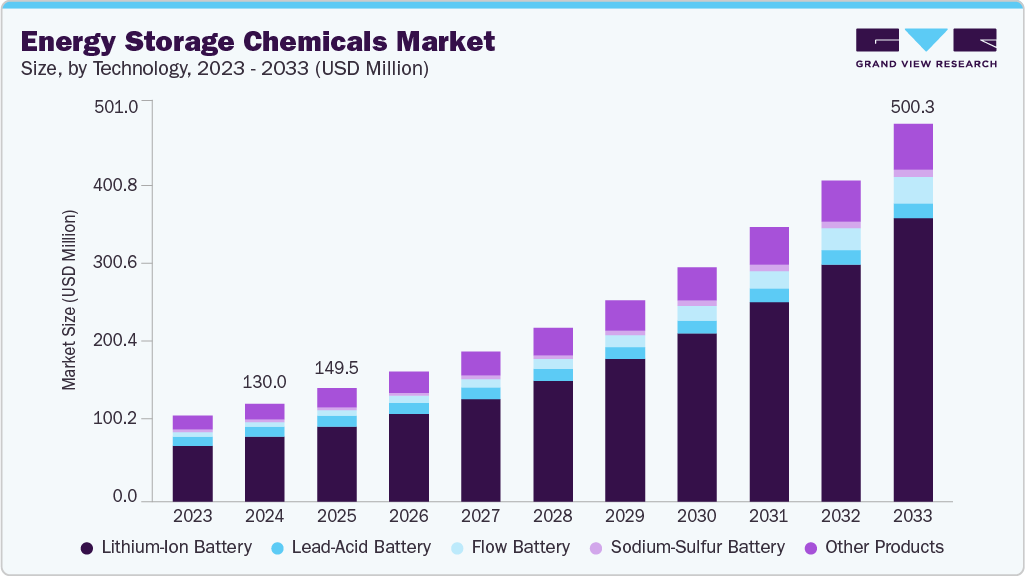

Energy Storage Chemicals Market growing at a CAGR of 16.3% from 2025 to 2033

The global energy storage chemicals market size was estimated at USD 130.0 million in 2024 and is projected to reach USD 500.3 million by 2033, growing at a CAGR of 16.3% from 2025 to 2033. The market growth is driven by the rapid expansion of battery-based energy storage systems (ESS) across electric vehicles (EVs), renewable energy integration, and grid stabilization applications.

Key Market Trends & Insights

- The Asia Pacific dominated the global energy storage chemical market, accounting for a 46.2% revenue share in 2024.

- China energy storage chemicals market is expected to grow over the forecast period.

- Based on technology, the battery storage segment dominated the energy storage chemicals industry, with a revenue share of 74.6% in 2024.

- Based on product, the lithium-ion battery segment dominated the energy storage chemicals market, with a revenue share of 65.6% in 2024.

- Based on end use, the automotive segment dominated the market, accounting for a 43.7% revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 130.0 Million

- 2033 Projected Market Size: USD 500.3 Million

- CAGR (2025-2033): 16.3%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/energy-storage-chemicals-market-report/request/rs1

The rising adoption of solar and wind power has increased the need for efficient storage solutions to manage energy intermittency, thereby boosting demand for high-performance battery chemicals, including lithium salts, electrolytes, and binders. Additionally, growing government incentives and clean energy policies worldwide are accelerating the deployment of advanced batteries, directly supporting market growth.

Another key driver is the technological advancement in battery chemistry, which has created opportunities for specialty chemicals tailored to enhance performance, energy density, and the lifecycle of storage systems. Developments in lithium-ion, sodium-sulfur, and flow battery technologies are driving the adoption of innovative materials, including solid-state electrolytes, conductive polymers, and redox-active compounds. These innovations not only enhance safety and efficiency but also expand the applicability of storage systems across various sectors, including electric mobility, industrial manufacturing, and grid infrastructure.

Furthermore, the energy storage chemicals industry is benefiting from the global shift toward localized and sustainable supply chains for critical energy materials. Governments and private players are investing heavily in domestic production of battery chemicals to reduce dependency on imports, especially for lithium, nickel, and cobalt derivatives. The emergence of recycling technologies for spent batteries and the recovery of valuable elements is further strengthening the circular economy model within the energy storage ecosystem. Collectively, these factors are shaping a robust growth trajectory for the energy storage chemicals market over the coming decade.

Market Concentration & Characteristics

The energy storage chemicals market exhibits a moderate to high level of concentration, particularly in the advanced battery materials segment, where a limited number of global players dominate the supply of critical inputs such as lithium salts, electrolytes, and cathode-active materials. Companies with established expertise in electrochemical materials, such as those producing LiPF₆, LiFSI, and high-purity solvents, maintain significant market share due to stringent quality requirements and lengthy qualification cycles by battery manufacturers. These barriers to entry make the market highly competitive and favor established chemical producers with integrated production capabilities and long-term supply contracts with battery OEMs.

At the same time, the market is witnessing increasing consolidation through mergers, joint ventures, and vertical integration between chemical producers, battery manufacturers, and energy companies. This integration is designed to secure raw material supply, enhance cost efficiency, and ensure consistent quality for large-scale energy storage deployments. Emerging participants, particularly in the Asia Pacific, are rapidly expanding their capacity to meet growing local demand; yet, the technological edge remains concentrated among a few multinational firms with strong R&D portfolios. As a result, while the broader market is expanding, the high-performance segment remains dominated by a concentrated group of suppliers controlling key chemical formulations and intellectual property.

Energy Storage Chemicals Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 149.5 million |

|

Revenue forecast in 2033 |

USD 500.3 million |

|

Growth rate |

CAGR of 16.3% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, product, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Middle East; Africa, Latin America |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Italy; Spain; France; China; Japan; South Korea; Saudi Arabia; South Africa; Brazil; Argentina |

|

Key companies profiled |

BASF SE; Ablemarle Corporation; LG Chem; Samsung SDI; Panasonic; 3M; Cuberg; Siemens; Solid Power; BioSolar; Vestas |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |