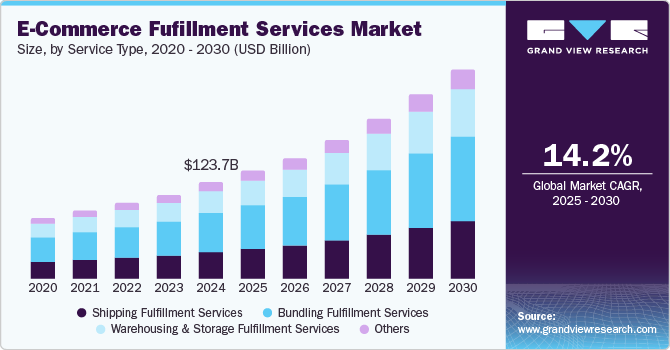

E-commerce Fulfillment Services Market Size, Share & Trends Analysis growing at a CAGR of 14.2% from 2025 to 2030

The global e-commerce fulfillment services market size was estimated at USD 123,689.1 million in 2024 and is projected to reach USD 272,141.6 million by 2030, growing at a CAGR of 14.2% from 2025 to 2030. The proliferation of electronic commerce and the resulting rise in the number of online buyers, especially in emerging economies, is anticipated to fuel the growth of the industry.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, shipping fulfillment services accounted for a revenue of USD 55,868.3 million in 2024.

- Bundling Fulfillment Services is the most lucrative service type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 123,689.1 Million

- 2030 Projected Market Size: USD 272,141.6 Million

- CAGR (2025-2030): 14.2%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/ecommerce-fulfillment-service-market/request/rs1

Fulfillment service centers enable online merchants to outsource services, including bundling, warehousing, shipping, and other value-added services such as return management and urgent parcel service. A fulfillment center is ideal for merchants who do not have robust warehousing capabilities to manage inventory directly and do not want to invest additional efforts in shipping. Besides, e-commerce fulfillment services can be managed in-house by the online merchant too.

Several consumers prefer ordering products online over in-store shopping due to several benefits offered in terms of convenience, cost, variety of choices, and lead time. E-commerce businesses significantly depend upon warehousing and shipping capabilities to get products transported from manufacturing units/ retailers to end-users in a shorter lead time. Traditionally warehousing was highly labor-intensive; however, in recent years, merchants have begun automating operations within the aisles of modern warehouses to minimize human intervention and thereby improve fulfillment productivity and reduce order delivery time. For instance, Amazon.com, Inc. uses robots in its fulfillment centers to assist associates in performing operations and drive faster shipping times.

With the majority of online purchasing sales coming from the urban area, and consumers increasingly demanding product delivery in the shortest possible turnaround time, the location of a fulfillment center is of strategic importance to e-commerce companies. Having centers near major cities that not only house products, but also perform other fulfillment services like sorting, bundling, labeling, and shipping helps players in the electronic commerce market to deliver products in a shorter turnaround time and win customer’s confidence. Thus, fulfillment centers remain a preferred choice for e-commerce companies that require efficient partners for their fulfillment operations.