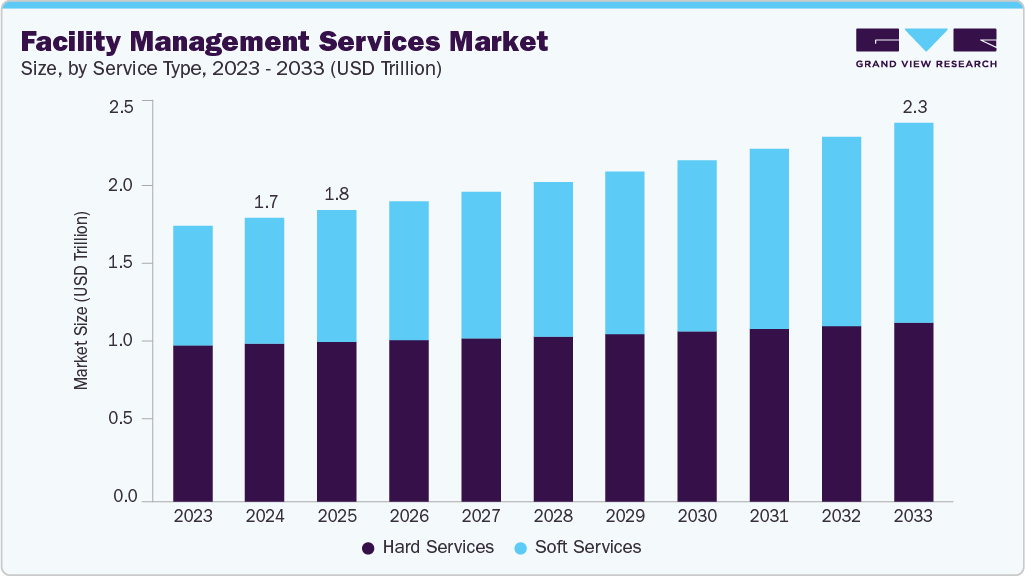

Facility Management Services Market Size, Share & Trends Analysis growing at a compound annual growth rate (CAGR) of 3.3% from 2025 to 2033

The global facility management services market size was valued at USD 1.75 trillion in 2024 and is projected to reach USD 2.33 trillion by 2033, growing at a compound annual growth rate (CAGR) of 3.3% from 2025 to 2033. The market is growing rapidly, driven by a surge in demand for integrated, tech-enabled solutions that enhance operational efficiency, workplace safety, and sustainability.

Key Market Trends & Insights

- North America dominated the global Facility management services market with the largest revenue share of 34.6% in 2024.

- The facility management services market in the U.S. led the North America market and held the largest revenue share in 2024.

- By offering type, outsourced segment led the market and held the largest revenue share of 61.5% in 2024.

- By organization size, large enterprises segment held the dominant position in the market and accounted for the leading revenue share of 66.5% in 2024.

- By end use, construction & real estate segment is expected to grow at the fastest CAGR of 5.8% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1.75 Trillion

- 2033 Projected Market Size: USD 2.33 Trillion

- CAGR (2025-2033): 3.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/facility-management-services-market-report/request/rs1

As businesses and industries integrate digital technologies into their physical environments, the demand for smarter and more efficient facility operations is accelerating. Organizations are prioritizing cost-effective, predictive, and data-driven facility management solutions to enhance performance and occupant experience. The widespread adoption of IoT, automation, and AI is enabling real-time monitoring, preventive maintenance, and resource optimization. There is also a strong push toward integrated service models and sustainable practices aligned with ESG goals. These evolving needs and innovations are driving significant growth in the facility management services industry.

The growing demand for smart building technologies is transforming facility management across industries such as corporate, healthcare, and education. Organizations are investing in IoT sensors, AI-driven analytics, and automation systems to enable real-time monitoring and predictive maintenance of their assets. These technologies help reduce operational costs, improve energy efficiency, and enhance occupant comfort and safety. Cloud-based platforms are increasingly being integrated to support seamless data management and operational control. Furthermore, regulatory emphasis on sustainability is driving the adoption of energy-efficient solutions. These combined factors are expected to substantially boost the growth of the facility management services industry over the forecast period.

The growing demand for enhanced workplace experience and employee well-being is redefining the role of facility management. Organizations are incorporating wellness programs, flexible space designs, and technology-enabled amenities to foster productivity and engagement. The shift to hybrid and remote work models is increasing the need for adaptable and health-conscious facility solutions. Facility management providers are leveraging smart access systems, indoor air quality monitoring, and mobile engagement tools to improve user satisfaction. As talent retention emerges as a significant challenge, companies are making substantial investments in enhancing workplace environments. This shift in focus is expected to propel ongoing growth in the facility management services sector.

Offering Type Insights

The outsourced segment led the market and accounted for 61.5% of the global revenue in 2024. The increasing demand for cost-effective and specialized expertise is driving growth in the outsourced facility management services segment. Organizations are increasingly turning to third-party providers to manage non-core functions, enabling them to focus on strategic priorities and enhance operational efficiency. This trend is further accelerated by the adoption of integrated service models and bundled contracts, which streamline processes and improve service quality. Additionally, rising pressure to meet sustainability goals and comply with regulatory standards is prompting firms to rely on outsourcing partners with domain-specific capabilities and technology-driven solutions.