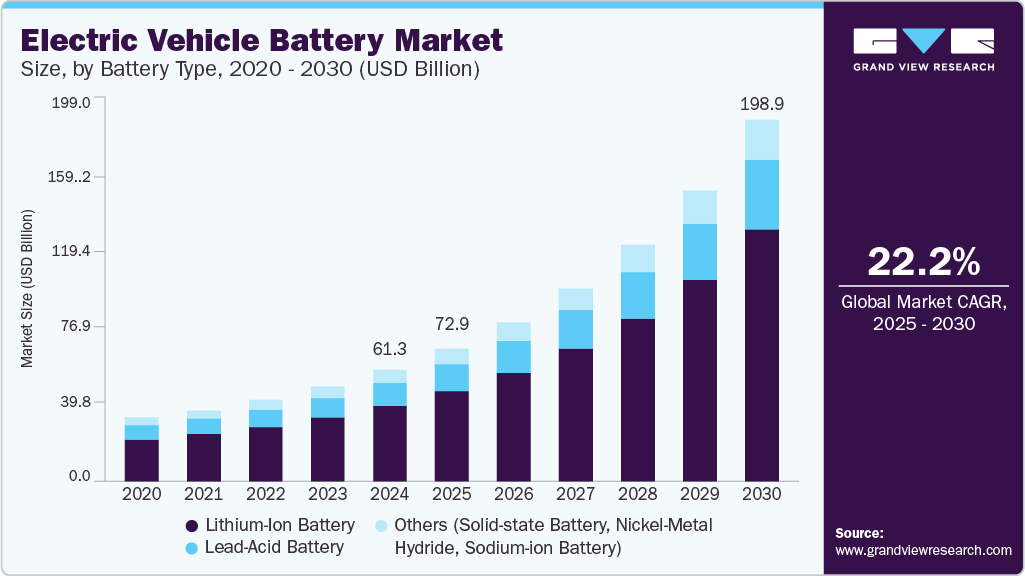

Electric Vehicle Battery Market Size, Share & Trends Analysis growing at a CAGR of 22.2% from 2025 to 2030

The global electric vehicle battery market size was estimated at USD 61.31 billion in 2024 and is projected to reach USD 198.86 billion by 2030, growing at a CAGR of 22.2% from 2025 to 2030. The growing emphasis of leading automakers on rolling out electric vehicles and rising battery demand for EVs are major factors behind the market growth.

Key Market Trends & Insights

- Asia Pacific electric vehicle battery market led the global market with a revenue share of 51.8% in 2024.

- The China electric vehicle battery market is the global leader in EV battery production and demand.

- In terms of battery segment, the lithium-ion battery segment accounted for the largest share of 67.4% in 2024.

- In terms of propulsion segment, the battery electric vehicle (BEV) segment held the largest market share in 2024.

- In terms of vehicle segment, the passenger cars segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 61.31 Billion

- 2030 Projected Market Size: USD 198.86 Billion

- CAGR (2025-2030): 22.2%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/electric-vehicle-battery-market/request/rs1

According to the International Energy Agency’s (IEA) Global EV Outlook, 2023 report, the surge in demand for automotive lithium-ion batteries is primarily attributed to the growth in electric passenger car sales, resulting in an estimated 65% increase in demand, from approximately 330 GWh in 2021 to 550 GWh in 2022. In addition, supportive government policies, growing consumer interest, and various strategies by automakers to speed up the electrification of new trucks, buses, and cars are contributing to the market growth. The growing developments in EV battery swapping technology and several battery manufacturers’ introduction of swappable battery packs for EVs further fuel the industry’s growth. For instance, in October 2021, Gogoro Inc. introduced its innovative battery-swapping system in China, the world’s largest market for two-wheeler vehicles. The company partnered with two of China’s prominent vehicle manufacturers, Dachangjiang (DCJ) and Yadea, to launch Huan Huan, a battery-swapping brand, starting with Hangzhou and expanding to more cities in China.

Furthermore, strategic collaborations between battery manufacturers, e-mobility providers, and energy suppliers are also expected to drive product sales in the forecast period. Leading suppliers are utilizing the most advanced technologies to improve the durability and lifespan of batteries during usage. These suppliers are employing strategic measures and advanced techniques to attain their net-zero emissions goals while simultaneously enhancing the efficiency of batteries. These efforts lead to batteries with extended lifespans, reduced electronic waste, and a reduced environmental impact related to their production and utilization.

The increasing automotive production, mainly in China, Germany, Japan, Mexico, South Korea, and India, among other nations, is also a significant factor driving the market growth. The increasing government spending on developing EV charging infrastructure in numerous countries also contributes to the market’s growth. The growing inclination of consumers toward personal conveyance is further boosting the demand for EV batteries. However, volatility in raw materials prices, such as lithium-ion and lead acid, can affect battery production costs and restrain market growth.

Electric Vehicle (EV) Battery Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 72.88 billion |

|

Revenue forecast in 2030 |

USD 198.86 billion |

|

Growth rate |

CAGR of 22.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Battery type, propulsion type, vehicle type, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Contemporary Amperex Technology Co., Limited; LG Energy Solution; BYD Motors; Panasonic Corp.; Samsung SDI Co., Ltd.; SK on Co., Ltd; Toshiba Corporation; EnerSys, Inc.; Hitachi, Ltd.; Mitsubishi Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |