Dynamic Positioning System Market Size, Share & Trends Analysis growing at a CAGR of 6.3% from 2025 to 2033

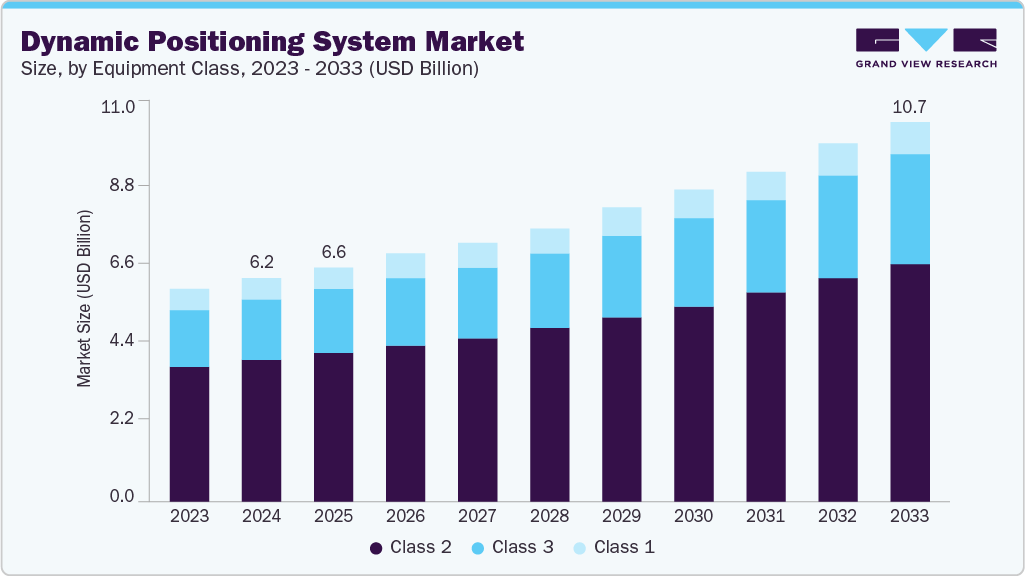

The global dynamic positioning system market size was estimated at USD 6.25 billion in 2024 and is projected to reach USD 10.71 billion by 2033, growing at a CAGR of 6.3% from 2025 to 2033. The surge in deepwater and ultra-deepwater oil and gas exploration is a major factor driving the demand for dynamic positioning systems (DPS).

Key Market Trends & Insights

- Europe dominated the global dynamic positioning system market with the largest revenue share of over 34.10% in 2024.

- The dynamic positioning system industry in the U.S. is expected to grow significantly over the forecast period.

- By equipment class, the class 2 segment led the market with the largest revenue share of 59.50% in 2024.

- By fit, the linefit segment dominated the industry in 2024.

- By system, the DP control system segment dominated industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD USD 6.25 Billion

- 2033 Projected Market Size: USD 10.71 Billion

- CAGR (2025-2033): 6.3%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/dynamic-positioning-system-market-report/request/rs1

The growth of global maritime trade and expanding port infrastructure projects has increased the demand for specialized vessels used in dredging, construction, and offshore support. These operations often occur in constrained or busy waterways where precise positioning is essential. Dynamic positioning systems enable such vessels to maintain stability and accuracy during critical tasks, enhancing safety, efficiency, and operational control in complex maritime environments.

In these challenging offshore environments, conventional anchoring or mooring methods are often impractical or unsafe due to water depth and seabed conditions. Precise vessel positioning becomes essential for critical operations such as drilling, maintenance, well intervention, and subsea construction. DPS-equipped vessels ensure stability and exact positioning by automatically adjusting thrusters and propulsion systems in response to environmental forces like wind, waves, and currents. Regions such as the Gulf of Mexico, Brazil’s pre-salt basin, and offshore West Africa are witnessing strong offshore exploration activities, creating a significant need for advanced DPS technology to support complex and high-risk offshore energy projects.

The expansion in emerging markets such as Southeast Asia, the Middle East, and West Africa is opening new growth avenues for dynamic positioning system (DPS) providers. These regions are experiencing a rise in offshore oil and gas exploration, driven by resource development initiatives and energy security needs. Additionally, naval modernization programs are boosting demand for advanced maritime technologies, including DPS. The growth of local shipbuilding industries in countries like Singapore, Indonesia, and the UAE is further fueling regional demand, as new offshore support vessels, naval ships, and specialized marine platforms are equipped with dynamic positioning capabilities. This emerging momentum offers significant opportunities for both DPS manufacturers and service providers seeking global expansion.

The high initial cost of installing dynamic positioning systems is a key restraint, particularly for Class 2 and Class 3 setups. These systems require costly components such as advanced thrusters, precision sensors, complex control units, and redundant power systems. For smaller operators or vessels with less critical operational needs, the significant capital expenditure may outweigh the perceived benefits, making DPS adoption financially challenging in cost-sensitive market segments.

Dynamic Positioning System Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 6.57 billion |

|

Revenue forecast in 2033 |

USD 10.71 billion |

|

Growth rate |

CAGR of 6.3% from 2025 to 2033 |

|

Actual data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD billion, and CAGR from 2025 to 2033 |

|

Report organization size |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Equipment class, fit, system, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Kongsberg Gruppen ASA; Wartsila Corporation; ABB Ltd.; GE Vernova; L3Harris Technologies, Inc.; Navis Engineering Oy; Marine Technologies LLC; Moxa Inc.; Japan Radio Company Ltd.; AB Volvo Penta; Brunvoll AS; Praxis Automation Technology B.V.; Sirehna; Twin Disc Inc.; Sonardyne, Inc. |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |