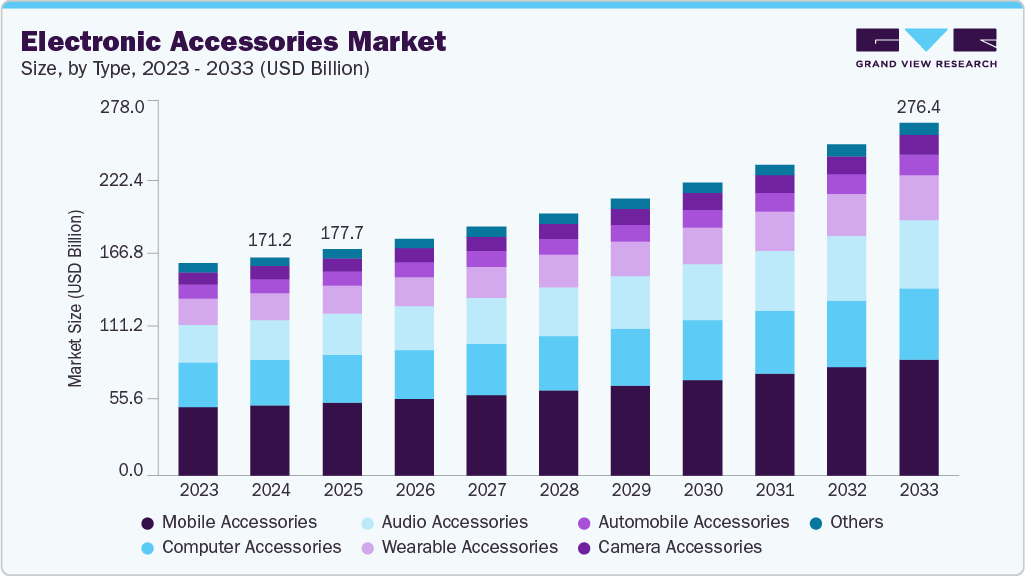

Electronic Accessories Market Size, Share & Trends Analysis growing at a CAGR of 5.7% from 2025 to 2033

The global electronic accessories market size was estimated at USD 171.20 billion in 2024 and is projected to reach USD 276.40 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033. The growing use of smartphones, tablets, laptops, wearables, and smart TVs is driving demand for electronic accessories.

Key Market Trends & Insights

- Asia Pacific electronic accessories market held the largest global revenue share of over 41.55% in 2024.

- The electronic accessories industry in the U.S. led North America with the largest revenue share in 2024.

- By product type, the mobile accessories segment accounted for a market share of over 32.0% in 2024.

- By price range, the premium segment is expected to grow at the fastest CAGR of over 7.0% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 171.20 Billion

- 2033 Projected Market Size: USD 276.40 Billion

- CAGR (2025-2033): 5.7%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/electronic-accessories-market-report/request/rs1

As smartphone penetration exceeds 80% in many regions, consumers increasingly purchase complementary products like chargers, cases, earbuds, and power banks. This rising ownership of smart devices fuels consistent accessory demand, especially in both emerging and developed markets, making it a key factor in the sustained growth of the electronic accessories industry.

The electronic accessories industry is experiencing a major transformation with a shift from traditional wired products to wireless and smart technologies. Consumers are increasingly favoring Bluetooth-enabled audio devices such as wireless earphones, speakers, and headsets for their convenience, portability, and sleek designs. Wireless chargers and Wi-Fi-enabled smart accessories have also gained popularity, especially among tech-savvy and minimalist users. Devices like Apple AirPods, Samsung Galaxy Buds, and smart rings from Oura and Ultrahuman exemplify this shift, offering seamless integration with smartphones and wearables. These innovations not only provide greater mobility and clutter-free usage but also align with the growing demand for multifunctional and intelligent gadgets. As the ecosystem of connected devices expands and battery technologies improve, wireless accessories are set to become the default choice across segments, further accelerating their global adoption and reinforcing their position as the key market growth drivers.

The global transition to work-from-home (WFH) and hybrid work models, accelerated by the COVID-19 pandemic, has permanently reshaped the demand landscape for electronic accessories. With professionals working remotely, there has been a substantial rise in the purchase of productivity-enhancing accessories such as webcams, noise-canceling headsets, external keyboards, ergonomic laptop stands, and high-speed routers. These tools have become essential for maintaining efficiency, collaboration, and communication in virtual work environments. Moreover, companies are now allocating budgets for employee technology upgrades, further boosting the business-to-business (B2B) demand for such accessories. This trend is not limited to corporate sectors; freelancers, content creators, and educators are also contributing to rising sales. As hybrid work continues to define the modern workplace, the demand for high-quality, durable, and comfortable computing accessories is expected to remain robust. The long-term adoption of flexible work arrangements will continue to be a major driver of growth within the electronic accessories ecosystem.

The electronic accessories market, particularly in segments like mobile and audio accessories, is becoming increasingly saturated due to the presence of numerous players offering similar or near-identical products. This overcrowding has led to intense price competition, as companies strive to undercut each other to gain market share. As a result, profit margins are compressed, and consumers often prioritize price over brand, leading to low brand loyalty. Even established brands face challenges maintaining differentiation, as functionality across products becomes standardized. This commoditization pressures manufacturers to either innovate rapidly or compete on volume and cost, making it difficult for smaller or premium-focused companies to sustain long-term profitability.

Product Type Insights

The mobile accessories segment accounted for a market share of over 32.0% in 2024. The rapid growth in smartphone ownership, particularly in emerging markets such as India, Indonesia, and parts of Africa, is a key driver of the mobile accessories market. As smartphones become more affordable and internet access expands, more users are entering the digital ecosystem. This surge in smartphone adoption leads to increased demand for essential accessories like chargers, earphones, protective cases, and power banks to enhance device functionality and longevity. In 2025, smartphone penetration has surpassed 80% in many regions globally, highlighting a maturing but still expanding market. This growing user base ensures consistent and recurring demand for mobile accessories, especially in value-conscious, high-growth markets.

The audio accessories segment is anticipated to grow at a significant CAGR of 6.9% during the forecast period. The audio accessories segment is witnessing a major shift from wired to wireless technologies, with True Wireless Stereo (TWS) devices adoption driving market growth. Products like Apple AirPods, Samsung Galaxy Buds, and affordable alternatives from Boat, Realme, and Soundcore are gaining popularity due to their convenience, compact design, and ease of use. The removal of headphone jacks in many modern smartphones has further accelerated this transition, pushing consumers toward Bluetooth-enabled solutions. TWS earbuds are now widely used for music, calls, gaming, and workouts, making them an essential accessory across age groups and income segments. This wireless trend is reshaping consumer expectations and product innovation.