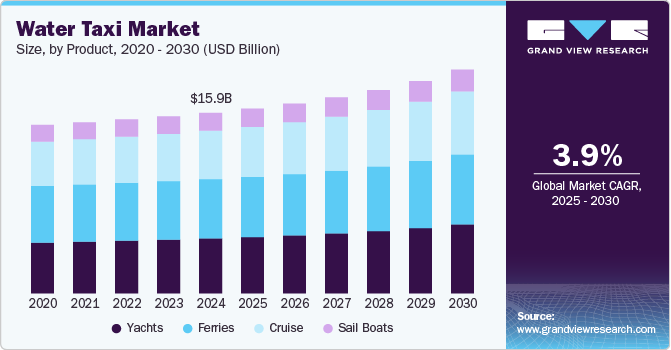

Edible Offal Market Size, Share & Trends Analysis growth rate (CAGR) of 4.3% from 2023 to 2030

The global edible offal market size was valued at USD 41.28 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. The growth of the market for edible offal is driven by its high nutritional value coupled with the economic cost of offal compared to other meat cuts.Edible offal is more affordable compared to prime cuts of meat. This affordability makes it an attractive option for consumers, who seek cost-effective protein sources. As meat prices fluctuate and economic conditions vary, edible offal provides an economical alternative without compromising on nutritional value. Edible offals offer higher nutrient density and contain higher amounts of vitamin B12 and iron compared to the other forms of lean muscle meat.

Several governments globally are promoting the use of offals as it reduces food wastage and possesses higher nutritional value than meats. The rise in greenhouse gases is contributing to the demand for animal by-products as it will help in mitigating GHG emissions by reducing the need for additional livestock production. Edible offal provides a valuable source of protein and nutrients. By satisfying the demand for high-protein food through the consumption of animal by-products, the industry can help meet nutritional needs while optimizing resource utilization and reducing the environmental burden associated with increased meat production.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/edible-offal-market-report/request/rs1

In addition, the food industry continually explores innovative ways to incorporate edible offal into processed food products. Offal can be used as an ingredient in sausages, pâtés, meatballs, and other processed meat products. This diversification allows offal to be presented in more approachable and convenient forms, catering to consumers’ preferences for ready-to-eat or easy-to-cook options. Furthermore,ready-to-eat or easy-to-cook offal-based products cater to the busy lifestyles of modern consumers who seek convenient and quick meal solutions. By incorporating offal into these products, the food industry helps overcome potential barriers to offal consumption, such as the perceived difficulty in preparation or the association with lower social status.

In terms of source, the pig offal segment held the largest share of 43.06% in terms of revenue in 2022. The utilization of pig offal helps in reducing food waste and maximizing the utilization of the entire pig carcass. This aligns with the growing consumer awareness of food waste and the desire to minimize environmental impact, contributing to the demand for pig offal. For instance, in the UK, the shipments of offal increased by 3% to 35,300 tonnes. This trend has fueled the demand for offal as it adds value to the pig carcass and helps reduce waste.

On the other hand, the horse offal is projected to have a significant CAGR of 6.2% during the forecast period. The horse offal is nutrient-dense and provides essential vitamins, minerals, and proteins. For example, horse liver is known for its high iron content and can be valued for its nutritional benefits. Consumers who prioritize nutrient-rich foods and seek variety in their diet may be drawn to horse offal for its nutritional profile.