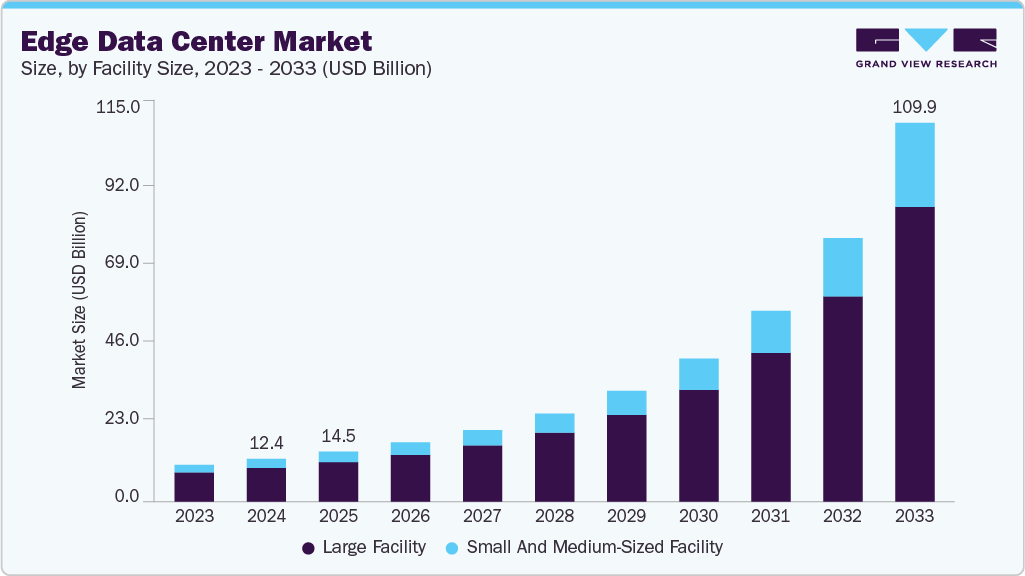

Edge Data Center Market Size, Share & Trends Analysis growing at a CAGR of 28.9% from 2025 to 2033

The global edge data center market size was estimated at USD 12.36 billion in 2024 and is projected to reach USD 109.91 billion by 2033, growing at a CAGR of 28.9% from 2025 to 2033. The growth is attributed to the rising adoption of emerging technologies such as the Internet of Things (IoT), big data, artificial intelligence, cloud computing, streaming services, and 5G across various industries, which generate massive volumes of network data and place increasing performance and computing demands on data centers.

Key Market Trends & Insights

- North America held a 34.4% revenue share of the global edge data center market in 2024.

- The edge data center industry in the U.S. is expected to grow significantly over the forecast period.

- By component, the solution segment held the largest revenue share of 87.3% in 2024.

- By facility size, the large facility segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.36 Billion

- 2033 Projected Market Size: USD 109.91 Billion

- CAGR (2025-2033): 28.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/edge-data-center-market-report/request/rs1

The ability of edge data centers to provide localized processing and storage resources is a key driver of market growth, as it significantly reduces latency and enhances performance by bringing data computation closer to the source of generation. This proximity enables real-time data analysis and faster response times, which are critical for latency-sensitive applications such as autonomous vehicles, smart manufacturing, telemedicine, and augmented reality. As businesses increasingly rely on time-critical operations and seek to improve user experience, the demand for decentralized infrastructure like edge data centers is accelerating, positioning them as essential components in modern digital ecosystems.

Edge data centers are increasingly driving market growth by offering robust edge-to-cloud orchestration and enhanced security for distributed, low-latency applications. Key trend is the integration of secure access service edge (SASE) architectures, which combine WAN capabilities and cloud-based security at the network edge. This reduces latency by avoiding long backhauls to centralized data centers, while implementing identity-driven, real-time policy enforcement and micro-segmentation to protect data and applications at their origin. Consequently, as IoT, autonomous systems, and smart-city deployments expand, the demand for localized, optimized edge sites continues to drive investment in platforms that seamlessly manage workloads across edge and core environments.

For instance, in June 2025, Cisco launched its initiative to build AI‑ready data centers and future‑proof workspaces geared toward enterprises seeking low‑latency edge processing capabilities. By combining advanced networking hardware with AI capabilities at edge locations, Cisco’s move reflects that industry leaders are meeting corporate demand for high‑performance, secure, and scalable edge infrastructure. This evolution, coupled with the increasing adoption of SASE frameworks, marks a significant transformation towards transitioning edge data centers from niche infrastructure to essential pillars of global IT architecture, driving accelerated market growth in the upcoming years.

Component Insights

The solution segment captured the largest share of 87.3% in 2024, primarily by delivering comprehensive, software-driven, fully integrated infrastructure tailored for distributed computing environments. Enterprises are increasingly favoring turn-key deployments that unify compute, storage, networking, power, and cooling into pre-engineered modules, enabling rapid on-site scalability, simplified lifecycle management, and efficient resource utilization compared to piecemeal or legacy setups. These all-in-one solutions ease the deployment of edge use cases like AI inference, IoT analytics, and real-time 5G workloads, offering plug-and-play functionality with centralized orchestration across hybrid environments. For instance, in May 2025, Dell Technologies introduced its software‑driven disaggregated infrastructure initiativeencompassing PowerProtect All‑Flash and PowerScale storage, PowerStore ransomware detection, and the Dell Automation Platform with NativeEdgeto automate and secure private cloud and edge operations. By decoupling computing, storage, and networking while integrating full-stack software automation, Dell enables organizations to provision edge clusters swiftly, respond to changing workloads, and maintain cyber-resilient operations with minimal manual effort.

The service segment is expected to grow at the fastest CAGR during the forecast period due to the increasing complexity of deploying and managing distributed edge infrastructure, which is driving demand for specialized services such as installation, integration, remote monitoring, maintenance, and lifecycle management. As enterprises expand their edge deployments to support latency-sensitive applications across multiple locations, they are relying on managed service providers (MSPs) and system integrators to ensure operational continuity, cybersecurity, and regulatory compliance without the need for extensive in-house IT teams. Moreover, the rapid adoption of AI, IoT, and 5G technologies is fueling the need for tailored consulting, orchestration, and performance optimization services that enable scalable and resilient edge ecosystems. Consequently, this shift toward service-centric value delivery is expected to significantly boost the growth of the services segment in the edge data center market.