Electric Utility Vehicle Market Size, Share & Trends Analysis growing at a CAGR of 6.7% from 2025 to 2030

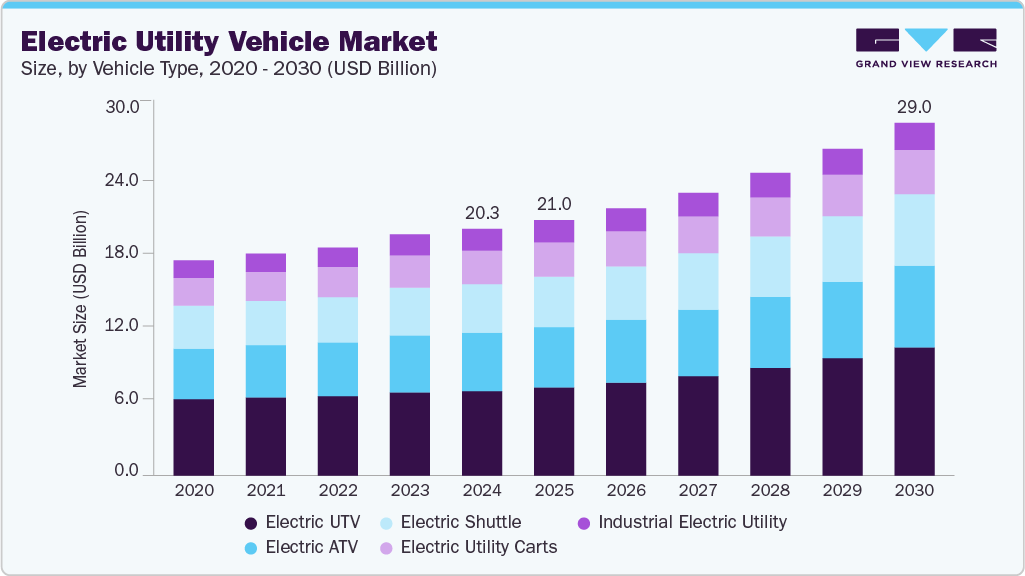

The global electric utility vehicle market size was estimated at USD 20.35 billion in 2024 and is projected to reach USD 29.07 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. The growth of the electric utility vehicle (EUV) market is primarily fueled by the rising adoption of electric utility task vehicles (UTVs) in agriculture, which are increasingly used for tasks such as towing, hauling, and farm surveying.

Key Market Trends & Insights

- North America electric utility vehicle market accounted for a significant share of over 33% in 2024 of the global revenue.

- The U.S. electric utility vehicle (EUV) market is experiencing robust growth.

- By vehicle type, the electric UTV segment accounted for the largest share of over 34% of the electric utility vehicle market in the year 2024.

- By battery type, the lithium-ion segment accounted for the largest share of over 58.0% of the global electric utility vehicle market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 20.35 Billion

- 2030 Projected Market Size: USD 29.07 Billion

- CAGR (2025-2030): 6.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/electric-utility-vehicle-market-report/request/rs1

Farmers are shifting toward electric UTVs due to their lower operational costs, reduced emissions, and quieter operation compared to traditional gasoline or diesel-powered alternatives. Governments in key agricultural regions, including North America and Europe, are further encouraging this transition through subsidies and incentives aimed at promoting sustainable farming practices. This trend is likely to persist as more farms acknowledge the long-term economic and environmental advantages of electric utility vehicles. Another major driver of market growth is the expanding use of electric utility vehicles in industrial logistics and warehousing. With the rapid growth of e-commerce and automated supply chains, businesses are increasingly relying on electric UTVs and low-speed electric vehicles (LSEVs) for material handling, warehouse operations, and factory logistics. These vehicles are particularly valued for zero emissions, making them ideal for indoor use in warehouses and manufacturing plants. Additionally, ports and airports are adopting electric utility vehicles for baggage handling, maintenance, and personnel transport, further boosting demand. The efficiency and cost savings associated with electric fleets in logistics are expected to sustain this upward trend.

The growing usage of connected vehicle technology and increasing internet & smartphone penetration also support the demand for electric utility vehicles. Electric UTV manufacturers use connected vehicle technology to provide riders with an improved riding experience, enhancing performance, efficiency, and effectiveness. For instance, in August 2022, Polaris Inc. introduced Ride Command+, a subscription-based connected vehicle service available across its entire UTV lineup. This advanced platform leverages vehicle-to-cellular connectivity to enable over-the-air (OTA) updates, ensuring vehicles remain up-to-date with the latest features and performance enhancements. A key offering of Ride Command+ is Vehicle Health, which provides users with remote access to critical diagnostics, including battery life status and estimated driving range, enhancing convenience, safety, and overall vehicle management.

In the rapidly growing electric utility vehicle market, custom-made UTVs are becoming increasingly popular among customers due to their ability to cater to specific purposes. Whether it’s for off-road exploration, agriculture, industrial use, or Recreation activities, customers can now have UTVs built precisely to match their requirements. This level of customization allows customers to maximize the utility and effectiveness of their electric UTVs while contributing to a greener and more sustainable future. As the demand for eco-friendly solutions rises, the availability of custom-made UTVs provides a promising pathway toward a cleaner and more versatile electric utility vehicle market.

Electric Utility Vehicle Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 21.05 billion |

|

Revenue forecast in 2030 |

USD 29.07 billion |

|

Growth rate |

CAGR of 6.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2024 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Vehicle type, battery type, drive type, propulsion type, seating capacity, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Addax Motors; Alke; American Landmaster; CLUB CAR; Columbia Vehicle Group Inc.; HISUN; Marshell Green Power; Polaris Inc.; Star EV Corporation; Textron Specialized Vehicles Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |