greater precision. This trend is especially strong in the automotive, heavy machinery, and aerospace industries. As efficiency demands rise, high-power fiber lasers are becoming a preferred solution. For instance, in October 2024, Coherent Corp., a semiconductor manufacturing company, launched the ARM FL20D fiber laser, featuring a 20 kW power level and a unique dual-ring beam configuration for precise, high-speed welding, particularly in demanding materials such as cast aluminum. The system is designed to improve efficiency and weld quality while reducing costs.

There is a growing trend of expanding access to advanced laser cutting systems in industrializing regions. Manufacturers are partnering with local automation and distribution firms to reach new markets more effectively. This allows for better after-sales service, training, and customization suited to regional needs. It also lowers adoption barriers for small and mid-sized enterprises. The approach is helping drive fiber laser deployment in areas previously reliant on conventional cutting methods. As a result, the market is expanding beyond traditional strongholds into new geographies. Companies are pursuing regional collaborations and distributor agreements to strengthen market presence, enhance service capabilities, and boost fiber laser adoption in growing industrial regions. For instance, in December 2024, Eagle Lasers, a manufacturer of fiber laser cutting systems partnered with Cuttech, Indian automation specialist as their official distributor. This strategic alliance aims to enhance Eagle’s market presence in India, enabling local manufacturers to access high-power laser cutting solutions such as the iNspire series and FlowIN systems.