Emission Monitoring Systems Market Size, Share & Trends Analysis growing at a CAGR of 10.3% from 2024 to 2030

The global emission monitoring systems market size was estimated at USD 4,212.9 million in 2023 and is projected to reach USD 8,272.2 million by 2030, growing at a CAGR of 10.3% from 2024 to 2030. The growth can be attributed to advancements in sensor technologies, data analytics, and remote monitoring capabilities that have significantly enhanced the functionality and efficiency of emission monitoring systems.

Key Market Trends & Insights

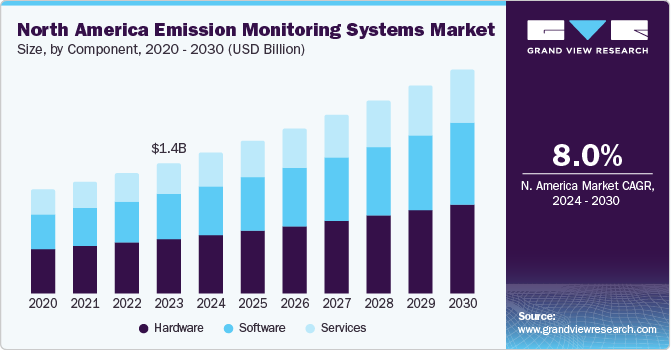

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, U.S. is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, continuous emission monitoring system (cems) accounted for a revenue of USD 3,354.5 million in 2023.

- Continuous Emission Monitoring System (CEMS) is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 4,212.9 Million

- 2030 Projected Market Size: USD 8,272.2 Million

- CAGR (2024-2030): 10.3%

- North America: Largest market in 2023

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/emission-monitoring-systems-market/request/rs1

Improved accuracy, reliability, and real-time data availability are driving the adoption of these systems. Emission monitoring systems (EMS) provide real-time data and analytics that enable organizations to identify areas of excessive emissions, energy waste, and process inefficiencies. Companies can enhance their overall operational efficiency and reduce costs by optimizing operations, reducing emissions, and minimizing energy consumption.

Moreover, the demand for these systems is significantly driven by stringent environmental regulations enforced by governments and regulatory bodies, including the United States Environmental Protection Agency (EPA), European Union Industrial Emissions Directive (IED), and National Environmental Laws and Regulations in Canada, among others. Industries are compelled by environmental regulatory authorities to implement EMS to track the release of pollutants.

These systems enable companies to measure various air pollutants’ concentrations or emission levels. EMS is deployed to monitor and assess multiple environmental pollutants, including Mercury (Hg), Sulfur Dioxide (SO2), Hydrogen Chloride (HCI), Carbon Monoxide (CO), Nitrogen dioxide (NOx), Carbon Dioxide (CO2), Ammonia (NH3), Methane (CH4), Sulphur Hexafluoride (SF6), Hydrogen Fluoride (HF), and Total Organic Carbon (TOC), among others.