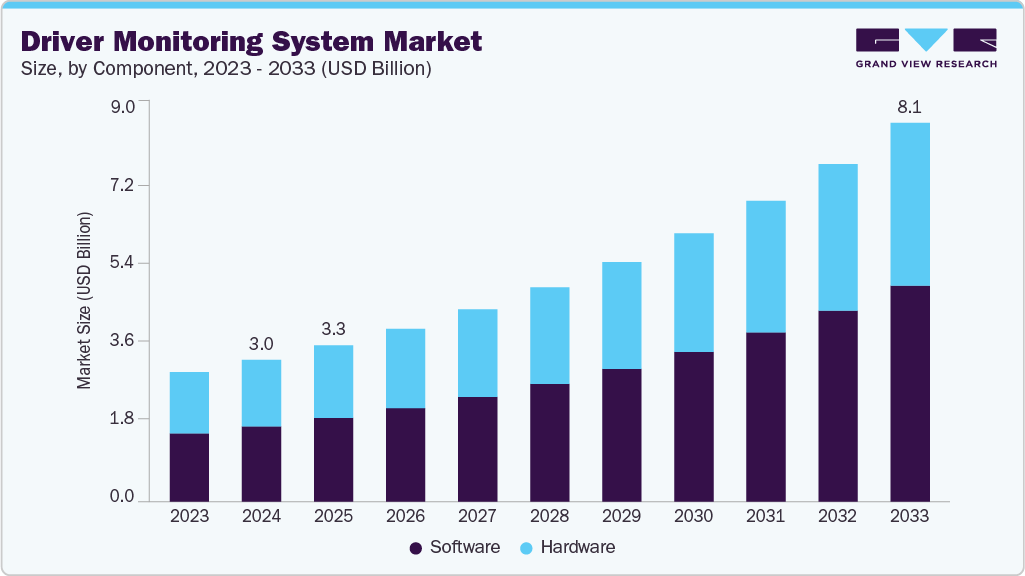

Driver Monitoring System Market Size, Share & Trends Analysis growing at a CAGR of 11.7% from 2025 to 2033

The global driver monitoring system market size was estimated at USD 3.03 billion in 2024 and is projected to reach USD 8.10 billion by 2033, growing at a CAGR of 11.7% from 2025 to 2033. The market is gaining momentum, driven by stringent regulatory mandates from governments across the globe requiring driver monitoring system (DMS) installation in new vehicles.

Key Market Trends & Insights

- North America’s driver monitoring system market accounted for a 34.2% share of the overall market in 2024.

- The driver monitoring system industry in the U.S. held a dominant position in 2024.

- By component, the software segment accounted for the largest share of 53.2% in 2024.

- By technology, the camera-based DMS segment held the largest market share in 2024.

- By functionality, the driver state monitoring segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.03 Billion

- 2033 Projected Market Size: USD 8.10 Billion

- CAGR (2025-2033): 11.7%

- North America: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/driver-monitoring-system-market-report/request/rs1

The rising integration of DMS within advanced driver assistance systems (ADAS) across autonomy levels L1 to L3 is driving strong demand from OEMs, supporting safer and more automated driving experiences. Also, increasing consumer awareness around in-cabin safety and growing demand for personalized features in luxury and electric vehicles further accelerate market growth.Expansion into commercial fleets and public transit creates a major growth opportunity for players in the driver monitoring system (DMS) industry, driven by the need to enhance driver accountability, ensure passenger safety, and comply with fleet management regulations. However, high system costs, integration complexities, and concerns around data privacy and driver consent pose significant challenges that may hinder broader adoption, especially in cost-sensitive vehicle segments.

Authorities in the EU, the U.S., and China have mandated DMS to reduce road accidents caused by drowsiness or distraction. In the EU, Regulation (EU) 2019/2144 requires all new vehicles of categories M and N to include advanced driver distraction warning (ADDW) systems from July 2026, capable of monitoring visual attention and issuing alerts when distraction is detected. In response, solution providers are accelerating product rollouts. For example, in February 2022, Cipia introduced its Driver Sense system, designed to track attention, drowsiness, and behaviors such as phone use or smoking. Aimed at both passenger and commercial fleets, it supports global regulatory compliance. These developments highlight how safety legislation is actively shaping DMS innovation and deployment.

As vehicles become increasingly semi-autonomous, ensuring continuous driver engagement and readiness becomes essential for safety compliance and accident prevention. DMS is being integrated into broader ADAS suites to deliver a holistic in-cabin safety ecosystem that includes lane-keeping, collision avoidance, and driver behavior analysis. For instance, in April 2023, AddSecure introduced an AI-powered video telematics solution that combines DMS and ADAS to monitor fatigue indicators such as yawning and head nodding, issuing real-time alerts to prevent drowsy driving incidents. The convergence of DMS with ADAS reflects an industry-wide trend toward system consolidation, where multi-function platforms enhance functionality, support regulatory standards, and reduce hardware redundancy in next-generation vehicles.